Real Estate & PDX Market Action Information

I am dedicated to providing authentic, excellent customer service; to me this means getting to know your needs and wants and finding the best solution for your specific situation. I plan to diligently work with you to prepare a competent strategy to effectively sell and/or purchase your home. I’d like to provide you with the information you need to make an informed decision. As we navigate through this process I will walk alongside you as your knowledgeable, trusted real estate resource.

Tuesday, July 1, 2025

NAR Pending Home Sales Report Reveals 1.8% Increase in May

Friday, June 27, 2025

Buying Your First Home? FHA Loans Can Help

Buying Your First Home? FHA Loans Can Help

If you’re a first-time homebuyer, you might feel like the odds are stacked against you in today’s market. But there are resources and programs out there that can help – if you know where to look. And one thing that can make homeownership easier to achieve? An FHA home loan.

They’re designed to help you overcome some of the biggest financial hurdles in the homebuying process – and that’s why so many first-timers are using them to make their purchase.

Whether you’re dreaming of ditching rent, planting roots, or just wanting a place that’s truly yours, an FHA home loan could be the path that gets you there sooner than you think.

Buying Your First Home Probably Doesn’t Feel Easy Right Now

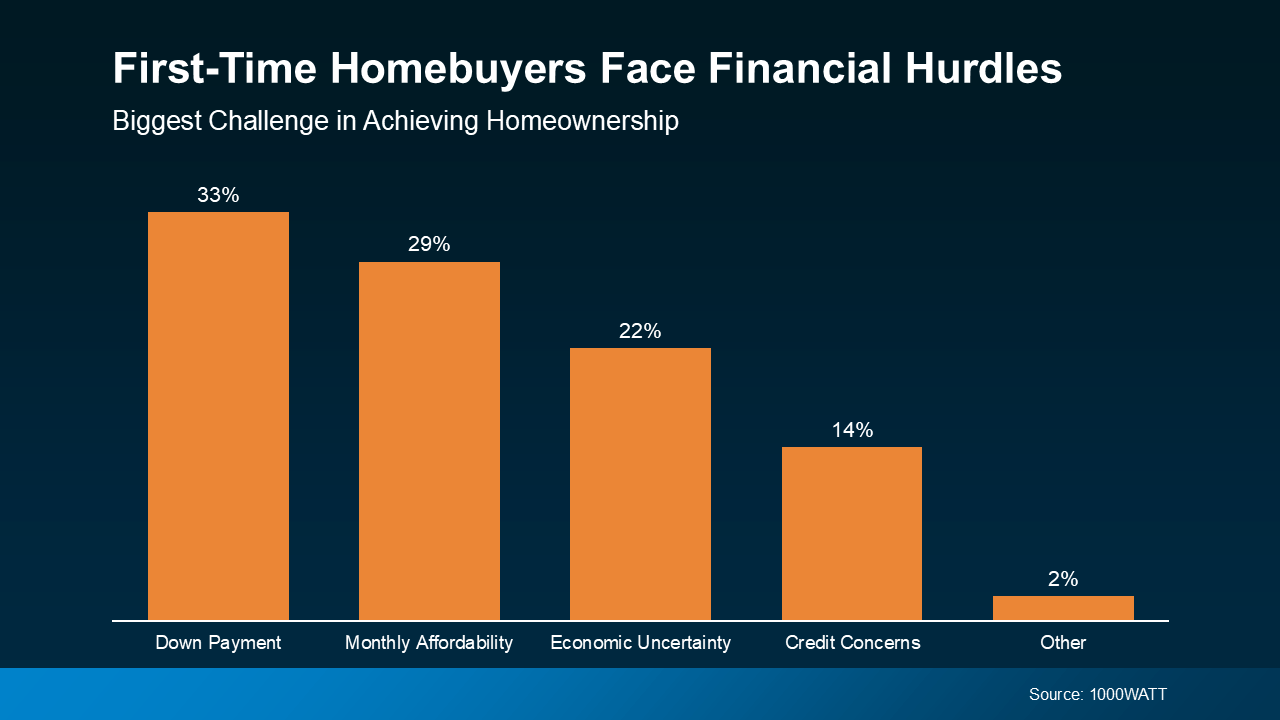

While the motivation to buy a home is still there for many people, affordability is a real challenge today. According to a survey from 1000WATT, potential first-time buyers say their top two concerns are saving enough for their down payment and making the monthly mortgage payments work at today’s home prices and mortgage rates (see graph below):

That’s Where FHA Loans Come In

That’s Where FHA Loans Come In

FHA loans help many first-time buyers overcome these challenges.

In fact, according to Intercontinental Exchange (ICE), the average first-time buyer using an FHA loan puts down just $16,000. That’s a big difference from the $77,000 they’re putting down with the typical conventional mortgage (see graph below):

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

That’s because, a lot of the time, the mortgage rate on FHA loans can be lower. Bankrate says:

“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

So, if you’re thinking about buying your first place, an FHA loan may be worth exploring.

Because of the potential for lower down payment requirements and maybe even a lower mortgage rate, it could help with the two most common hurdles first-time buyers face today – saving enough money upfront and affording the monthly payment.

A trusted lender can walk you through the details, compare your options, and help you figure out what loan type makes the most sense for your situation.

Bottom Line

With the right loan and the right guidance, homeownership may be more achievable than you think.

Do you want to talk more about your options? A trusted lender is there to help.

Thursday, June 26, 2025

Think It’s Better To Wait for a Recession Before You Move? Think Again.

Think It’s Better To Wait for a Recession Before You Move? Think Again.

Fear of a recession is back in the headlines. And if you’re thinking about buying or selling sometime soon, that may leave you wondering if you should reconsider the timing of your move.

A recent survey by John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) shows 68% of people are delaying plans to buy or sell due to economic uncertainty.

But it may not be for the reason you think. Not everyone is holding off because they’re worried. Some buyers are waiting because they’re hopeful. According to Realtor.com:

“In 2025Q1, 3 in 10 (29.8% of) surveyed homebuyers said a recession would make them at least somewhat more likely to purchase a home . . . This reflects a common dynamic where some buyers see a downturn as an opportunity. If the economy enters a recession, the Federal Reserve may respond by lowering interest rates to stimulate activity, potentially putting downward pressure on mortgage rates and easing affordability concerns. As a result, buyers—especially those with limited down payments—might view a recession as a more favorable time to enter the market.”

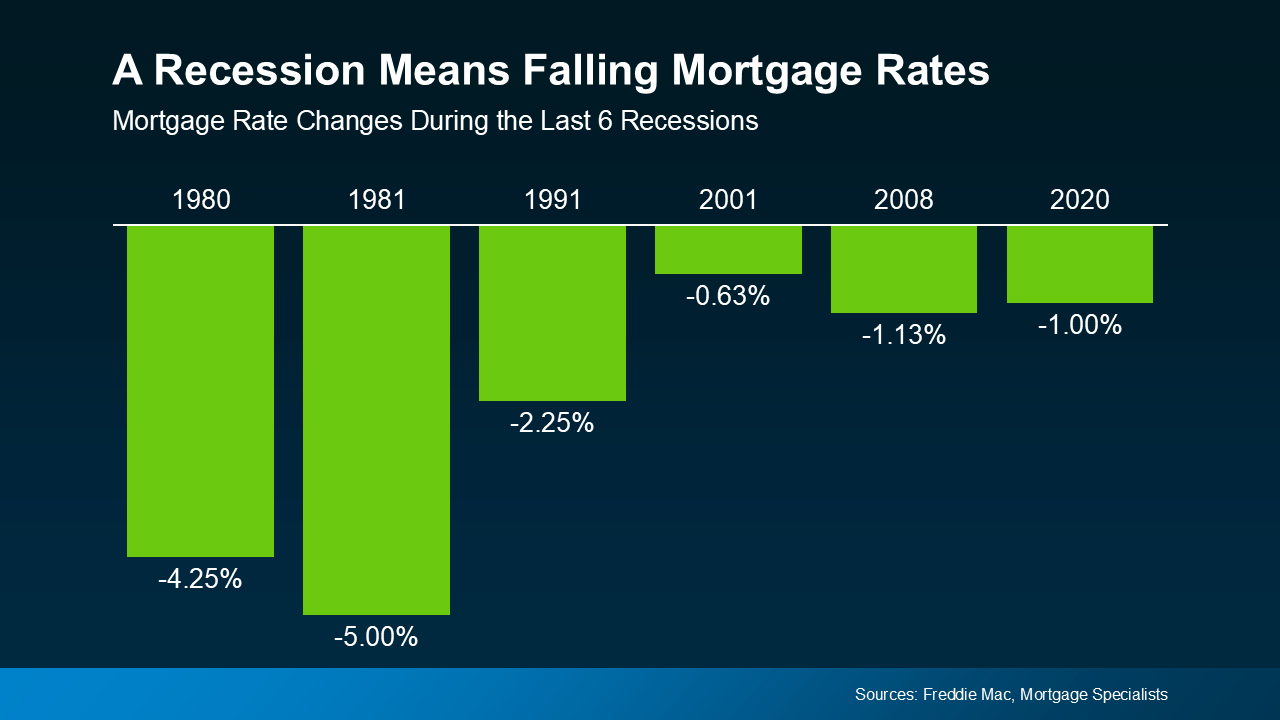

And there’s some truth to the idea that a recession could bring about lower mortgage rates. History shows mortgage rates usually drop during economic slowdowns. That’s not guaranteed – but it is a common pattern. Looking at data from the last six recessions, you can see mortgage rates fell each time (see graph below):

But here’s what those buyers may not be considering. Many of those hopeful buyers are assuming something else will happen too – that home prices will drop. And that’s where history tells a different story.

But here’s what those buyers may not be considering. Many of those hopeful buyers are assuming something else will happen too – that home prices will drop. And that’s where history tells a different story.

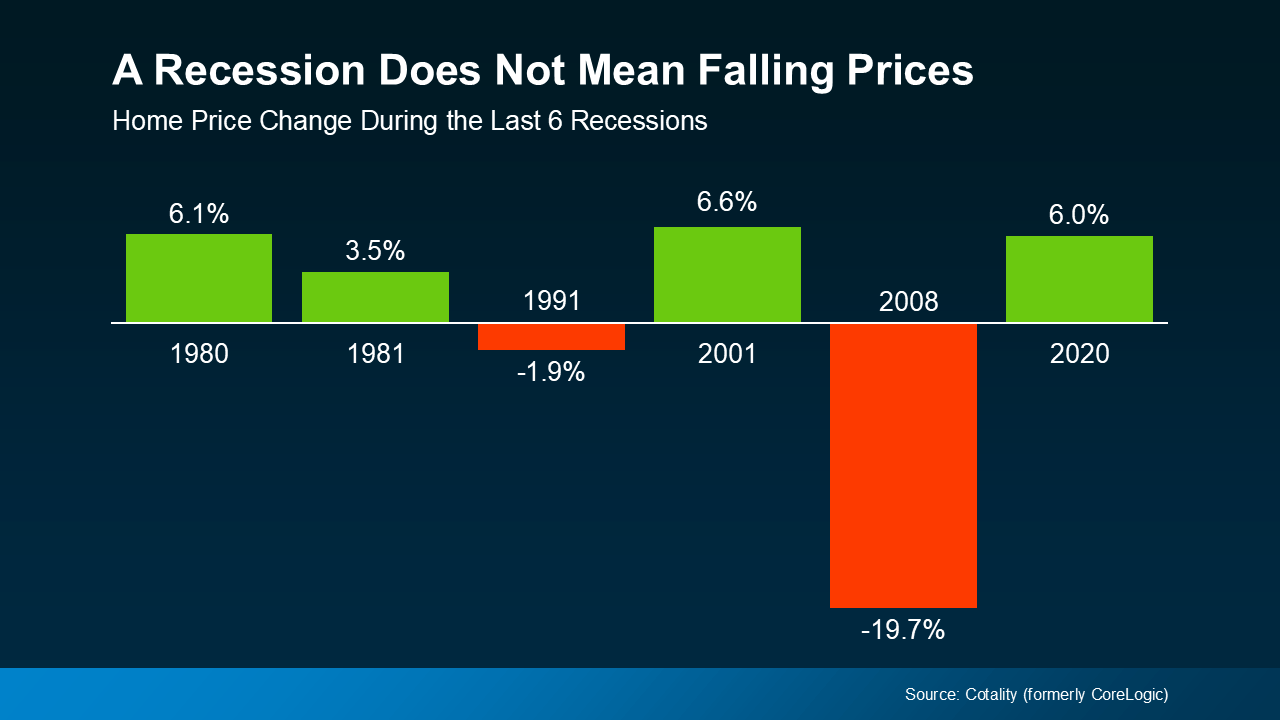

According to data from Cotality (formerly CoreLogic), home prices went up in four of the last six recessions (see graph below)

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing inventory deficit, even as the number of homes on the market is rising.

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing inventory deficit, even as the number of homes on the market is rising.

Since prices tend to stay on whatever path they’re already on, know this: prices are still holding steady or rising in most metros, although at a much slower pace. So, a big drop isn’t likely. As Robert Frick, Corporate Economist with Navy Federal Credit Union, explains:

"Hopes that an economic slowdown will depress housing prices are wishful thinking at this point . . ."

Bottom Line

If you’ve been waiting for a recession to make your move, it’s important to understand what really happens during one – and what likely won’t. Lower mortgage rates could be on the table. But lower home prices? That’s far less likely.

Don’t wait for a market that may never come. If you’re thinking about buying or selling, let’s connect to talk through what today’s economy really means for you – and make a smart plan that works in your favor, regardless of what the headlines say.

3 Reasons To Buy a Home This Summer

3 Reasons To Buy a Home This Summer

Are you thinking about buying a home, but not sure if now’s the right time? A lot of people are waiting and wondering what the market’s going to do next. But here’s something only the savviest buyers realize:

This summer might actually be the best time to buy in years. Here are three big reasons why.

1. You Have More Negotiating Power

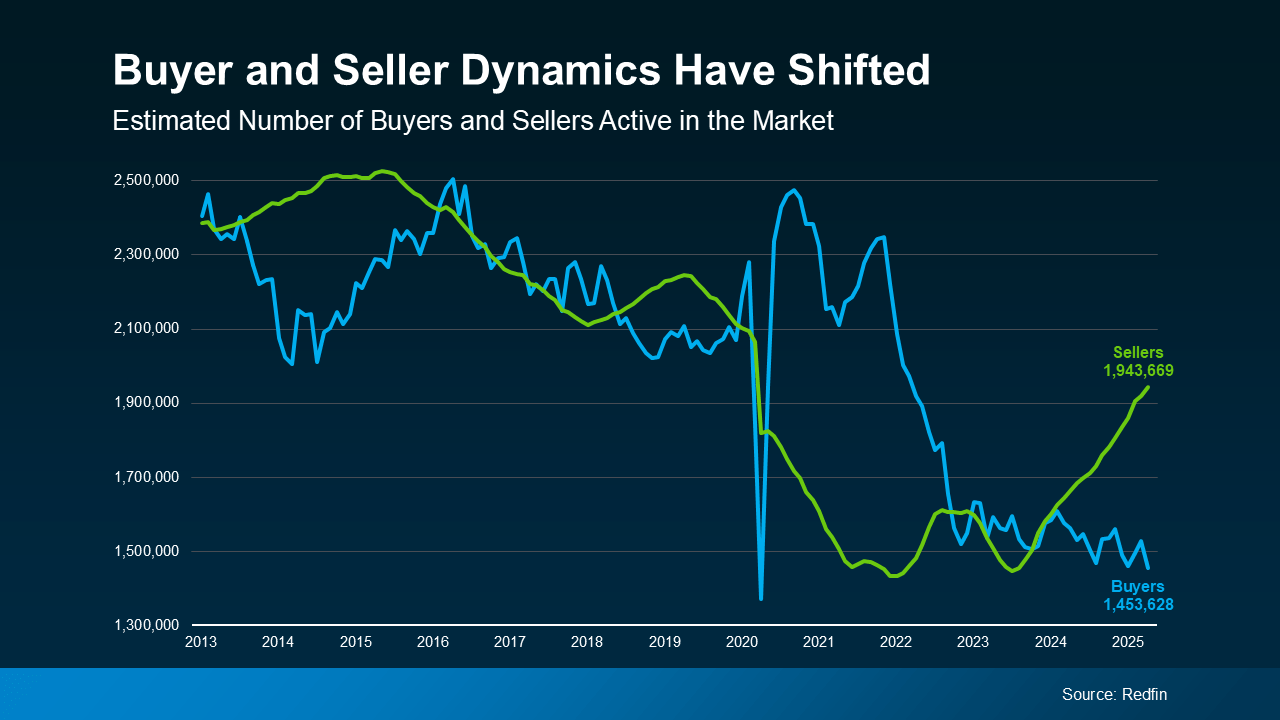

After several years of sellers having all the leverage, things are starting to shift. Check out the graph below. It uses data from Redfin to show that right now, there are more sellers active in the market than buyers:

Take a look at what happened back in 2021 through roughly 2023. In that time period, there were far more buyers (the blue line) looking to buy than homes for sale (the green line). That’s what drove the intense competition, bidding wars, and the exponential price growth the market saw back then.

Take a look at what happened back in 2021 through roughly 2023. In that time period, there were far more buyers (the blue line) looking to buy than homes for sale (the green line). That’s what drove the intense competition, bidding wars, and the exponential price growth the market saw back then.

Now, the market has shifted, and buyers are regaining their negotiating power as a result. With more sellers than buyers, sellers may be more willing to pay for repairs, cover some of your closing costs, or lower their asking price. The return of this kind of normal balance is a sign of a much healthier, more sustainable market. As Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), explains:

“ . . . with housing inventory levels reaching five-year highs, homebuyers in nearly every region of the country are in a better position to negotiate more favorable terms.”

And just in case you're worried there are too many homes on the market, here's what you should know. Overall inventory is still lower than normal, so you don’t have to worry about a nationwide oversupply or a crash.

2. You Have More Choices

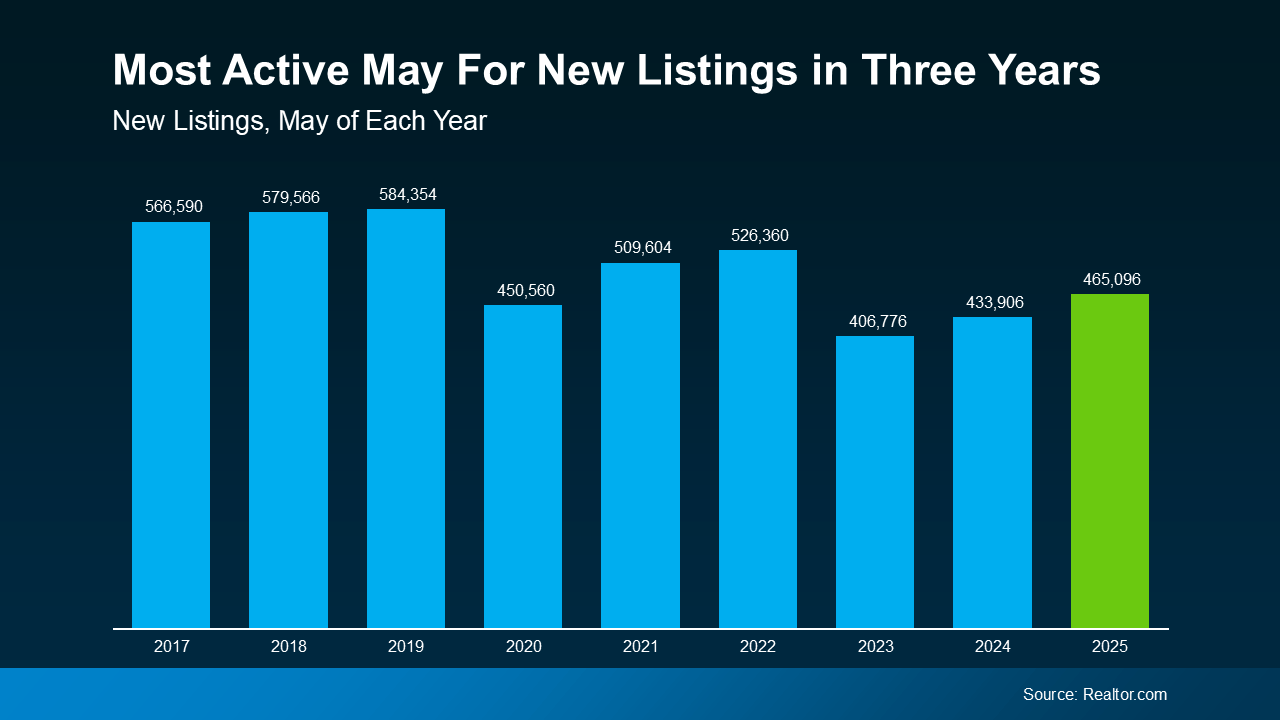

The number of homes for sale has improved a lot. Based on the latest data from Realtor.com, more homes were listed this May than in May 2024 or May 2023 (see graph below):

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

And more homes for sale means more choices. There’s a good chance your perfect match just hit the market – or it will soon. So, it’s a great time to explore what’s out there. As Jake Krimmel, Economist at Realtor.com, says:

“With more fresh inventory hitting the market, buyers have better opportunities to find a home that fits their needs."

3. You May See More Flexibility on Price

With more homes for sale, they’re not selling at the same frenzied pace they were just a few years ago.

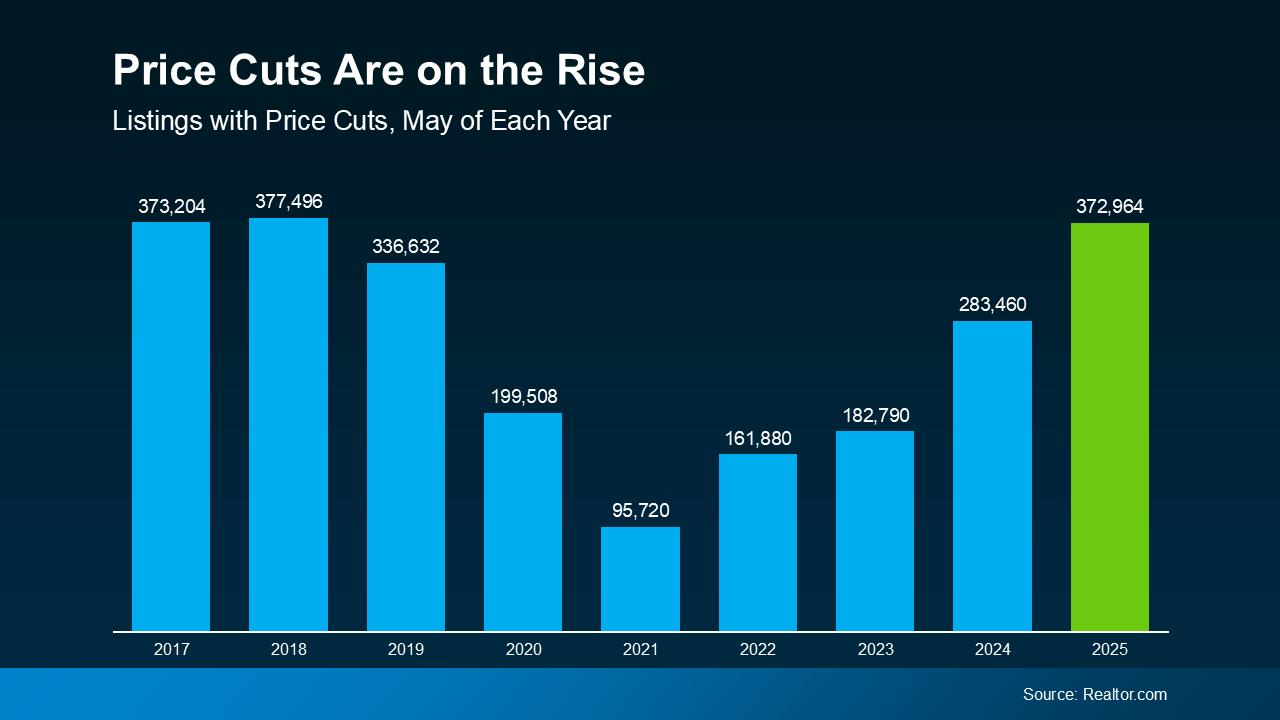

Since homes are taking more time to sell, some sellers are choosing to lower their asking prices to draw buyers back in or speed up the process. And that's to-be-expected. According to Realtor.com, 19.1% of listings had a price cut this May (see graph below):

That’s the fifth straight month where more sellers have reduced their price. And, as of May, the volume of price cuts is back at normal levels. This is yet another sign of the return to a more balanced market.

That’s the fifth straight month where more sellers have reduced their price. And, as of May, the volume of price cuts is back at normal levels. This is yet another sign of the return to a more balanced market.

While you shouldn’t expect a big discount, you may find sellers are a bit more flexible right now. As a recent article from The Street says:

“Although sellers have had the upper hand in the housing market over the past few years, houses are now staying on the market for longer, shifting negotiating power back to homebuyers.”

Just remember, most sellers still aren’t adjusting their prices – just the ones who overpriced to start with. So, this isn’t a sign of a crash, it’s a sign of some sellers having outdated expectations in a shifting market.

Bottom Line

This summer brings a powerful combo for buyers: more homes to choose from, less competition, and sellers being more flexible on pricing. If you’re ready to make a move, let’s connect.

What would finding the right home this summer mean for your next chapter?

Why More Sellers Are Choosing To Move, Even with Today’s Rates

Why More Sellers Are Choosing To Move, Even with Today’s Rates

It’s hard to let go of a 3% mortgage rate. There’s no question about it. It’s the main reason why so many homeowners have delayed their move in recent years. But here’s something to consider.

While your low rate might be ideal, it doesn’t make up being too cramped, having a staircase your knees can’t handle anymore, or being 1,000 miles from your family. And those real-life needs are pushing more sellers off the fence despite today’s rates.

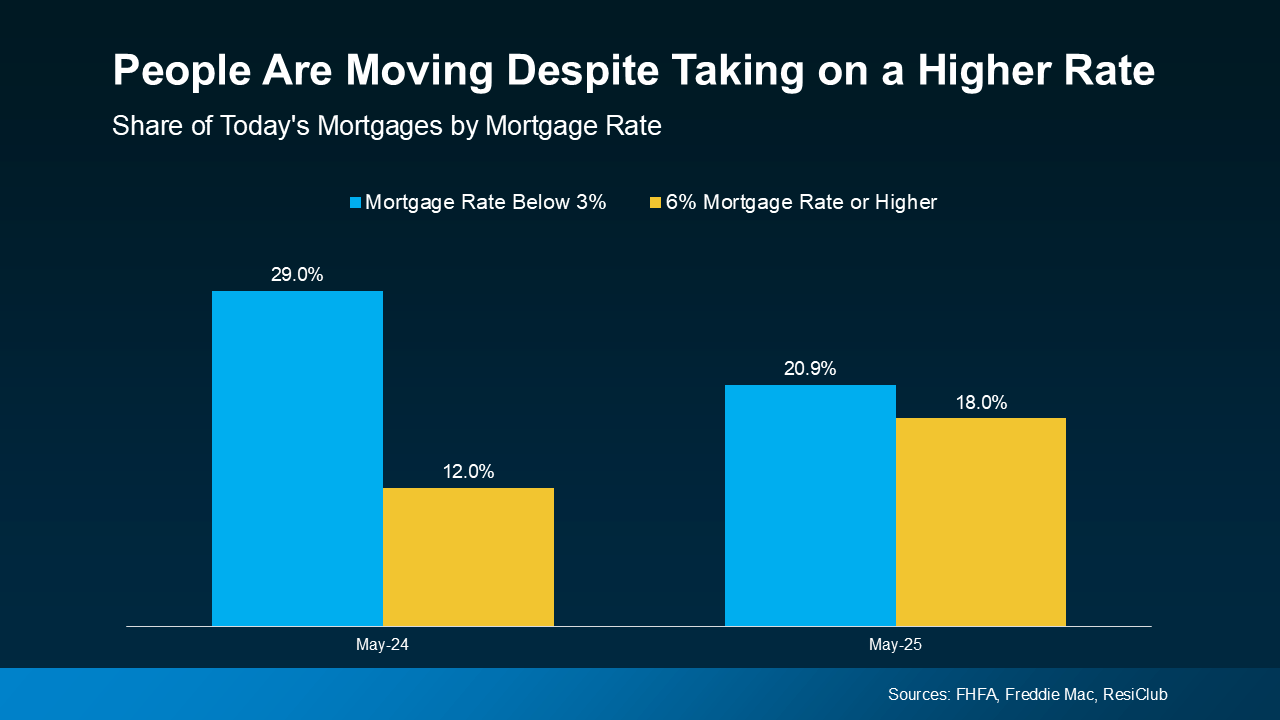

Data shows the share of homeowners with a mortgage rate below 3% is dropping as more people move. And, as a result, the share of homeowners taking on a mortgage rate above 6% is rising, too (see graph below):

The Biggest Reasons People Are Moving Right Now

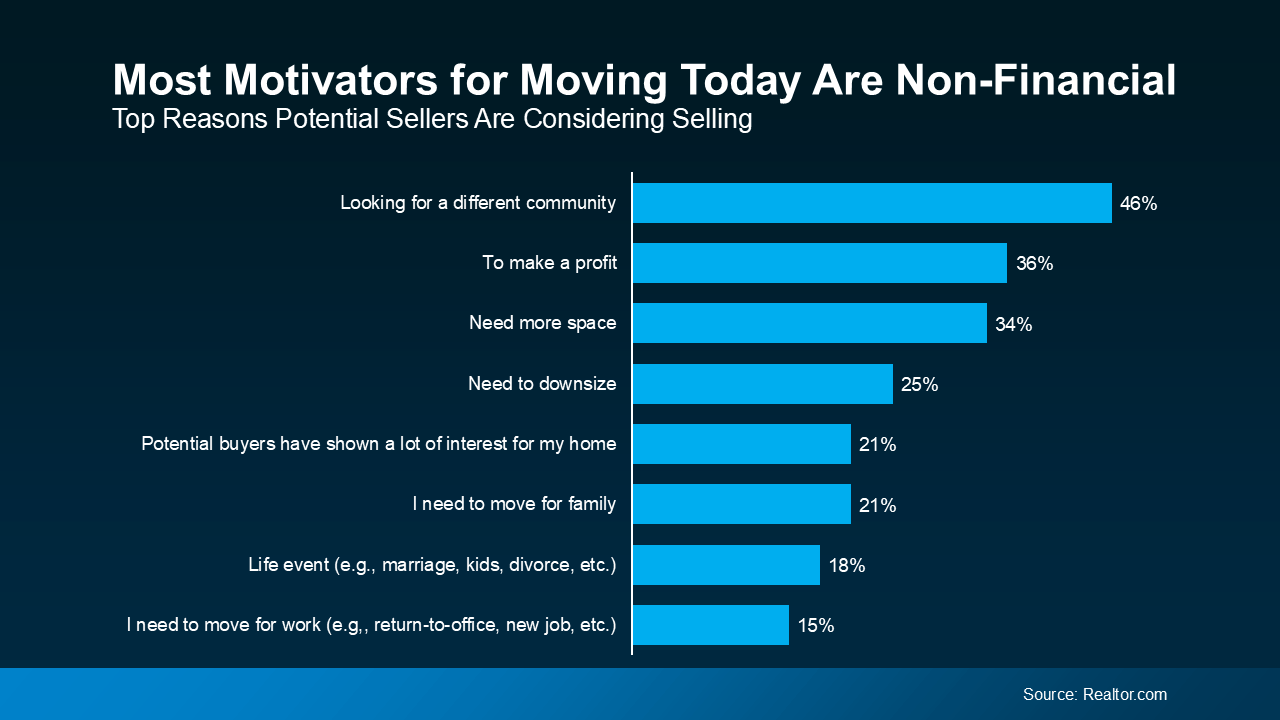

Why are some homeowners willing to take on a higher rate? A survey from Realtor.com helps shed light on that. It shows 79% of homeowners considering selling today are doing it out of necessity. And that same survey says most of the necessary reasons people are moving are non-financial in nature (see graph below):

Do any of these reasons resonate for you, too?

Do any of these reasons resonate for you, too?

- You Need More Space: Whether it’s a new baby, children needing their own rooms, or having your parents move in so it’s easier to take care of them, outgrowing your space can happen fast.

- You Need Less Space: The kids are out of the house now and you’re craving a life that’s a little simpler. Downsizing can be a major relief: fewer rooms to clean, less to maintain, and lower utility bills, too.

- You Want to Be Closer to Family: Whether it’s to help with grandchildren or care for aging parents, sometimes the pull of being near loved ones outweighs the math.

- A Relationship in Your Life Has Changed: Divorce, separation, or moving in together after a marriage or new partnership – all can create the need for a fresh start and a new place to call home.

- Your Job Is Taking You Somewhere New: If you finally landed your dream job or your partner’s company is relocating, you may need to move too.

What About Mortgage Rates?

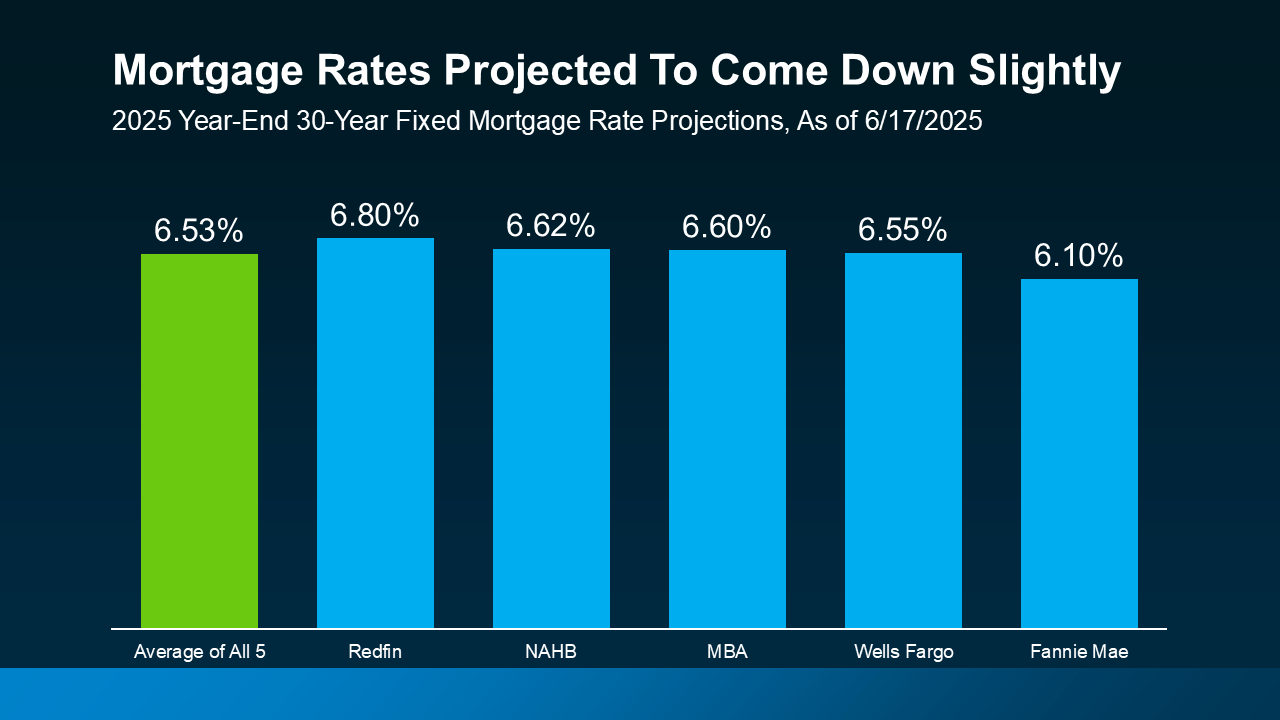

Yes, experts expect mortgage rates to ease, but slowly. The latest projections show only modest declines this year – not the 3% you may be hoping for (see graph below):

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

So, while waiting for a big drop in rates might sound strategic, it could just mean more time feeling stuck in a space that no longer fits. And for many, that waiting game has already gone on long enough.

According to Realtor.com, nearly 2 in 3 potential sellers have been thinking about moving for over a year. If you’re one of them, maybe it’s time to ask:

How much longer are you willing to press pause on your life?

Bottom Line

Maybe your current house fit your life five years ago. But that “for now” house you bought in 2020? It just can’t deliver on what you need in 2025. And that’s not just okay, it’s normal.

Mortgage rates are part of the equation, for sure. But the bigger question is:

What kind of home do you need to support the life you’re living now?

Let’s talk about what’s changed, and what kind of move would actually take your life forward.

The Rooms That Matter Most When You Sell

The Rooms That Matter Most When You Sell

Now that buyers have more options for their move, you need to be a bit more intentional about making sure your house looks its best when you sell. And proper staging can be a great way to do just that.

What Is Home Staging?

It’s not about making your house look super trendy or like it belongs in a magazine. It’s about helping it feel welcoming and move-in ready, so it's easy for buyers to picture themselves living there.

It’s important to understand there’s a range when it comes to staging. It can include everything from simple tweaks to more extensive setups, depending on your needs and budget. But a little bit of time, effort, and money invested in this process can really make a difference when you sell – especially in today’s market.

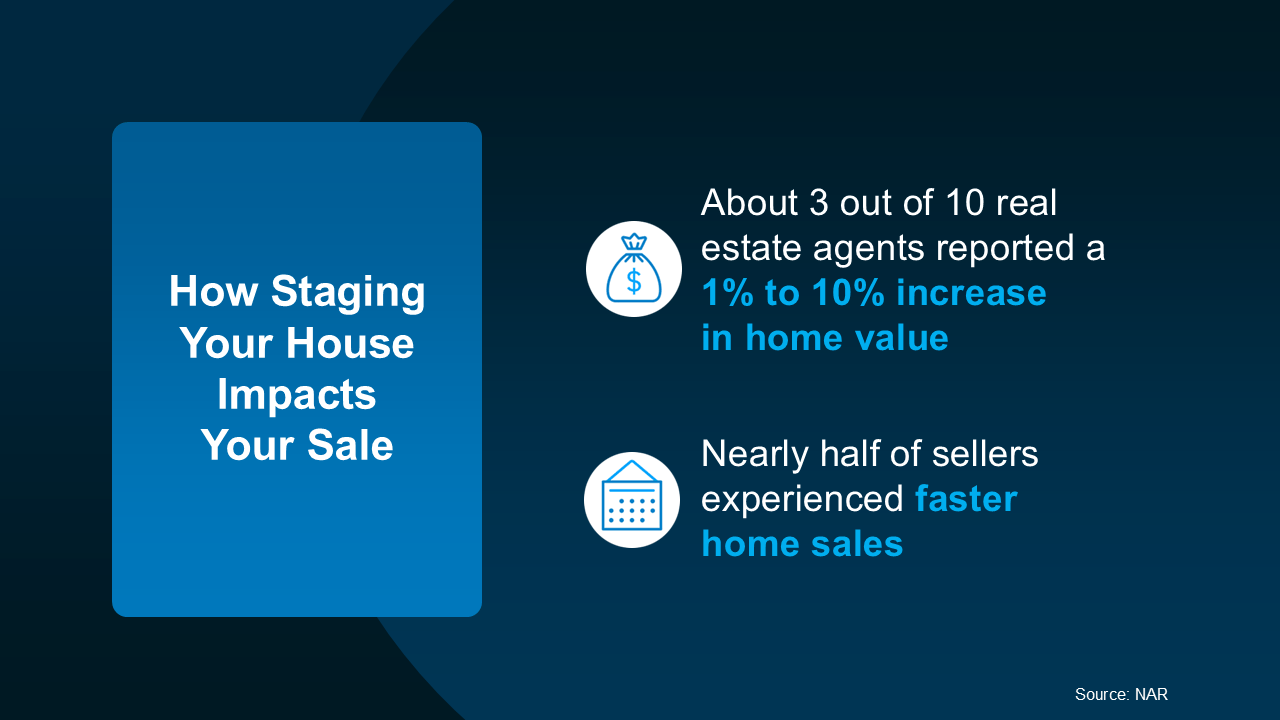

A study from the National Association of Realtors (NAR) shows staged homes sell faster and for more money than homes that aren't staged at all (see below):

Which Rooms Matter Most?

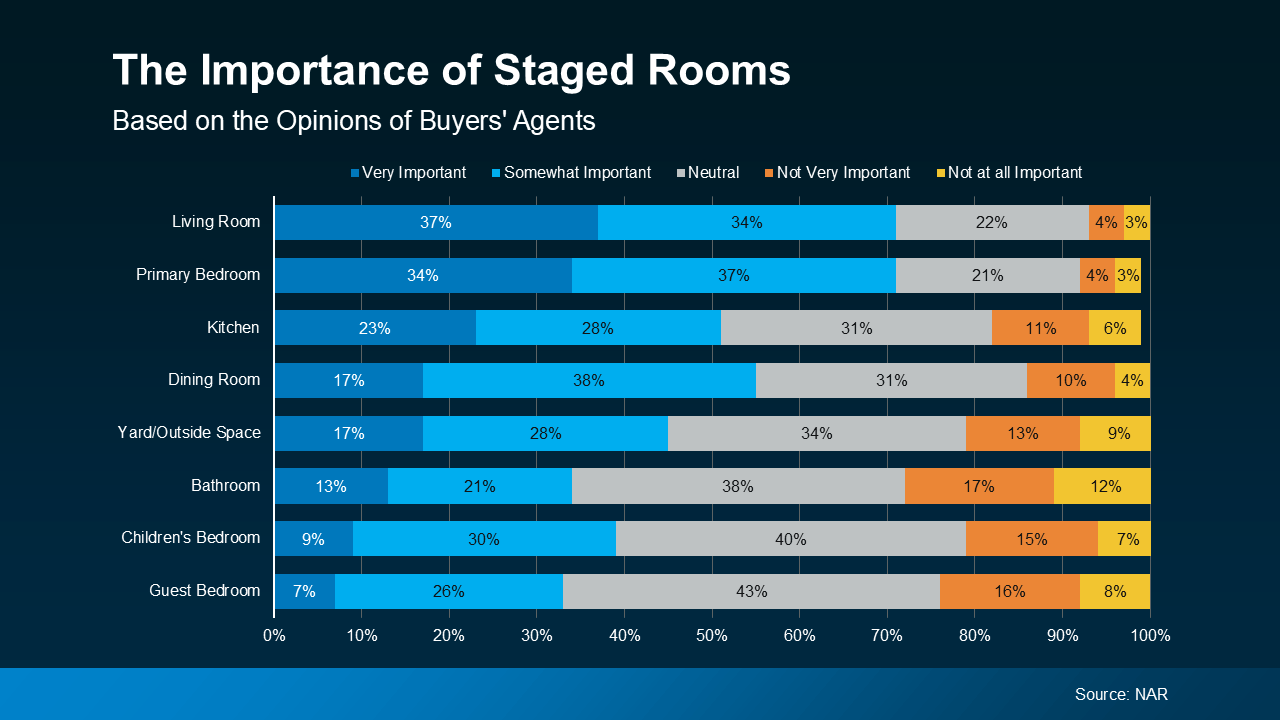

The best part is, odds are you don’t have to stage your whole house to make an impact. According to NAR, here’s where buyers’ agents say staging can make the biggest difference (see graph below):

As you can see, agents who talk to buyers regularly agree, the most important spaces to stage are the rooms where buyers will spend the most time, like the living room, primary bedroom, and kitchen.

As you can see, agents who talk to buyers regularly agree, the most important spaces to stage are the rooms where buyers will spend the most time, like the living room, primary bedroom, and kitchen.

While this can give you a good general idea of what may be worth it and what’s probably not, it can’t match a local agent’s expertise.

How an Agent Helps You Decide What You Need To Do

Agents are experts on what buyers are looking for where you live, because they hear that feedback all the time in showings, home tours, walkthroughs, and from other agents. And they'll use those insights to give their opinion on your specific house and what areas may need a little bit of staging help, like if you need to:

- Declutter and depersonalize by removing photos and personal items

- Arrange your furniture to improve the room's flow and make it feel bigger

- Add plants, move art, or re-arrange other accessories

A lot of buyers can use the agent’s know-how as the only staging advice they need. But, if your home needs more of a transformation, or it’s empty and could benefit from rented furniture, a great agent will be able to determine if bringing in a professional stager might be a good idea, too. Just know that level of help comes with a higher price tag. NAR reports:

“The median dollar value spent when using a staging service was $1,500, compared to $500 when the sellers' agent personally staged the home.”

A local agent will help you weigh the costs and benefits based on your budget, your timeline, and the overall condition of your house. They’ll also consider how quickly similar homes are selling nearby and what buyers are expecting at your price point.

Bottom Line

Staging doesn’t have to be over-the-top or expensive. It just needs to help buyers feel at home. And a great agent will help you figure out the level of staging that makes the most sense for your goals.

Which room in your house do you think would make the biggest impression on a buyer?

Let’s walk through your home together and chat about what will make your house stand out.

Wednesday, June 25, 2025

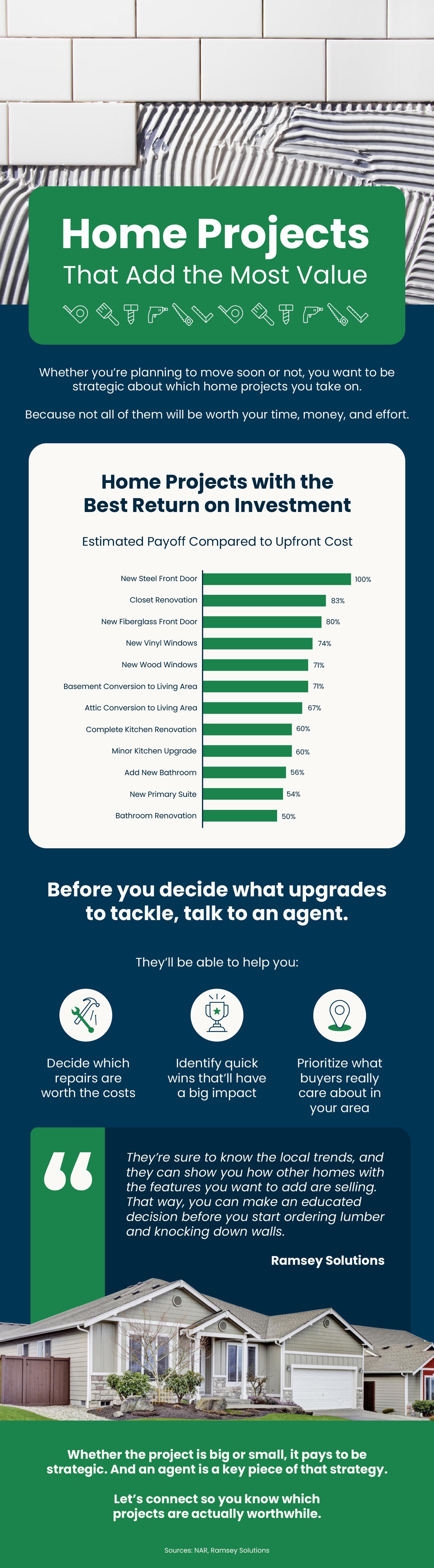

Home Projects That Add the Most Value

Home Projects That Add the Most Value

Some Highlights

- Whether you’re planning to move soon or not, you want to be strategic about which home projects you take on. Because not all of them will be worth it.

- Before you decide what upgrades to tackle, talk to an agent who knows what’s in demand in your area and where you’re most likely to recoup the costs.

- Let’s connect so you know which projects are actually worthwhile.

NAR Pending Home Sales Report Reveals 1.8% Increase in May

NAR Pending Home Sales Report Reveals 1.8% Increase in May : Consistent job gains and rising wages are modestly helping the housing market, ...

-

NAR Releases New Consumer-Focused Resources Ahead of Practice Changes in Settlement Agreement : The resources will help both REALTORS® and c...

-

Roughly 11,000 Homes Will Sell Today – Will Yours Be One of Them? Are you hesitant to sell your house because you’re worried no one’s buyi...

-

2025 Housing Market Forecasts Some Highlights Wondering what to expect when you buy or sell a home this year? Here’s what the experts sa...