I am dedicated to providing authentic, excellent customer service; to me this means getting to know your needs and wants and finding the best solution for your specific situation. I plan to diligently work with you to prepare a competent strategy to effectively sell and/or purchase your home. I’d like to provide you with the information you need to make an informed decision. As we navigate through this process I will walk alongside you as your knowledgeable, trusted real estate resource.

Friday, January 29, 2021

Contract Signings Surge to Highest Rate Ever in December

30-Year Rates Inch Back Down This Week, Average 2.73%

Monday, January 25, 2021

Mortgage Rates Continue to Hover Near Record Lows

Report: Minorities to Fuel Household Growth

Builders Rush to Produce More Homes

Friday, January 22, 2021

Financial Fundamentals for Homebuyers [INFOGRAPHIC]

Financial Fundamentals for Homebuyers [INFOGRAPHIC]

![Financial Fundamentals for Homebuyers [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/01/21112814/20210122-MEM-1046x2231.png)

Some Highlights

- When you’re thinking about buying a home, there are a few key steps to take before you even start to look at houses.

- From saving for your down payment to getting pre-approved for a mortgage, you’ll want to make sure you keep your financial plan on track from the beginning.

- Let’s connect today to make sure you have an introduction to a trusted lender and the best possible real estate guidance as you begin your homebuying process.

Thursday, January 21, 2021

What Experts Are Saying about the 2021 Job Market

What Experts Are Saying about the 2021 Job Market

Earlier this month, the Bureau of Labor Statistics (BLS) released their most recent Jobs Report. The report revealed that the economy lost 140,000 jobs in December. That’s a devastating number and dramatically impacts those households that lost a source of income. However, we need to give it some context. Greg Ip, Chief Economics Commentator at the Wall Street Journal (WSJ), explains:

“The economy is probably not slipping back into recession. The drop was induced by new restrictions on activity as the pandemic raged out of control. Leisure and hospitality, which includes restaurants, hotels, and amusement parks, tumbled 498,000.”

In the same report, Michael Pearce, Senior U.S. Economist of Capital Economics, agreed:

“The 140,000 drop in non-farm payrolls was entirely due to a massive plunge in leisure and hospitality employment, as bars and restaurants across the country have been forced to close in response to the surge in coronavirus infections. With employment in most other sectors rising strongly, the economy appears to be carrying more momentum into 2021 than we had thought.”

Once the vaccine is distributed throughout the country and the pandemic is successfully under control, the vast majority of those 480,000 jobs will come back.

Here are two additional comments from other experts, also reported by the WSJ that day:

Nick Bunker, Head of Research in North America for Indeed:

“These numbers are distressing, but they are reflective of the time when coronavirus vaccines were not rolled out and federal fiscal policy was still deadlocked. Hopefully, the recent legislation can help build a bridge to a time when vaccines are fully rolled out and the labor market can sustainably heal.”

Michael Feroli, Chief U.S. Economist for JPMorgan Chase:

“The good news in today’s report is that outside the hopefully temporary hit to the food service industry, the rest of the labor market appears to be holding in despite the latest public health challenges.”

What impact will this have on the real estate market in 2021?

Some are concerned that with millions of Americans unemployed, we may see distressed properties (foreclosures and short sales) dominate the housing market once again. Rick Sharga, Executive Vice President at RealtyTrac, along with most other experts, doesn’t believe that will be the case:

“There are reasons to be cautiously optimistic despite massive unemployment levels and uncertainty about government policies under the new Administration. But while anything is possible, it’s highly unlikely that we’ll see another foreclosure tsunami or housing market crash.”

Bottom Line

For the households that lost a wage earner, these are extremely difficult times. Hopefully, the new stimulus package will lessen some of their pain. The health crisis, however, should vastly improve by mid-year with expectations that the jobs market will also progress significantly.

Tuesday, January 19, 2021

Top Siding Options for 2021

Jan 15, 2021

Homes both old and new face a determined foe: the elements. One of the only defenses against moisture, wind, and heat is the siding your house is clad in. You can think of it a bit like house armor. So, when it comes time to choose your home’s main line of defense, what will it be? The cheapest option you can possibly come up with, or a well-considered siding that is both durable and attractive? It’s time to look at your siding options.

Siding Choices for 2021

Although you can side your house in an amazing array of materials, from metal barn siding to asphalt shingles, there are definitely options that are far more effective and attractive than others. Siding options haven’t changed a lot this year, but there’s plenty to be said for the materials that are widely available today. Common siding choices include:

- Vinyl. Although vinyl is final, it’s not always the most durable material out there. There are a range of grades of vinyl siding, and which you choose matters. Look for a heavier option, with a longer warranty, if you want to ensure your siding will be around a while. Higher end vinyl siding comes in a wide range of patterns, too, including imitation shakes and fish scales (rounded shingles), plus it can be oriented either vertically or horizontally, depending on your home’s style and your personal preference. On the other hand, while vinyl may be the most versatile material for the money currently on the market, if you live in an area where high winds are a problem, it may be difficult to keep vinyl siding attached.

- Fiber cement. Made from a combination of cement and wood fibers, fiber cement siding is durable and long-lasting. Unlike its predecessor, modern fiber cement no longer contains asbestos, but does still retain the same unrelenting strength. It’s a heavy duty siding, however, so expect to pay more for installation. You’ll also likely be needing to repaint it occasionally. Fiber cement costs more than vinyl siding in general, but has a useful lifespan of 50 years or more, so if you plan to stay in your home and are looking for an alternative to stone or brick, it might be the answer.

- Wood. Good old-fashioned wood siding has been a popular choice for generations, but modern homes have steered away from it for a variety of reasons. Because wood siding requires a lot of maintenance, many homeowners simply don’t have the time to reseal or repaint it often enough to maintain the original look, and over time this lack of care can lead to insect infestations. Wood siding is great for some applications, but it’s only as good as the care you give it. If you’re prepared to go the long haul on your home, or just want a small accent, wood might be a great option. The cost will vary considerably depending on the thickness, style, and species of wood you choose.

- Composite. Composite, also known as engineered wood, is a compromise for homeowners who want a wood look, but don’t want all the upkeep of real wood. It’s still going to need more care than other types of siding, but you can still expect to get 20 or 30 years of use from it. Unlike real wood, which can be sanded and refinished if you get lax in maintenance or simply want to give it a different finish, composite siding is kind of a set-it-and-forget-it option. It will be the color or stain you chose initially unless you remove it all and start again.

- Brick or Stone. Brick and stone go hand in hand when it comes to siding choices. Both are sturdy materials that require an expert mason to install properly, so if you’re considering a DIY siding job, these may not be the right option. Considerable skill goes into properly creating a stone or brick siding, and without the proper prep work, your siding can simply slip off your house. It’s not a pretty picture. On the flip side, stone and brick are pretty much forever, requiring only minimal tuckpointing for maintenance. So, as long as you don’t decide to paint brick or stone, you’ve got siding you can trust for a lifetime.Siding Your Home in 2021

Choosing the siding that’s best for your home’s needs, your favorite aesthetic, and your budget can be challenging, but a professional siding installer can help you navigate the many options. Just look in HomeKeepr for a recommendation for siding installers and brick masons in your area, they’ll be happy to answer your questions and narrow your options.

Siding Your Home in 2021

Choosing the siding that’s best for your home’s needs, your favorite aesthetic, and your budget can be challenging, but a professional siding installer can help you navigate the many options. Just look in HomeKeepr for a recommendation for siding installers and brick masons in your area, they’ll be happy to answer your questions and narrow your options.

Things to Avoid after Applying for a Mortgage [INFOGRAPHIC]

Things to Avoid after Applying for a Mortgage [INFOGRAPHIC]

![Things to Avoid after Applying for a Mortgage [INFOGRAPHIC]](https://files.mykcm.com/2021/01/14132936/20210115-MEM-1046x1762.png)

Some Highlights

- There are a few key things to make sure you avoid after applying for a mortgage to help make sure you still qualify for your loan at the closing table.

- Along the way, be sure to discuss any changes in income, assets, or credit with your lender, so you don’t unintentionally jeopardize your application.

- The best plan is to fully disclose your intentions with your lender before you do anything financial in nature.

Friday, January 15, 2021

Cha-Ching Check: Cash Beyond Your Down Payment

Jan 14, 2021

Shopping for a house can leave you exhausted and spiritually broken, especially when that dream home is proving tricky to find in your price range. Even though you’ll eventually find the right one, you may also find yourself cutting it close on cash if you didn’t properly prepare financially. So it’s time for your pre-purchase cha-ching check.

What It Costs to Close

For sellers, closing is a fairly simple process, and most of the time they walk away with a check in hand. But for buyers, closing can be one of the largest expenses of their lives. You know it’s going to be pricey, but it’s a much easier pill to swallow if you’re totally ready for everything that’s going to go into that transaction. And there’s a lot more to paying for your new home than just coming up with the down payment. If you’re like most borrowers, to cover additional expenses on the big day, you can expect to add an additional three to six percent on top of that big chunk you’ve saved.

Those costs include, but aren’t limited to:

- Real estate-related expenses. Your lender should have already disclosed the fees they collect in order to actually do the work of creating your home loan, but there are other fees related to your loan that may or may not have been covered. These include potential lender requirements like appraisals and home inspections, as well as any repairs you’ve chosen to pay for at closing.

- Loan-related fees. If you haven’t talked to a lender yet, you may be surprised at some of the fees that are charged to take your loan from a little dream to a big investment in your future. An application fee is generally required to begin the process, as it covers the costs of things like your credit report and the initial loan processing. Other fees include prepaid interest (interest that accumulates between closing day and the day of your first payment), loan origination fees, discount points, and mortgage broker fees. These can really add up!

- Prepaid escrow expenses. Because items like your taxes and homeowner’s insurance are generally paid out of an escrow account, you’ll have to put some money into it at the get-go to kick things off. The actual initial deposits will depend on where you live, but count on at least two months, if not a full year, of each being collected to establish that account. If you have mortgage insurance, the same would also apply.

- Title-related fees. Although it would be wonderful to live in a world where you could trust that a seller was absolutely, without question, capable of guaranteeing you could buy and own their home without complications, that world doesn’t really exist. But that’s why title searches and title insurance do. These different fees pay to ensure that you will be able to buy a house without anyone else having a legal claim to it later, which would complicate your ownership considerably. Before a bank will loan you money, they want to know that a home has a clear title. Title searches track all the people who have owned the property before, and title insurance protects against any problems that might have accumulated on the title over time.

Have Questions About Closing Cha-Ching?

Today is a great day to get connected with an experienced mortgage lender or broker who can explain the fees involved in closing a loan for your specific situation. But where will you find one? Look no further than your friendly HomeKeepr community! Before you know it, you’ll have the name of a lender you can trust to help prepare you for the financial commitment required to buy your next home.

Thursday, January 14, 2021

Why Right Now May Be the Time to Sell Your House

Why Right Now May Be the Time to Sell Your House

The housing market made an incredible recovery in 2020 and is now positioned for an even stronger year in 2021. Record-low mortgage interest rates are a driving factor in this continued momentum, with average rates hovering at historic all-time lows.

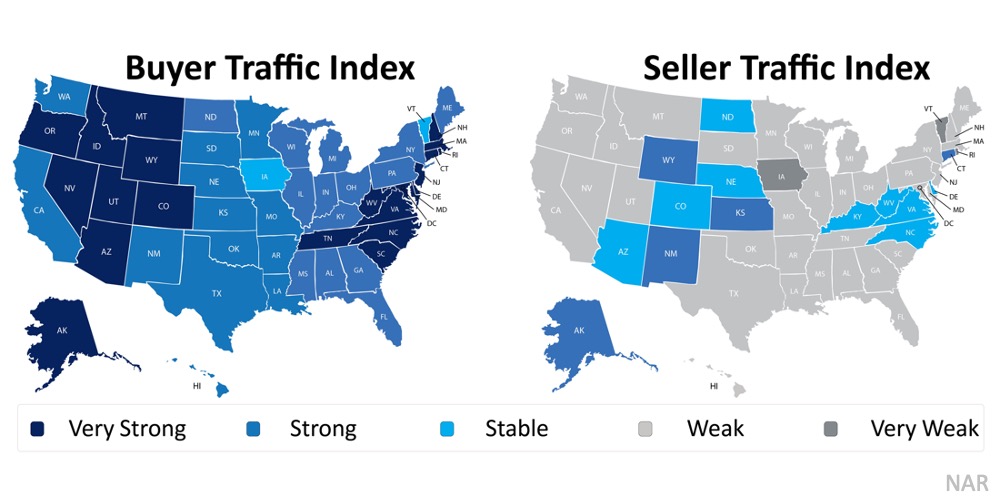

According to the latest Realtors Confidence Index Survey from the National Association of Realtors (NAR), buyer demand across the country is incredibly strong. That’s not the case, however, on the supply side. Seller traffic is simply not keeping up. Here’s a breakdown by state: As the maps show, buyer traffic is high, but seller traffic is low. With so few homes for sale right now, record-low inventory is creating a mismatch between supply and demand.

As the maps show, buyer traffic is high, but seller traffic is low. With so few homes for sale right now, record-low inventory is creating a mismatch between supply and demand.

NAR also just reported that the actual number of homes currently for sale stands at 1.28 million, down 22% from one year ago (1.64 million). Additionally, inventory is at an all-time low with 2.3 months supply available at the current sales pace. In a normal market, that number would be 6.0 months of inventory – significantly higher than it is today.

What does this mean for buyers and sellers?

Buyers need to remain patient in the search process. At the same time, they must be ready to act immediately once they find the right home since bidding wars are more common when so few houses are available for sale.

Sellers may not want to wait until spring to put their houses on the market, though. With such high buyer demand and such a low supply, now is the perfect time to sell a house on optimal terms.

Bottom Line

The real estate market is entering the year like a lion. There’s no indication it will lose that roar, assuming inventory continues to come to market.

Tuesday, January 12, 2021

Reasons to Hire a Real Estate Professional [INFOGRAPHIC]

Reasons to Hire a Real Estate Professional [INFOGRAPHIC]

![Reasons to Hire a Real Estate Professional [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/01/07152500/20210108-MEM-1046x1665.png)

Some Highlights

- Choosing the right real estate professional to work with is one of the most important decisions you can make in your homebuying or selling process.

- The right agent can explain current market conditions and break down exactly what they mean for you.

- If you’re considering buying or selling a home this year, let’s connect so you can work with someone who has the experience to answer all of your questions about pricing, contracts, negotiations, and more.

Monday, January 11, 2021

Is It Time to Replace Your Windows?

Jan 11, 2021

People don’t always appreciate all the roles that windows fill in the home. They provide natural light, give you a way to open up and let in some fresh air, and even help regulate indoor temperatures. Many homes even use windows to add a decorative element that is hard to achieve with other forms of decoration. With that said, not all windows are created equal. Some windows use cheap materials to keep costs down. Your old windows may have started out in good shape but ended up showing their age as time goes by. They may have even become damaged or otherwise in need of repair. Regardless of the reason, you might have windows in your home that just aren’t doing what you need them to do. Should you replace them? Here are a few things that you should consider to help you make this decision.

What’s Wrong With Your Windows?

Before rushing in and replacing windows, stop and think about the actual reason that you want to replace them. Do you simply not like the way that they look, or is there a bigger problem? Do the windows leak or have drafts? Is there visible damage to the glass or the window frame? There are a lot of viable reasons why you might replace windows in your home, but if you’re on the fence then it’s worth taking the time to articulate what those reasons are.

Repair or Replace?

In some cases, you might not actually need to replace your windows to take care of your issues with them. If you’re dealing with cracked glass, damaged window frames, or other forms of damage, you might be able to repair the windows at a lower cost than replacing them outright. If repair is an option, try getting some quotes to see whether it’s cheaper in your case to repair than replace.

Consistent Styling

It’s possible that at some point in the past, one or more windows in your home was replaced for some reason. Unfortunately, when that happened there may not have been a lot of care put into matching the replacement with the existing windows. This usually leaves the home with a few windows that stick out like sore thumbs. If you’re tired of certain windows being an eyesore, you might replace them and upgrade to something that more closely matches the other windows in your home. As an alternative, you could also replace all the windows and create a new style that’s all your own.

Improving Energy Efficiency

One big reason for replacing windows is to improve the overall energy efficiency of your home. Modern windows tend to go a lot further toward keeping things warm in the winter and cool in the summer than older windows do. By upgrading your windows to more energy-efficient models you can not only eliminate drafts and take care of other issues, but you can also save yourself a significant amount of money over time.

Replace One or All?

One thing to consider when looking at window replacements is whether you want to only replace certain windows or if you want to upgrade all the windows in your home. Replacing all the windows creates a more uniform style, but it also comes at a significantly higher cost. It’s certainly an option if it fits your budget, but if the price tag is a bit steep then you might also look into only replacing certain windows with similar styles that will closely match the existing windows in the home.

Getting New Windows Installed

When the time does come to replace some or all of your windows, you want to make sure that the job is done right. This is where HomeKeepr can help. Sign up for a free account today to find window installers in your area who can get the job done right without breaking the bank.

Homeownership Still More Affordable Than Renting in Most Counties

What Does 2021 Have in Store for Home Values?

What Does 2021 Have in Store for Home Values?

According to the latest CoreLogic Home Price Insights Report, nationwide home values increased by 8.2% over the last twelve months. The dramatic rise was brought about as the inventory of homes for sale reached historic lows at the same time buyer demand was buoyed by record-low mortgage rates. As CoreLogic explained:

“Home price growth remained consistently elevated throughout 2020. Home sales for the year are expected to register above 2019 levels. Meanwhile, the availability of for-sale homes has dwindled as demand increased and coronavirus (COVID-19) outbreaks continued across the country, which delayed some sellers from putting their homes on the market.

While the pandemic left many in positions of financial insecurity, those who maintained employment and income stability are also incentivized to buy given the record-low mortgage rates available; this is increasing buyer demand while for-sale inventory is in short supply.”

Where will home values go in 2021?

Home price appreciation in 2021 will continue to be determined by this imbalance of supply and demand. If supply remains low and demand is high, prices will continue to increase.

Housing Supply

According to the National Association of Realtors (NAR), the current number of single-family homes for sale is 1,080,000. At the same time last year, that number stood at 1,450,000. We are entering 2021 with approximately 270,000 fewer homes for sale than there were one year ago.

However, there is some speculation that the inventory crush will ease somewhat as we move through the new year for two reasons:

1. As the health crisis eases, more homeowners will be comfortable putting their houses on the market.

2. Some households impacted financially by the pandemic will be forced to sell.

Housing Demand

Low mortgage rates have driven buyer demand over the last twelve months. According to Freddie Mac, rates stood at 3.72% at the beginning of 2020. Today, we’re starting 2021 with rates one full percentage point lower than that. Low rates create a great opportunity for homebuyers, which is one reason why demand is expected to remain high throughout the new year.

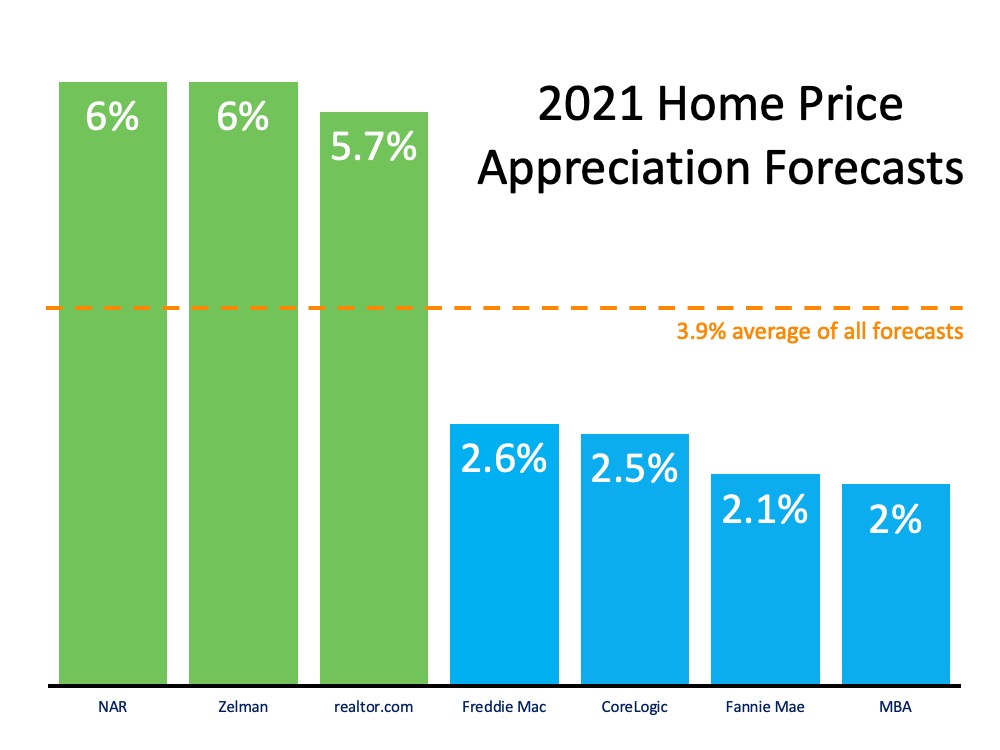

Taking into consideration these projections on housing supply and demand, real estate analysts forecast homes will continue to appreciate in 2021, but that appreciation may be at a steadier pace than last year. Here are their forecasts:

Bottom Line

There’s still a very limited number of homes for sale for the great number of purchasers looking to buy them. As a result, the concept of “supply and demand” mandates that home values in the country will continue to appreciate.

Thursday, January 7, 2021

What’s New in Water Heaters?

Jan 07, 2021

Your water heater is an important part of your home, especially if you have a family. Between cooking, cleaning, doing dishes, washing clothes, washing hands, and all the other things you use hot water for throughout the day, knowing that your water heater can handle your needs is vital. If your trusty old water heater has seen better days, it may be time to look for a replacement. Chances are a lot has changed in water heaters since yours was installed, though, so here are some of the more recent advancements in water heaters that you should know about.

Improved Efficiency

Water heaters are a lot more efficient than they used to be, which is good news for your wallet. Because of updates to efficiency standards, smaller water heaters tend to be around 4 percent more efficient, and large water heaters can be up to 25 to 50 percent more efficient. That means less time and energy spent heating water up, more hot water available at any given time, and possibly a significant savings when it comes to how much you spend each year on keeping hot water available in your home.

Changing Sizes

As a result of the improved efficiency of water heaters, most water heater models feature more insulation than older water heaters did. In some cases this isn’t really noticeable, since more efficient insulation can be used to keep size differences minimal. Depending on how old your old water heater is, though, you may find that new water heater models are simply larger and thicker than your current one is. This may not be a big deal, but if your current water heater is in a tight area without much extra room around it, then it’s definitely worth keeping this in mind.

More Tankless Options

For a long time, tankless water heaters seemed to occupy something of a niche corner of the market. In recent years, though, they have become much more common in homes, and more manufacturers are offering tankless options. Since these water heaters don’t feature a large tank that has to keep water hot, a tankless water heater might be worth considering if you have a limited amount of space in your home.

Hybrid Water Heaters

If you want to save space but are worried about going completely tankless, a hybrid water heater might be right for you. These water heaters use a small tank of water that’s kept hot, and also feature heating technology similar to tankless heaters to supply additional hot water beyond what the tank offers. This lets you save space, time, and money, since the small tank heats faster than a large tank would and ensures that you won’t have any unfortunate lapses that might occur if you have more demand than a tankless heater can manage.

Smart Water Heaters

As with many home appliances, water heaters are available with a number of smart options as well. You can control these water heaters from your smartphone, performing actions such as adjusting water temperatures and even turning the heater off and on without having to touch the water heater itself. On top of this, many smart water heaters also feature options such as Vacation Mode which reduces water temperatures while you’re away to save on water heating costs. You may even be able to sync this with other smart home features to set Vacation Mode as part of a larger overall routine for when you’re at work, traveling, or otherwise away from the house for more than a few hours.

Choosing a New Water Heater

Picking the right water heater for your home can be a challenge. Fortunately, HomeKeepr is here to help. Sign up for a HomeKeepr account for free today and you can find local pros who can help you pick the right water heater for your needs. Once it arrives, they can even install it for you.

Is This the Year to Sell My House?

Is This the Year to Sell My House?

If one of the questions you’re asking yourself is, “Should I sell my house this year?” consumer sentiment about selling today should boost your confidence in the right direction. Even with the current health crisis that continues to challenge our nation, Americans still feel good about selling a house. Here’s why.

According to the latest Home Purchase Sentiment Index from Fannie Mae, 57% of consumer respondents to their survey indicate now is a good time to buy a home, while 59% feel it’s a good time to sell one:

“The percentage of respondents who say it is a good time to sell a home remained the same at 59%, while the percentage who say it’s a bad time to sell decreased from 35% to 33%. As a result, the net share of those who say it is a good time to sell increased 2 percentage points month over month.”

As you can see, many still believe that, despite everything going on in the world, it is still a good time to sell a house.

Why is now a good time to sell?

There simply are not enough homes available to meet today’s buyer demand, and they’re selling just as quickly as they’re coming to the market. According to the National Association of Realtors (NAR), unsold inventory available today sits at a 2.3-month supply at the current sales pace, which is down from a 2.5-month supply from the previous month. This record-low inventory is not even half of what we need for a normal or neutral housing market, which should have a 6.0-month supply of unsold inventory to balance out.

With so few homes available for buyers to choose from, we’re in a true sellers’ market. Homeowners ready to make a move right now have the opportunity to negotiate the best possible contracts with buyers who are feeling the pull of intense competition when it comes to finding their dream home. Lawrence Yun, Chief Economist for NAR, notes how quickly homes are selling right now, further confirming the benefits to sellers this season:

"The market is incredibly swift this winter with the listed homes going under contract on average at less than a month due to a backlog of buyers wanting to take advantage of record-low mortgage rates."

However, this sweet spot for sellers won’t last forever. As more homes are listed this year, this tip toward sellers may start to wane. According to Danielle Hale, Chief Economist at realtor.com, more choices for buyers are on the not-too-distant horizon:

“The bright spot for buyers is that more homes are likely to become available in the last six months of 2021. That should give folks more options to choose from and take away some of their urgency. With a larger selection, buyers may not be forced to make a decision in mere hours and will have more time to make up their minds.”

Bottom Line

If you’re ready to make a move, you can feel good about the current sentiment in the market and the advantageous conditions for today’s sellers. Let’s connect today to determine the best next step when it comes to selling your house this year.

Tuesday, January 5, 2021

Gen X, Millennials Likely to Keep Home Buying Strong for Years to Come

Why Not to Wait Until Spring to Make a Move

Why Not to Wait Until Spring to Make a Move

The housing market recovery coming into the new year has been nothing short of remarkable. Many experts agree the turnaround from the nation’s economic pause is playing out extremely well for real estate, and the current market conditions are truly making this winter an ideal time to make a move. Here’s a dive into some of the biggest wins for homebuyers this season.

1. Mortgage Rates Are Historically Low

In 2020, mortgage rates hit all-time lows 16 times. Continued low rates have set buyers up for significant long-term gains. In fact, realtor.com notes:

“Given this means homes could cost potentially tens of thousands less over the lifetime of the loan.”

Essentially, it’s less expensive to borrow money for a home loan today than it has been in years past. Although mortgage rates are expected to remain relatively low in 2021, even the slightest increase can make a big difference in your payments over the lifetime of a home loan. So, this is a huge opportunity to capitalize on right now before mortgage rates start to rise.

2. Equity Is Growing

According to John Burns Consulting, 58.7% of homes in the U.S. have at least 60% equity, and 42.1% of all homes in this country are mortgage-free, meaning they’re owned free and clear.

In addition, CoreLogic notes the average equity homeowners gained since last year is $17,000. That’s a tremendous amount of forced savings for homeowners, and an opportunity to use this increasing equity to make a move into a home that fits your changing needs this season.

3. Home Prices Are Appreciating

According to leading experts, home prices are forecasted to continue appreciating. Today, many experts are projecting more moderate home price growth than last year, but still moving in an upward direction through 2021.

Knowing home values are increasing while mortgage rates are so low should help you feel confident that buying a home before prices rise even higher is a strong long-term investment.

4. There Are Not Enough Homes for Sale

With today’s low inventory of homes on the market, which is contributing to this home price appreciation, sellers are in the driver’s seat. The competition is high among buyers, so homes are selling quickly.

Making a move while so many buyers are looking for homes to purchase may mean your house rises to the top of the buyer pool. Selling your house before more listings come to the market in the traditionally busy spring market might be your best chance to shine.

Bottom Line

If you’re considering making a move, this may be your moment, especially with today’s low mortgage rates and limited inventory. Let’s connect to get you set up for homebuying success in the new year.

Monday, January 4, 2021

Exodus to the Suburbs Appears to Be Reversing

Eye-Catching Painting Tips for Homeowners

Jan 04, 2021

The way your home is decorated says a lot about you, your family, and your lifestyle. Not only does choosing the right colors set the mood in a place, putting those colors in the right spots can also dramatically change the features of a room. There are so many ways to use color to change your home!

Using Paint to Change the Game

The possibilities that new paint creates are literally endless. And the great part about playing with paint is that it’s really easy to change if you decide you’re not thrilled with the results. Unlike building projects, changing the paint in your home can be done with limited expense or hassle.

Here are just a few ideas to enhance the details of the house you already have:

- Pay close attention to the door. Your front door is one of the best spots for setting the mood for your whole home. It says something that your windows never could, so it’s important to paint it like it matters. Matching the house trim is old hat; today’s front doors feature bold or fun colors that complement the rest of your outdoor color scheme. Some houses can also see a bump in interest when homeowners try the same trick on their garage doors.

- Choose bold trim colors. Your trim doesn’t always have to be white, though it shouldn’t be the same color as the wall. Instead, you can make a huge statement by highlighting some of the more decorative elements of your home with paint colors that have something to say for themselves. Pair light gray walls with black trim, or choose several different colors to accent ornate trim work in older homes.

- Rethink built-in cabinets and shelving. Plenty of homes have built-in shelving or cabinets, but most homeowners opt to paint these the same color as the trim in their homes, effectively hiding a potentially eye-popping element. Instead of blending your built-ins into the background, choose colors to highlight them. Painting doors a different color than walls and trim, or selecting a bold or bright color for the back wall of an open shelving unit can really make a statement. This trick can also work for the risers on wooden staircases.

- Why not white? A lot of people shy away from white walls because they feel like the color lends an institutional feel to a room, but white doesn’t have to be hospital-grade. There are a range of barely there colors within the white spectrum, and you can enhance them with color pops in the room itself. It’s your house; if you want a white, don’t let anyone tell you you’re wrong. Choosing a trim color that complements your white is also vital to success with all-white walls.

- Color on the ceiling? Sure! There’s been a long tradition of ceilings being painted a flat white, but that wasn’t always the case. In the past, ceilings have been havens of color in rooms of various sizes and shapes. Depending on the effect you’re looking to create, you can use lighter or darker colors to visually raise or lower the ceiling, or accent decorative ceilings with color for added dimension.

- Try textured paint. Wall texture comes and goes as a trend, but it’s a great way to deal with older homes that may have irregular or downright rough walls. Today’s texture paint goes well beyond Venetian plasters, giving you a huge range of options in texture and more ways to get an end result you’ll absolutely adore. Use a heavy texture as an accent, or go a little lighter for interest throughout your living space.

What If You’re No Picasso?

If you’re not sure how to accomplish your design goals in your home, or you simply lack the skill to do the job right, it’s ok. That’s what your HomeKeepr community is for! Not only can you get recommendations for painters in your area, you’ll know they’re going to be absolute professionals with an eye for details. Just pop into your HomeKeepr app to get started.

Foreclosure Numbers Are Nothing Like the 2008 Crash

Foreclosure Numbers Are Nothing Like the 2008 Crash If you’ve been keeping up with the news lately, you’ve probably come across some artic...

-

How Resilient Is the Housing Market? : Real estate demand is making a comeback, and the rebound will provide continued support to home price...

-

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages If you remember the housing crash back in 2008, you may recall just how...

-

Is Owning a Home Still the American Dream for Younger Buyers? Everyone has their own idea of the American Dream, and it's different fo...