Buying a Home Is Still Affordable

The last year has put emphasis on the importance of one’s home. As a result, some renters are making the jump into homeownership while some homeowners are re-evaluating their current house and considering a move to one that better fits their current lifestyle. Understanding how housing affordability works and the main market factors that impact it may help those who are ready to buy a home narrow down the optimal window of time in which to make a purchase.

There are three main factors that go into determining how affordable homes are for buyers:

- Mortgage Rates

- Mortgage Payments as a Percentage of Income

- Home Prices

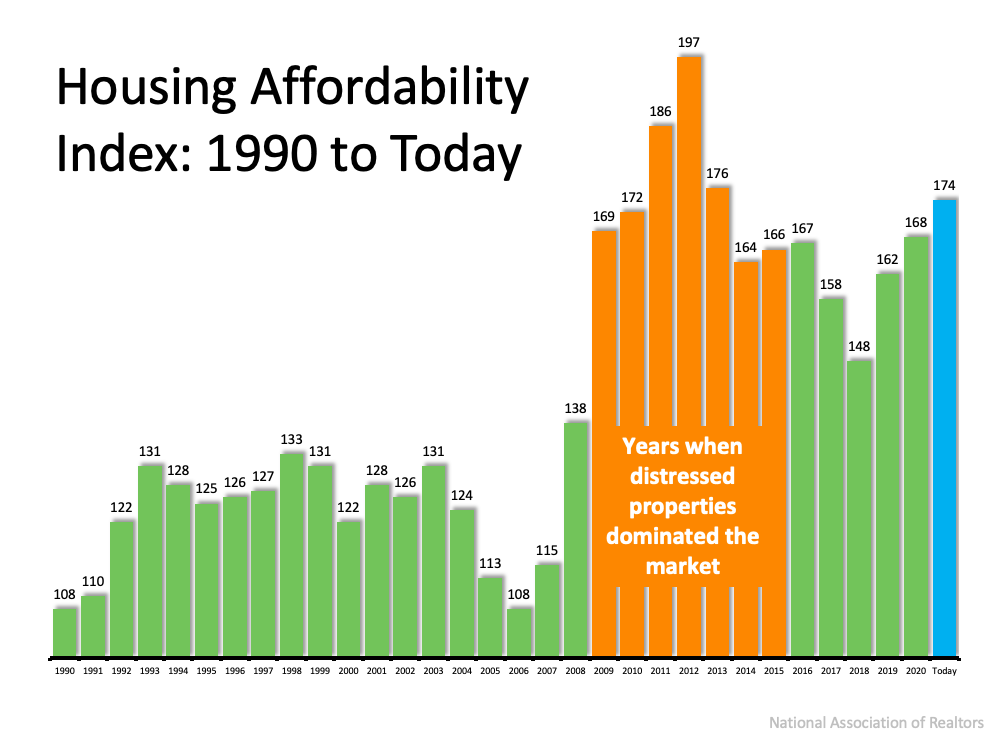

The National Association of Realtors (NAR) produces a Housing Affordability Index. It takes these three factors into account and determines an overall affordability score for housing. According to NAR, the index:

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here’s a graph of the index going back to 1990: The blue bar represents today’s affordability. We can see that homes are more affordable now than they’ve been at any point since the housing crash when distressed properties (foreclosures and short sales) dominated the market. Those properties were sold at large discounts not seen before in the housing market for almost one hundred years.

The blue bar represents today’s affordability. We can see that homes are more affordable now than they’ve been at any point since the housing crash when distressed properties (foreclosures and short sales) dominated the market. Those properties were sold at large discounts not seen before in the housing market for almost one hundred years.

Why are homes so affordable today?

Although there are three factors that drive the overall equation, the one that’s playing the largest part in today’s homebuying affordability is historically low mortgage rates. Based on this primary factor, we can see that it’s more affordable to buy a home today than at any time in the last eight years.

If you’re considering purchasing your first home or moving up to the one you’ve always hoped for, it’s important to understand how affordability plays into the overall cost of your home. With that in mind, buying while mortgage rates are as low as they are now may save you quite a bit of money over the life of your home loan.

Bottom Line

If you feel ready to buy, purchasing a home this summer may save you a significant amount of money over time based on historical affordability trends. Let’s connect today to determine if now is the right time for you to make your move.