I am dedicated to providing authentic, excellent customer service; to me this means getting to know your needs and wants and finding the best solution for your specific situation. I plan to diligently work with you to prepare a competent strategy to effectively sell and/or purchase your home. I’d like to provide you with the information you need to make an informed decision. As we navigate through this process I will walk alongside you as your knowledgeable, trusted real estate resource.

Monday, November 30, 2020

New-Home Sales Are 41.5% Higher Than a Year Ago

Record Number of Homeowners Stand to Lower Mortgage Payments

Get Fired Up! Checking Your Furnace for Winter

Nov 30, 2020

When the last of the brightly colored leaves cling tightly to otherwise bare trees, you know that winter is coming. It’s a sad state of affairs, but happens every year, just like clockwork. The sleet, the snow, the ice, the cold, it all comes in a cycle, and because of that, you need to be paying particular attention to your furnace this time of year. Even if it hasn’t yet started raining down frozen apocalypse upon your head where you live, being ready for the day you’ll have to kick the heat on is a good idea. After all, you don’t want to find out that your furnace isn’t working properly when there’s a foot of snow in the forecast.

Furnace Basics

There are a lot of different kinds of ways to heat a house, but this article is about furnaces in particular. A furnace is a complex piece of equipment that not only contains a heat source, but also a blower to distribute heat throughout a home using a duct system. It’s part of a larger HVAC system, which generally also includes an air conditioner or heat pump. They can be mounted in attics, crawlspaces, garages, basements, and even outdoors in the right situation.

You should already be performing basic maintenance on your HVAC system, no matter what season. This would include items like changing the furnace filter (or cleaning it if it’s an electrostatic one) and flushing the condensation line. Keep those up, even in the winter.

Getting Ready for Winter

As for winter-specific tasks, your furnace should have a pre-launch check at least yearly. If you’re already using it for heating, it’s not too late, just remember to do this before you fire it up next year. Go through this list and hit all the items on it:

- Thermostat. Likely you use your thermostat year-round, but if you don’t, check that your furnace will come on and go off with the control on the wall. If your thermostat is very old, it might be a good idea to replace it with a programmable or smart thermostat to help you save more fuel or electricity this winter.

- Pilot light. Older gas or propane-powered furnaces often have a standing flame pilot light, which is exactly what it sounds like. It’s a fire in your house. All the time. Make sure the pilot light is actually lit if your furnace has one, otherwise you’re gonna be cold, and there’s also a chance gas is leaking in your home. If it’s a newer furnace, it likely has an electric ignitor, which will light the furnace automatically when it kicks on. If you’re not getting heat from a furnace with an electric ignitor, follow the instructions on your furnace to reset it; if that fails, try resetting the breaker.

- Detectors. Smoke and CO2 detectors should be checked regularly, but definitely before you fire up the furnace. They have test buttons on them for this purpose. If they don’t go off, check the batteries or connections if they’re hardwired. Any detectors that fail inspection should be replaced immediately.

These are all simple things you can do to get ready for furnace season. However, there are a few other tasks that you should call an expert in to check or maintain.

When to Call in the Pros

Obviously, you’ll need to call a pro if your furnace won’t come on despite your best efforts. But you should also have an HVAC professional out to clean the air handler, flame sensors, and other vital parts of your furnace. Some DIYers might be able to do this with no issue, but for the general public, it’s safer and much smarter to call someone who knows furnaces inside and out.

Where would you find such a person? Well, in your HomeKeepr community, where you can search for an HVAC professional in your area. It’s great to know that the pros you’re working with have been used by the people in your own networks and found to be at the top of their game.

Wednesday, November 25, 2020

Monday, November 23, 2020

Get Started With Home Winterization

Nov 23, 2020

While the fall has been mild and even warm in many areas, it’s important to realize that winter is right around the corner. There’s no way to tell what the winter might hold, and even if you don’t see much in the way of snow and ice you can still run into some problems if your home isn’t ready for cold winter temperatures. To make sure that you’re as ready as possible for whatever the winter might have in store, here are some things to consider as you make your winterization plans.

Weatherproofing and Heat Loss

One big problem during the winter is heat loss, with doors and windows being some of the biggest culprits here. A few big aspects of weatherproofing to prevent heat loss involve things like installing weather strips on your doors and windows, caulking around windows where you can feel a draft, adding a door sweep to keep drafts from occurring under your door, and even installing a storm door if you don’t have one. Adding thermal plastic over windows and other exposed surfaces can help with this as well.

Leaks and Burst Pipes

Depending on where you live, leaky pipes and even pipes bursting after a freeze can be big problems during the winter. There are a few ways to prevent this, including disconnecting external hoses, installing covers over external faucets, and adding pipe insulation to the pipes under your home. Sealing or caulking cracks and other openings where pipes and conduits travel through walls can also help, as can installing heat cables on your pipes if freezing is a major concern.

Prepare for Heat

If you’re like most people, you’re going to need to heat your home during the winter. It’s best to do some maintenance and testing of your heating systems while it’s still warm so that you’re not left in the cold once winter hits in earnest. If you use a fireplace, have your chimney cleaned to remove creosote and blockages before you have to use it. Clean any external components of your heating system to remove leaves and other debris, then turn the heat on to make sure that it’s actually working properly. Don’t be alarmed if you smell a bit of dust burning off, but if the burning smell continues or the heat isn’t coming out of the vents very well then get some maintenance done on your system.

Check the Roof

Your roof and gutters should be checked toward the end of autumn, after the leaves have mostly stopped falling and before the temperatures drop too much. Look for signs of damaged or missing shingles, as well as any obvious dips, leaks, or weak spots in the roof. Clean your gutters thoroughly and make sure that they’re securely fastened to your home. You might consider installing snow or ice guards to prevent large amounts of snow becoming a falling hazard during the winter as well. In addition, take the time to check your attic and make sure that all the insulation is in good condition and that there’s sufficient ventilation to keep mold and other problems at bay.

Last-Minute Maintenance

While you’re not likely to use them much during the winter, be sure to take an afternoon to clean and maintain your mowers, trimmers, and any other power equipment before you stow it away for the winter. This also applies for any grills or other outdoor equipment you won’t be using again until spring. While you’re at it, do some maintenance and testing of equipment such as leaf blowers, snow blowers, and portable heaters that you might need to use over the winter to make sure that everything is in proper working order.

Winterization Upgrades

Heating bills can really climb during a hard winter, so this might be a good time to invest in energy-efficient heating solutions such as a smart thermostat or an upgraded heat pump. HomeKeepr can help you find an HVAC installer that will get you exactly what you need to stay toasty all winter without breaking the bank. Sign up for a free account today to find the pro you need.

Thursday, November 19, 2020

Will Mortgage Rates Remain Low Next Year?

Will Mortgage Rates Remain Low Next Year?

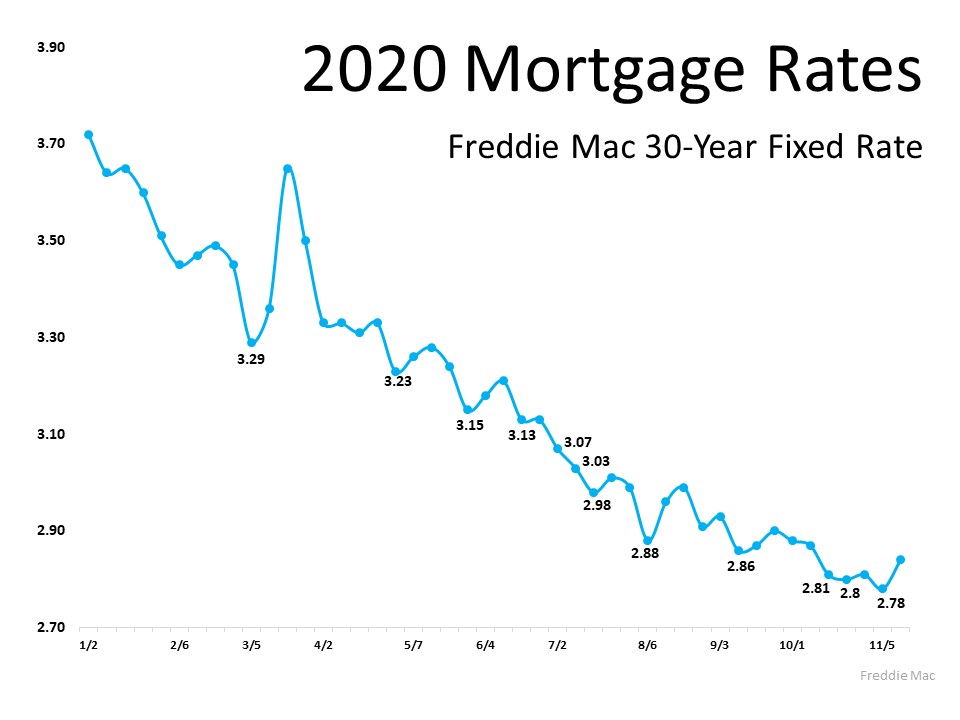

In 2020, buyers got a big boost in the housing market as mortgage rates dropped throughout the year. According to Freddie Mac, rates hit all-time lows 12 times this year, dipping below 3% for the first time ever while making buying a home more and more attractive as the year progressed (See graph below): When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

When you continually hear how rates are hitting record lows, you may be wondering: Are they going to keep falling? Should I wait until they get even lower?

The Challenge with Waiting

The challenge with waiting is that you can easily miss this optimal window of time and then end up paying more in the long run. Last week, mortgage rates ticked up slightly. Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates jumped this week as a result of positive news about a COVID-19 vaccine. Despite this rise, mortgage rates remain about a percentage point below a year ago.”

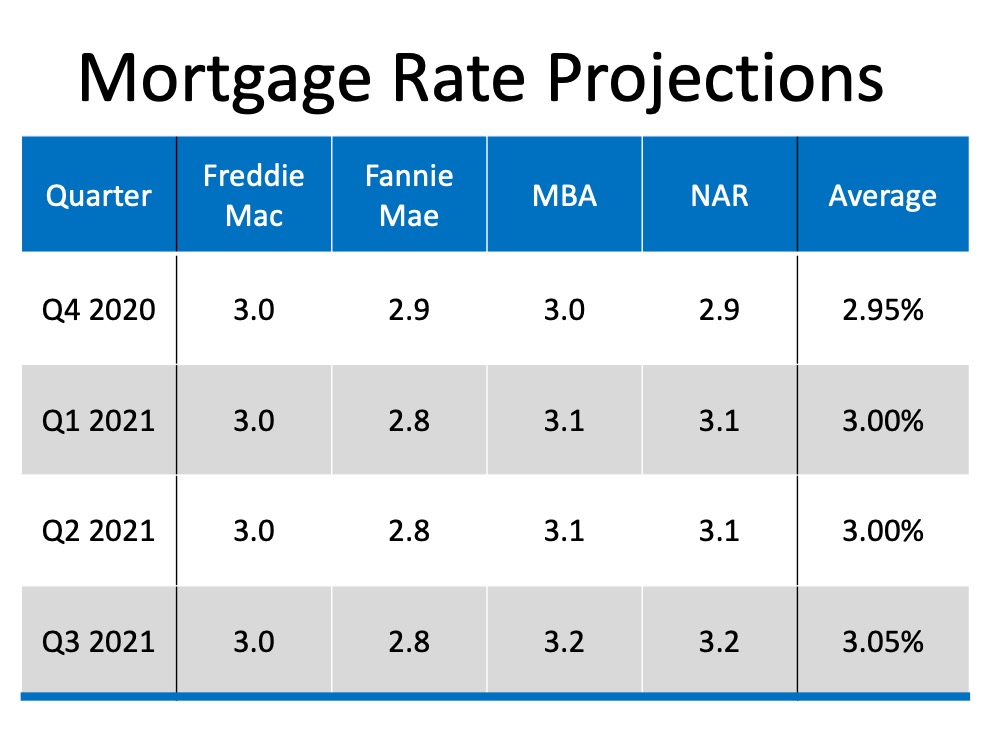

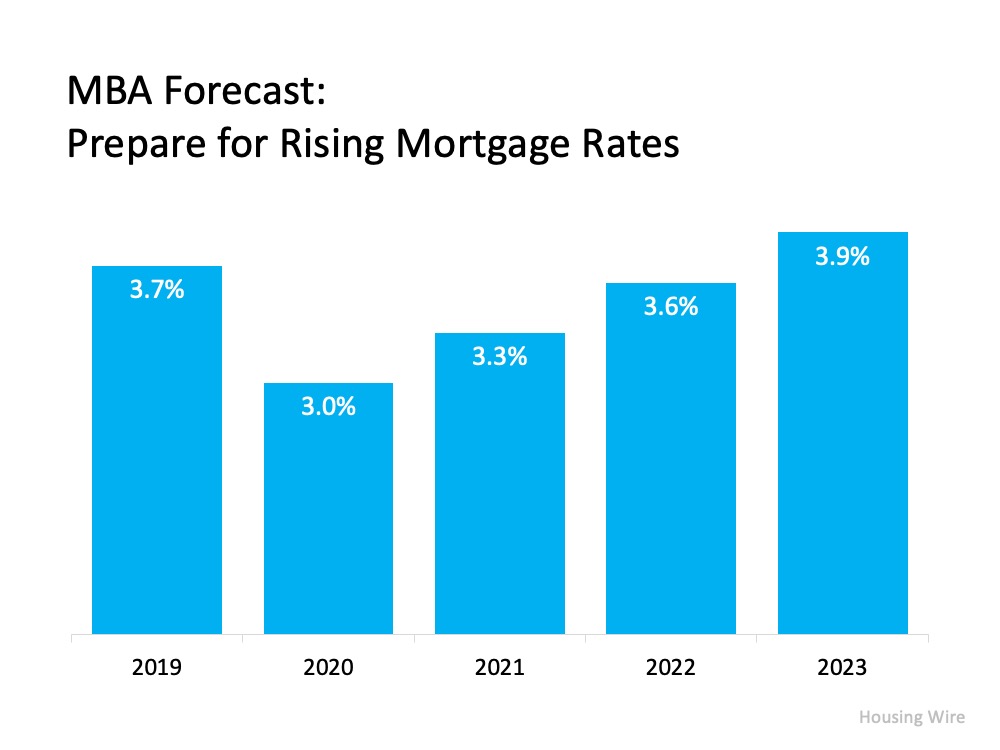

While rates are still lower today than they were one year ago, as the economy continues to get stronger and the pandemic is resolved, there’s a very good chance interest rates will rise again. Several top institutions in the real estate industry are projecting an increase in mortgage rates over the next four quarters (See chart below): If you’re planning to wait until next year or later, Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), forecasts mortgage rates will begin to steadily rise:

If you’re planning to wait until next year or later, Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), forecasts mortgage rates will begin to steadily rise: As a buyer, you need to decide if waiting makes financial sense for you.

As a buyer, you need to decide if waiting makes financial sense for you.

Bottom Line

If you’re planning to buy a home and want to take advantage of today’s low rates, now is the time to do so. Don’t assume they’re going to stay this low forever.

Wednesday, November 18, 2020

Why Do I Need Earnest Money?

Nov 16, 2020

When you’re shopping for a home, it can feel like you’re hemorrhaging money. You’ve got all sorts of things to pay for, from loan application fees to home inspections, so when the issue of earnest money comes up unexpectedly, it can be a “slam on the brakes” moment. Now that the days of low to no down payments are largely past and markets everywhere seem to be running thin on inventory, earnest money may well be the most important negotiating tool you’ve never heard of.

What Is Earnest Money?

When you make an offer on a home, part of that offer can include a little show of good faith on your part, in the form of cold, hard cash. Generally, one to three percent of the offer price is pretty normal for an earnest money deposit, but this can vary pretty widely based on market conditions. And the more you put up, the better. But what happens to that money?

Earnest money is literally just a show of faith. When you go to the closing table, it becomes part of your cash to close equation, which includes other line items like your down payment, your closing costs, and your prepaid items. It’s not a bribe or an extra fee to convince a seller to sell to you. It will simply be applied in full as a credit in your closing documents, reducing the amount of money you need to bring with you on the big day.

Here’s the one kicker. If you were to decide to back out of the contract with no real cause, the seller may be entitled to some or all of that earnest money. However, plenty of situations exist where you may not be able to close, but your earnest money will be refunded, such as:

- An unacceptable home inspection. This all has to be stipulated in your contract; there are no givens in a real estate transaction, but there are things that are pretty standard. Having an unacceptable home inspection, if the seller is not willing to make reasonable repairs, can be a cause for terminating the contract and getting your earnest money back.

- Your financing falls through. Again, you’ll need a financing clause or addendum to ensure you’re covered in this event, but because financing is so important to real estate transactions in general, they are pretty standard. If your financing falls through due to no fault of your own (you’ve been laid off, your bank closes, a co-borrower dies), you should generally be able to reclaim your earnest money. The specifics will be in your real estate sales contract, so pay close attention.

- The seller can’t close. There are a few rare situations where a seller can’t close the transaction. These are incredibly uncommon, but they do happen once in a while. For example, you might find out that the seller only believed they were the owners of the home. This can occur when a parent dies without a will, forcing the property into probate court even when it’s clear an only child will be the sole heir. And in the case that the seller can close, but chooses not to for whatever reason, you would also get your money back.

What Is an Earnest Money Note?

In some markets, you may have an additional option for earnest money, known as an earnest money promissory note. This is essentially an IOU that accompanies the offer. On the note, you’ll specify exactly when you’ll either turn the paper into actual cash or forfeit the offer entirely. Though these were once very common, they’re far less so today. If you choose to use an earnest money promissory note, be sure to describe in great detail why you’re not able to provide earnest money on the spot and how you will remedy this.

For example, if you have some stocks you were going to cash out for your down payment, but didn’t want to touch until you were really ready, you may need time to sell enough to cover the earnest money. In that case, specify this as the reason and say that you’ll initiate a sale on a certain day, then convert the note on that day. Make sure to leave yourself a little leeway, because if you fail to perform, you can suffer serious consequences.

Generally speaking, earnest money promissory notes can be considered a sign of a weak offer, but this varies from offer to offer and market to market and you should inquire before taking that leap.

Single-Family Rentals Can Be a Good Deal for Investors

Chances of Another Foreclosure Crisis? “About Zero Percent.”

Chances of Another Foreclosure Crisis? “About Zero Percent.”

There seems to be some concern that the 2020 economic downturn will lead to another foreclosure crisis like the one we experienced after the housing crash a little over a decade ago. However, there’s one major difference this time: a robust forbearance program.

During the housing crash of 2006-2008, many felt homeowners should be forced to pay their mortgages despite the economic hardships they were experiencing. There was no empathy for the challenges those households were facing. In a 2009 Wall Street Journal article titled Is Walking Away From Your Mortgage Immoral?, John Courson, Chief Executive of the Mortgage Bankers Association, was asked to comment on those not paying their mortgage. He famously said:

“What about the message they will send to their family and their kids?”

Courson suggested that people unable to pay their mortgage were bad parents.

What resulted from that lack of empathy? Foreclosures mounted.

This time is different. There was an immediate understanding that homeowners were faced with a challenge not of their own making. The government quickly jumped in with a mortgage forbearance program that relieved the financial burden placed on many households. The program allowed many borrowers to suspend their monthly mortgage payments until their economic condition improved. It was the right thing to do.

What happens when forbearance programs expire?

Some analysts are concerned many homeowners will not be able to make up the back payments once their forbearance plans expire. They’re concerned the situation will lead to an onslaught of foreclosures.

The banks and the government learned from the challenges the country experienced during the housing crash. They don’t want a surge of foreclosures again. For that reason, they’ve put in place alternative ways homeowners can pay back the money owed over an extended period of time.

Another major difference is that, unlike 2006-2008, today’s homeowners are sitting on a record amount of equity. That equity will enable them to sell their houses and walk away with cash instead of going through foreclosure.

Bottom Line

The differences mentioned above will be the reason we’ll avert a surge of foreclosures. As Ivy Zelman, a highly respected thought leader for housing and CEO of Zelman & Associates, said:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

Monday, November 16, 2020

Foreclosure Filings Are on the Rise

Why Working from Home May Spark Your Next Move

Why Working from Home May Spark Your Next Move

If you’ve been working from home this year, chances are you’ve been at it a little longer than you initially expected. Businesses all over the country have figured out how to operate remotely to keep their employees healthy, safe, and productive. For many, it may be carrying into next year, and possibly beyond.

While the pandemic continues, Americans are re-evaluating their homes, floorplans, locations, needs, and more. Some need more space, while others need less. Whether you’re renting or own your home, if remote work is part of your future, you may be thinking about moving, especially while today’s mortgage rates are so low.

A recent study from Upwork notes:

“Anywhere from 14 to 23 million Americans are planning to move as a result of remote work.”

To put this into perspective, last year, 6 million homes were sold in the U.S. This means roughly 2 – 4X as many people are considering moving now, and there’s a direct connection to their ability to work from home.

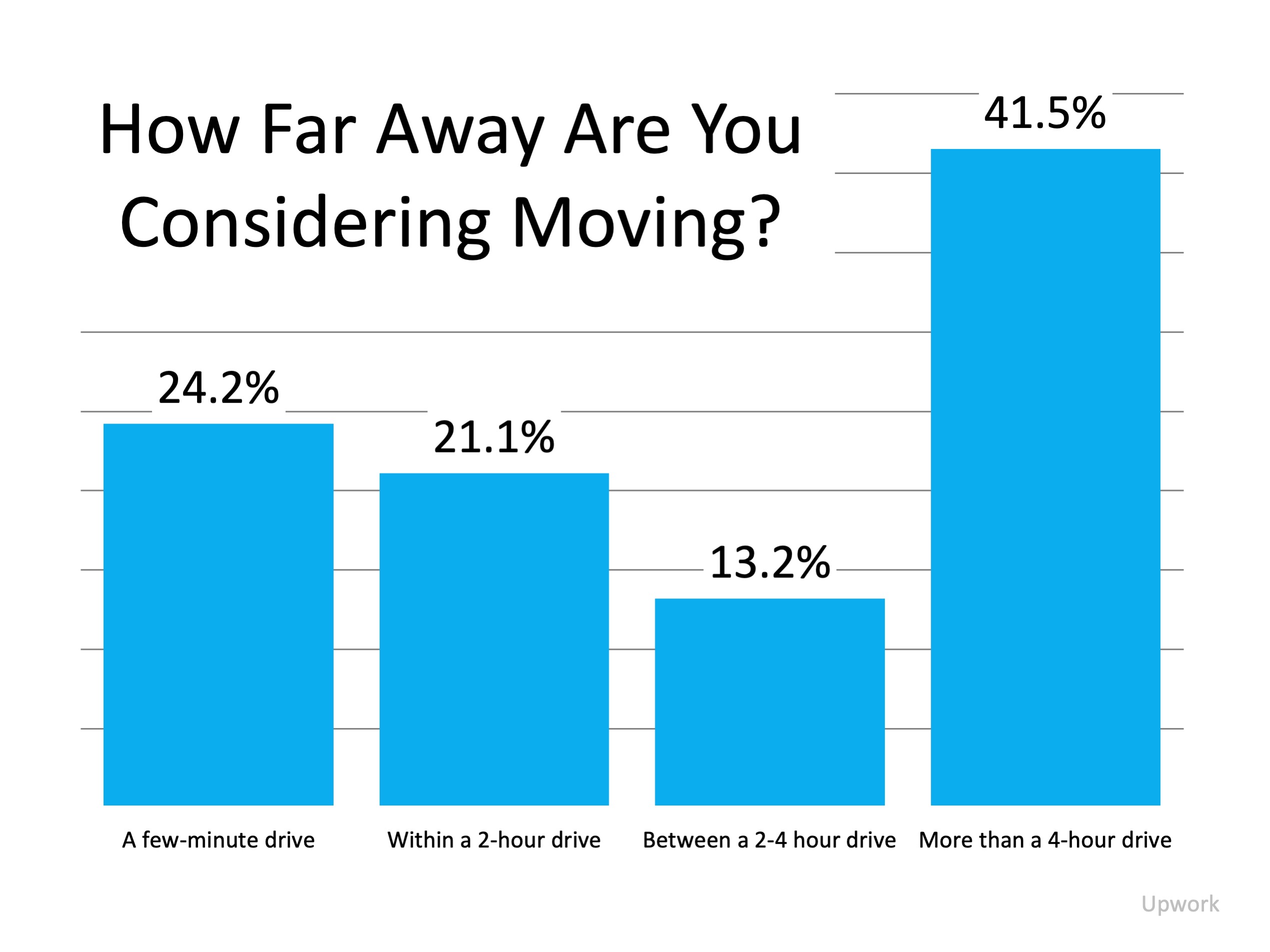

The same study also notes while 45.3% of people are planning to stay within a 2-hour drive from their current location, 41.5% of the people who are citing working from home as their primary reason for making a move are willing to look for a home more than 4 hours away from where they live now (See graph below): In some cases, moving a little further away from your current location might mean you can get more home for your money. If you have the opportunity to work remotely, you may have more options available by expanding your search. Upwork also indicates, of those surveyed:

In some cases, moving a little further away from your current location might mean you can get more home for your money. If you have the opportunity to work remotely, you may have more options available by expanding your search. Upwork also indicates, of those surveyed:

“People are seeking less expensive housing: Altogether, more than half (52.5%) are planning to move to a house that is significantly more affordable than their current home.”

Whether you can eliminate your daily commute to the office, or you simply need more space to work from home, your plans may be changing. If that’s the case, it’s time to connect with a local real estate professional to assess your evolving needs and determine your path together.

Bottom Line

This has been a year of change, and what you need in a home is no exception. Let’s connect today to make sure you have expert guidance on your side to help you find a home that fits your remote work needs.

Pandemic Caused Buyers to Seek Multi-Generational Homes, Sellers to Sell Faster

Sunday, November 15, 2020

Home Sellers Stand to Gain More Equity This Winter

Saturday, November 14, 2020

Buyers Under Pressure as Homes Continue to Sell Quickly

Friday, November 13, 2020

Three Ways Low Inventory Is a Win for Sellers

Three Ways Low Inventory Is a Win for Sellers

The number of houses for sale today is significantly lower than the high buyer activity in the current housing market. According to Lawrence Yun, Chief Economist for the National Association of Realtors (NAR):

"There is no shortage of hopeful, potential buyers, but inventory is historically low."

When the demand for homes is higher than what’s available for sale, it’s a great time for homeowners to sell their house. Here are three ways low inventory can help you win if you’re ready to make a move this fall.

1. Higher Prices

With so many more buyers in the market than homes available for sale, homebuyers are frequently entering into bidding wars for the houses they want to purchase. This buyer competition drives home prices up. As a seller, this can definitely work to your advantage, potentially netting you more for your house when you close the deal.

2. Greater Return on Your Investment

Rising prices mean homes are also gaining value, which drives an increase in the equity you have in your home. In the latest Homeowner Equity Insights Report, CoreLogic explains:

“In the second quarter of 2020, the average homeowner gained approximately $9,800 in equity.”

This year-over-year growth in equity gives you the ability to put that money toward a down payment on your next home or to keep it as extra savings.

3. Better Terms

When we’re in a sellers’ market like we are today, you’re in the driver’s seat if you sell your house. You have the power to sell on your terms, and buyers are more likely to work with you if it means they can finally move into their dream home.

So, is low housing inventory a big deal?

Yes, especially if you want to sell your house at the perfect time. Today’s market gives sellers immense negotiating power. However, it won’t last forever, especially as more sellers return to the housing market next year. If you’re considering selling your house, the best time to do so is now.

Bottom Line

If you’re interested in taking advantage of the current sellers’ market, let’s connect today to determine your best move in our local market.

Wednesday, November 11, 2020

Hot Housing Market Likely Won’t Cool in Winter

What Is a Building Permit?

Nov 09, 2020

Chances are, you’ve at least heard of building permits even if you haven’t applied for one yourself. Going by their name alone, you can probably guess the general gist of what these permits are used for. You might be surprised to find out that a lot of homeowners don’t really know that much about building permits, especially when it comes to details such as when you need to apply for one. It can actually get kind of confusing at times, so here’s a rundown of the basics of building permits so you won’t be left scratching your head the next time you’re considering a new project around the house.

What Are Building Permits?

As the name implies, a building permit is a written permission granted by a municipality or other governing body that allows you to build something within the body’s jurisdiction. That’s a fancy way of saying that the city or other area you live in gave you permission to build within the city or county limits. This helps to ensure that the work you’re doing is safe and falls within the guidelines established by local building and construction codes. Since these codes can be different depending on the location where you live, building permits help to ensure that everything complies with all local regulations.

Applying for a Permit

In most areas, applying for a building permit is a pretty straightforward process. You fill out an application, prepare a site plan that details what you’ll be building, and schedule an appointment to have the plan approved. Once your permit is approved, you may need to schedule inspections of the works site as well to ensure that things are following the plan that was laid out in your application. Bear in mind that the specific process and any fees or other costs associated with the application process will vary depending on local zoning rules and other legal specifics of the area where you live.

Building Permit Changes

Once you have a building permit, you’re free to go ahead with your building project. What happens if your plans change during the building process, though? The answer depends on the nature of your change. Depending on the jurisdiction you’re in, you may be free to continue your project if the changes are relatively minor or still in the spirit of the original permit. If there are major deviations from what you specified in your original application, however, you’ll almost certainly need to either have your permit amended or apply for a new permit to cover the project as it now stands. Bear in mind that this depends heavily on the jurisdiction that issues the permit, so be sure to check and see how that affects your permit before making major changes to your project.

Do You Need a Permit?

One bit of good news is that not all construction projects require you to apply for a building permit. While this depends largely on the specifics of local building codes, you typically won’t need a building permit for small projects or projects that don’t make structural changes to your home. And you may not need one for some significant modifications, such as replacing plumbing or electrical wiring. As an example, you’re likely not going to need a building permit to paint your house or install a small fence around your backyard, though you may still need to clear those changes with your homeowner’s association if you’re in one. However, should you decide to add walls, convert your garage to a living room, or build a new exterior building, you could very well need a permit depending on where you live.

Finding a Contractor to Help

If you’re frustrated by the process of getting a building permit, there’s some good news: If you bring on a contractor to get the job done, they’ll likely take care of all necessary permits as well. HomeKeepr can connect you with the perfect contractor to both do the work and handle the paperwork, based on real recommendations from people you trust. Sign up for a free account today to get started.

Monday, November 9, 2020

Buying Frenzy Heats Up in Second-Home Market

Thursday, November 5, 2020

Why the 2021 Forecast Doesn’t Call for a Foreclosure Crisis

Why the 2021 Forecast Doesn’t Call for a Foreclosure Crisis

As the current forbearance mortgage relief options come to an end, many are wondering if we’ll face a foreclosure crisis next year. This is understandable, especially for those who remember the housing crisis that began in 2008. The reality is, plans have been put in place through forbearance to ensure history doesn’t repeat itself.

This year, homeowners are able to request 180 days of mortgage relief through forbearance. Upon expiration of that timeframe, they’re also entitled to request 180 additional days, bringing the total to 360 days of deferred payment eligibility. As forbearance expires, homeowners should stay in touch with their lender, because creating a plan for the deferred payments is a critical next step to avoiding foreclosure. There are multiple options for homeowners to pursue at this point, and with the right planning and communication with the lender, foreclosure doesn’t have to be one of them.

Many homeowners are concerned that they’ll have to pay the deferred payments back in a lump sum payment at the end of forbearance. Thankfully, that’s not the case. Fannie Mae explains:

“You don’t have to repay the forbearance amount all at once upon completion of your forbearance plan…Here’s the important thing to remember: If you receive a forbearance plan, you will have options when it comes to repaying the missed amount. You don’t have to pay the forbearance amount at once unless you are able to do so.”

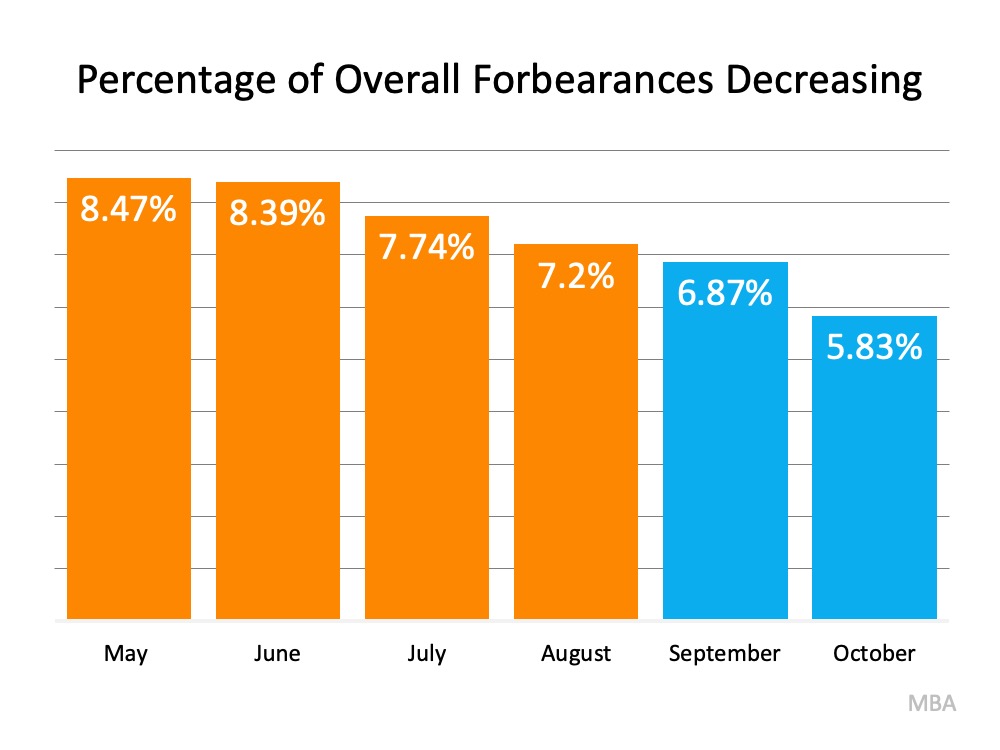

When looking at the percentage of people in forbearance, we can also see that this number has been decreasing steadily throughout the year. Fewer people than initially expected are still in forbearance, so the number of homeowners who will need to work out alternative payment options is declining (See graph below): This means there are fewer and fewer homeowners at risk of foreclosure, and many who initially applied for forbearance didn’t end up needing it. Mike Fratantoni, Senior Vice President and Chief Economist at the Mortgage Bankers Association (MBA), explains:

This means there are fewer and fewer homeowners at risk of foreclosure, and many who initially applied for forbearance didn’t end up needing it. Mike Fratantoni, Senior Vice President and Chief Economist at the Mortgage Bankers Association (MBA), explains:

"Nearly two-thirds of borrowers who exited forbearance remained current on their payments, repaid their forborne payments, or moved into a payment deferral plan. All of these borrowers have been able to resume - or continue - their pre-pandemic monthly payments."

For those who are still in forbearance and unable to make their payments, foreclosure isn’t the only option left. In their Homeowner Equity Insights Report, CoreLogic indicates:

“In the second quarter of 2020, the average homeowner gained approximately $9,800 in equity during the past year.”

Many homeowners have enough equity in their homes today to be able to sell their houses instead of foreclosing. Selling and protecting the overall financial investment may be a very solid option for many homeowners. As Ivy Zelman, Founder of Zelman & Associates, mentioned in a recent podcast:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

Bottom Line

If you’re currently in forbearance or think you should be because you’re concerned about being able to make your mortgage payments, reach out to your lender to discuss your options and next steps. Having a trusted and knowledgeable professional on your side to guide you is essential in this process and might be the driving factor that helps you stay in your home.

Tuesday, November 3, 2020

Hot Flooring Trends for Homeowners

Nov 02, 2020

Very few things in a home can make such a difference to both form and function as new floors. Flooring reflects not only your style and personality, but also your lifestyle. The right floor can make it easier to keep your home cleaner, hide imperfections, and set the mood for a cozy living space. And although flooring has generally been an “anything goes” environment for a while in home design, there are certain trends that have been a lot more popular than others. Here’s a brief round-up that should make your flooring search a little easier.

Hard Flooring Options

Hard flooring is any kind of flooring with a solid, and generally non-porous, surface. It’s a pretty big group of materials, really. Hard flooring offers many benefits. The materials are more resilient to regular use, so wear life is longer. And cleaning is easier because there’s no fibers to capture things like pet hair, loose skin cells, dirt, and microbes. Some of this year’s most popular hard flooring options include:

- Vinyl Plank. Vinyl plank is designed much like laminate flooring, with a tongue and groove locking system that creates a watertight seal when properly installed. The difference between vinyl plank and laminate flooring, however, is that vinyl plank is made from solid vinyl, rather than being several layers of different materials sandwiched together. It’s a great choice for wet areas like kitchens and bathrooms, and for households with pets and children. As a bonus, vinyl plank is available in a huge range of patterns, from synthetic marble to the super hot high variation wood-like floor patterns. There’s a vinyl plank product for basically any situation.

- Wood-Look Porcelain Tile. If you want something that will last longer than vinyl plank, but still look like wood, wood-look porcelain tiles are a great option. They look like wood planks, but are made from extremely durable porcelain. It’s an option that’s very permanent and will last for many, many years to come. They can also be purchased in the high variation wood patterns, though the effect is less obvious than with vinyl plank since there is grout between the tiles.

- Terrazzo. This might be the coolest flooring you’ve never heard of. Although it’s popular, many people don’t know the term for it. Terrazzo is that tile flooring that’s made from concrete with lots of inclusions like glass, shells, or other interesting bits mixed in. It looks great in mid-century modern homes, or those decorated in the style. And since concrete is extremely durable, it will last and last.

- Reclaimed Wood. There are lots of places you can go to buy reclaimed wood, sometimes referred to as “architectural salvage.” When a building is being torn down, firms can sometimes acquire the materials, especially if the building is historic. You can also talk to individuals you know who are looking to commit crimes like removing all the original hardwoods from a home they’re remodeling, and pick up the flooring for cheap. It can be labor intensive to install reclaimed wood floors, but you’ll end up with a totally unique look and keep building materials out of the landfill, so it’s kind of a double win.

What About Carpet?

Homeowners have run hot and cold about carpet across the generations. Sometimes they’re in, sometimes they’re out, and usually there are some people who are still really into them even when their popularity is waning. Right now the trend in carpets is to opt for carpeting in limited spots, like using carpet runners for stairs. Carpet tiles are seeing some popularity, especially since they come in a ton of fun colors and tend to have a very low nap, making them easy to keep clean. If you want more carpet, look for large area rugs or keep your carpet in low-use rooms like bedrooms. “Maximalism” is making a big comeback, encouraging big patterns and colors with big personalities. Clashing is the new matching, it would seem.

How About a Flooring Installer?

Once you know what kind of flooring you’d prefer, you’ll need to find someone to install it. Some flooring shops have an in-house flooring installer, but you can’t always rely on these experts to be as expert as you’d like. That’s where HomeKeepr comes in where you’ll have a list of flooring experts who can help you. Not every flooring installer installs every kind of flooring, so be sure to ask them about their areas of expertise before you make your final decision.

Monday, November 2, 2020

NAR Releases 2021 Statistical & Forecast News Release Schedule

Pending Home Sales Falter 2.2% in September

Sunday, November 1, 2020

Buyer Demand Strong Even as Pending Home Sales Cool Slightly

Foreclosure Numbers Are Nothing Like the 2008 Crash

Foreclosure Numbers Are Nothing Like the 2008 Crash If you’ve been keeping up with the news lately, you’ve probably come across some artic...

-

How Resilient Is the Housing Market? : Real estate demand is making a comeback, and the rebound will provide continued support to home price...

-

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages If you remember the housing crash back in 2008, you may recall just how...

-

Is Owning a Home Still the American Dream for Younger Buyers? Everyone has their own idea of the American Dream, and it's different fo...