I am dedicated to providing authentic, excellent customer service; to me this means getting to know your needs and wants and finding the best solution for your specific situation. I plan to diligently work with you to prepare a competent strategy to effectively sell and/or purchase your home. I’d like to provide you with the information you need to make an informed decision. As we navigate through this process I will walk alongside you as your knowledgeable, trusted real estate resource.

Monday, March 29, 2021

Existing-Home Sales Descend 6.6% in February

What It Means To Be in a Sellers’ Market

What It Means To Be in a Sellers’ Market

If you’ve given even a casual thought to selling your house in the near future, this is the time to really think seriously about making a move. Here’s why this season is the ultimate sellers’ market and the optimal time to make sure your house is available for buyers who are looking for homes to purchase.

The latest Existing Home Sales Report from The National Association of Realtors (NAR) shows the inventory of houses for sale is still astonishingly low, sitting at just a 2-month supply at the current sales pace.

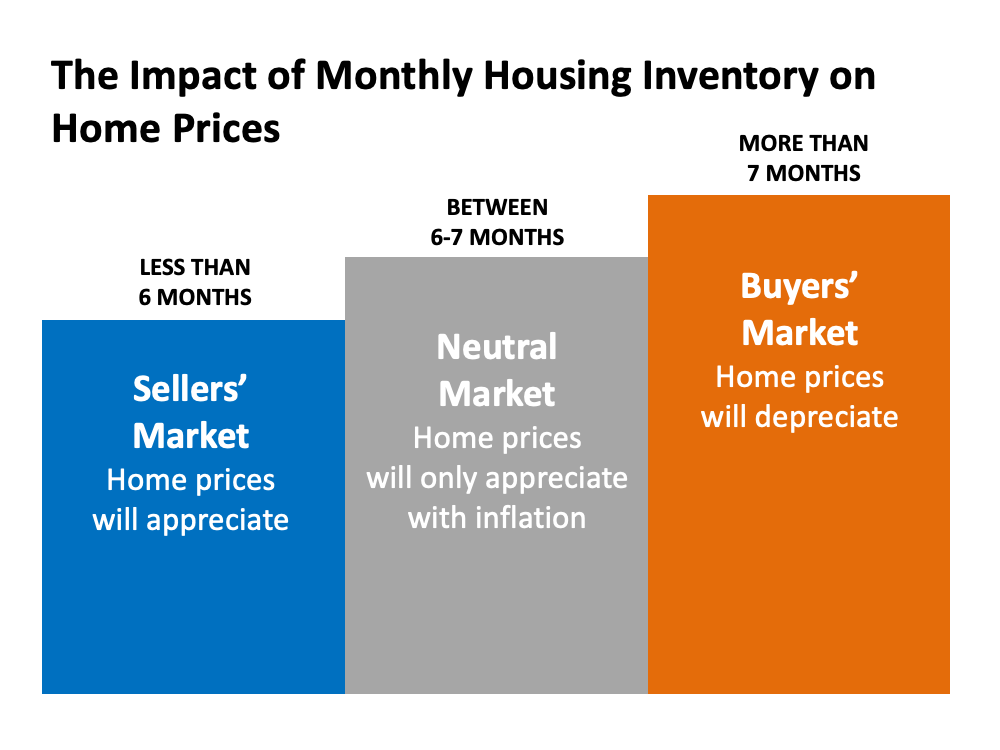

Historically, a 6-month supply is necessary for a ‘normal’ or ‘neutral’ market in which there are enough homes available for active buyers (See graph below): When the supply of houses for sale is as low as it is right now, it’s much harder for buyers to find homes to purchase. As a result, competition among purchasers rises and more bidding wars take place, making it essential for buyers to submit very attractive offers.

When the supply of houses for sale is as low as it is right now, it’s much harder for buyers to find homes to purchase. As a result, competition among purchasers rises and more bidding wars take place, making it essential for buyers to submit very attractive offers.

As this happens, home prices rise and sellers are in the best position to negotiate deals that meet their ideal terms. If you put your house on the market while so few homes are available to buy, it will likely get a lot of attention from hopeful buyers.

Today, there are many buyers who are ready, willing, and able to purchase a home. Low mortgage rates and a year filled with unique changes have prompted buyers to think differently about where they live – and they’re taking action. The supply of homes for sale is not keeping up with this high demand, making now the optimal time to sell your house.

Bottom Line

Home prices are appreciating in today’s sellers’ market. Making your home available over the coming weeks will give you the most exposure to buyers who will actively compete against each other to purchase it.

Thursday, March 25, 2021

Buyer & Seller Perks in Today’s Housing Market

Buyer & Seller Perks in Today’s Housing Market

Right now, the housing market is full of outstanding opportunities for both buyers and sellers. Whether you’re thinking of buying your first home, moving up to a bigger one, or selling so you can downsize this spring, there are perks today that are powering big moves for people across the country. Here are the top two to keep on the radar this season.

The Biggest Perk for Buyers: Low Mortgage Rates

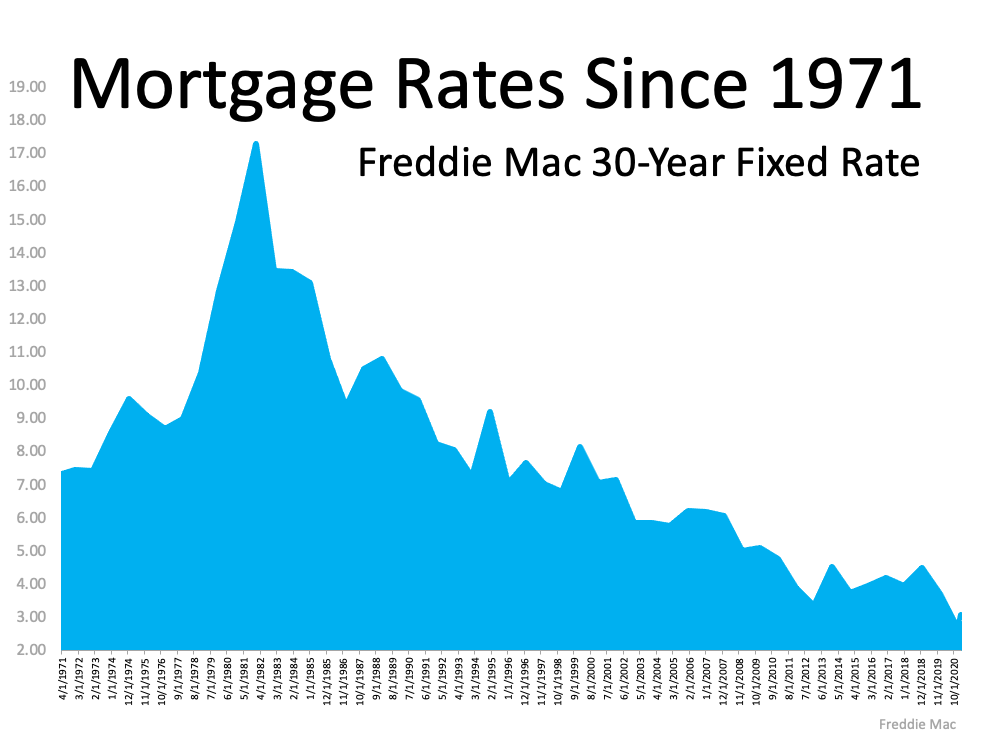

Today’s most compelling buyer incentive is low mortgage interest rates. The 30-year fixed-rate is now averaging just over 3%. While that’s slightly higher than the record-lows from 2020 and earlier this year, it’s still way lower than historic norms, making purchasing a home an ongoing perk for hopeful buyers (See graph below): This is a huge advantage for buyers and helps to make owning a home attainable for more households – and there’s good reason to strive for homeownership. The latest Homeowner Equity Report from CoreLogic shows how homeowners saw major gains in their net worth last year, all thanks to owning a home. Frank Martell, President and CEO of CoreLogic, explains:

This is a huge advantage for buyers and helps to make owning a home attainable for more households – and there’s good reason to strive for homeownership. The latest Homeowner Equity Report from CoreLogic shows how homeowners saw major gains in their net worth last year, all thanks to owning a home. Frank Martell, President and CEO of CoreLogic, explains:

“Positive factors like record-low interest rates and a booming housing market encouraged many families to enter homeownership. This growing bank of personal wealth that homeownership affords was noticed by many but in particular for first-time buyers who want a piece of the cake. As a result, we may see more of those currently renting start to enter the market in the near future.”

Low mortgage rates are a plus for buyers right now, but experts forecast we’ll see them continue to rise as the year goes on. If you’re ready to purchase a home, it’s wise to get started on the process soon so you can secure today’s comparatively low rate.

The Biggest Perk for Sellers: Low Inventory

Today, there are simply not enough houses on the market for the number of buyers looking to purchase them, and it’s creating a serious sellers’ market. According to Danielle Hale, Chief Economist at realtor.com:

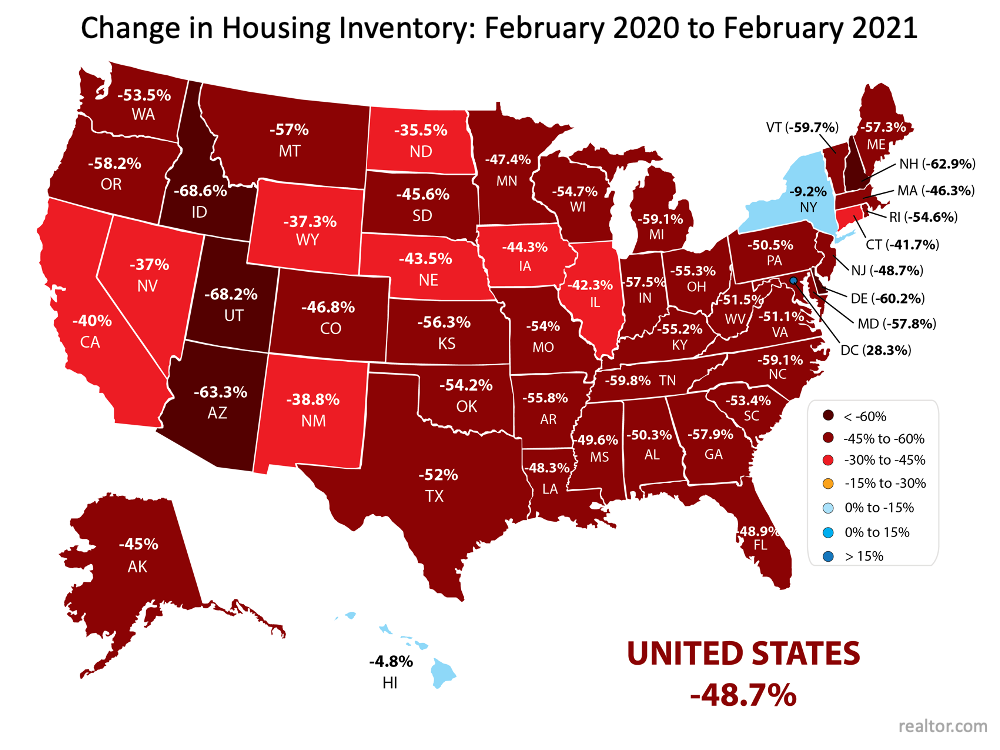

“Total active inventory continues to decline, dropping 50 percent. With buyers active in the market and sellers still slow to put homes up for sale, homes are selling quickly and the total number actively available for sale at any point in time continues to decline.” (See map below):

The lack of houses for sale continues to challenge the market, and with low mortgage rates fueling buyer demand, homes are hard for buyers to find today. According to the latest Realtors Confidence Index Survey by the National Association of Realtors (NAR), the average house is now receiving 4.1 offers and is on the market for only 20 days.

The lack of houses for sale continues to challenge the market, and with low mortgage rates fueling buyer demand, homes are hard for buyers to find today. According to the latest Realtors Confidence Index Survey by the National Association of Realtors (NAR), the average house is now receiving 4.1 offers and is on the market for only 20 days.

Buyers are clearly eager to purchase, and because of the shortage of inventory available, they’re often entering bidding wars. This is one of the factors keeping home prices strong and giving sellers leverage in the negotiation process.

Homeowners who are in a position to sell shouldn’t wait to make their move. There’s a light at the end of the tunnel for today’s inventory shortage, so listing this spring will get your house on the market when conditions are most favorable. With low inventory and high buyer demand, homeowners can potentially earn a greater profit on their houses and sell them quickly in the fast-paced spring market.

Bottom Line

Whether you’re thinking about buying or selling a home, there are major perks available in today’s housing market. Let’s connect today to discuss how these favorable conditions play to your advantage in our local area.

Tuesday, March 23, 2021

Economist: Oregon real estate more affordable amid pandemic

Friday, March 19, 2021

Americans See Major Home Equity Gains [INFOGRAPHIC]

Americans See Major Home Equity Gains [INFOGRAPHIC]

![Americans See Major Home Equity Gains [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/03/18144837/20210319-MEM-1046x1558.png)

Some Highlights

- Today’s home price appreciation is driving equity higher throughout the country.

- If your needs are changing and you’re ready for a new home, your equity may be a great asset to power your next move.

- Now is a great time to put your equity toward a down payment on the home of your dreams.

Thursday, March 18, 2021

Fed Vows to Keep Benchmark Rate Low

Tuesday, March 16, 2021

6 Simple Graphs Proving This Is Nothing Like Last Time

6 Simple Graphs Proving This Is Nothing Like Last Time

Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales and prices were both up substantially over the year before. 2020 was so strong that many now fear the market’s exuberance mirrors that of the last housing boom and, as a result, we’re now headed for another crash.

However, there are many reasons this real estate market is nothing like 2008. Here are six visuals to show the dramatic differences.

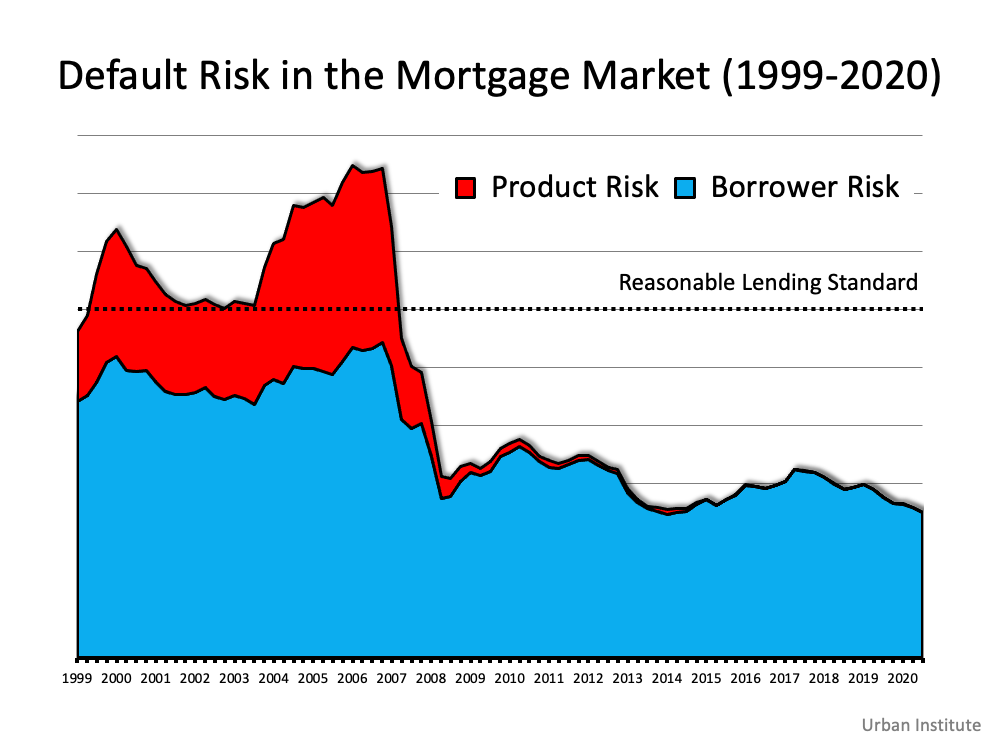

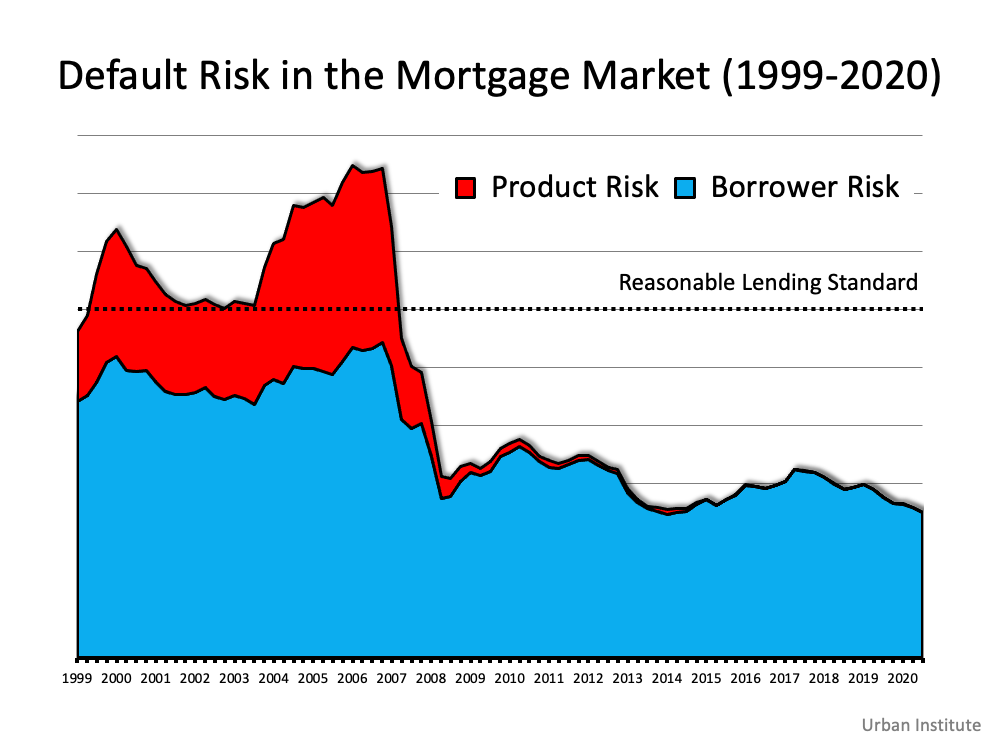

1. Mortgage standards are nothing like they were back then.

During the housing bubble, it was difficult not to get a mortgage. Today, it’s tough to qualify. Recently, the Urban Institute released their latest Housing Credit Availability Index (HCAI) which “measures the percentage of owner-occupied home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

The index shows that lenders were comfortable taking on high levels of risk during the housing boom of 2004-2006. It also reveals that today, the HCAI is under 5 percent, which is the lowest it’s been since the introduction of the index. The report explains:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

This is nothing like the last time.

This is nothing like the last time.

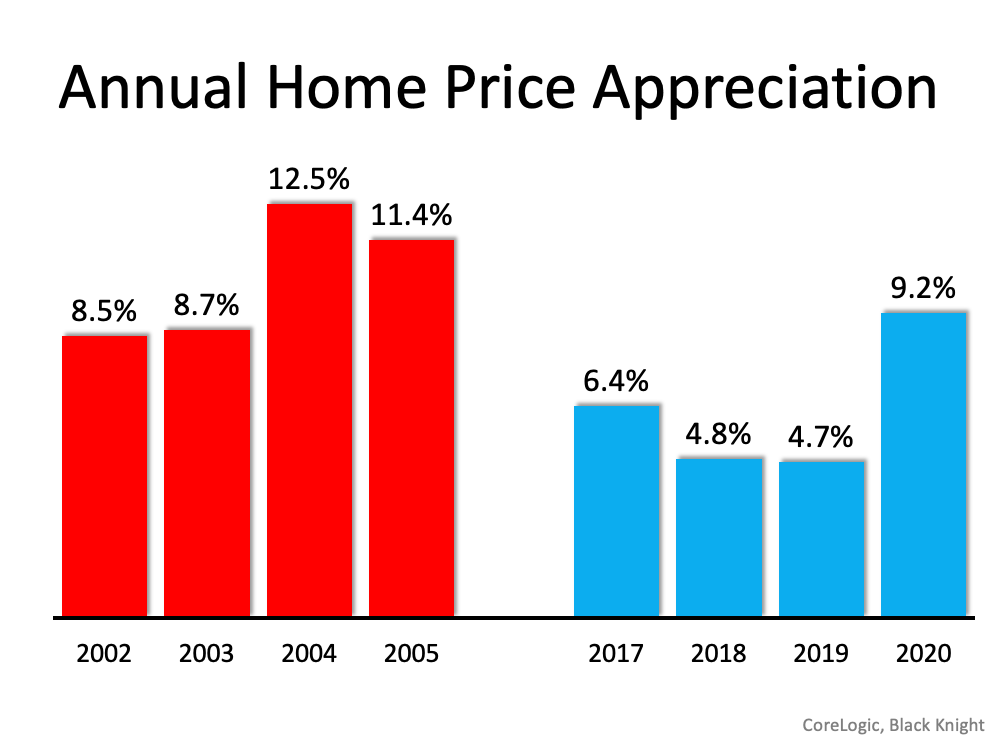

2. Prices aren’t soaring out of control.

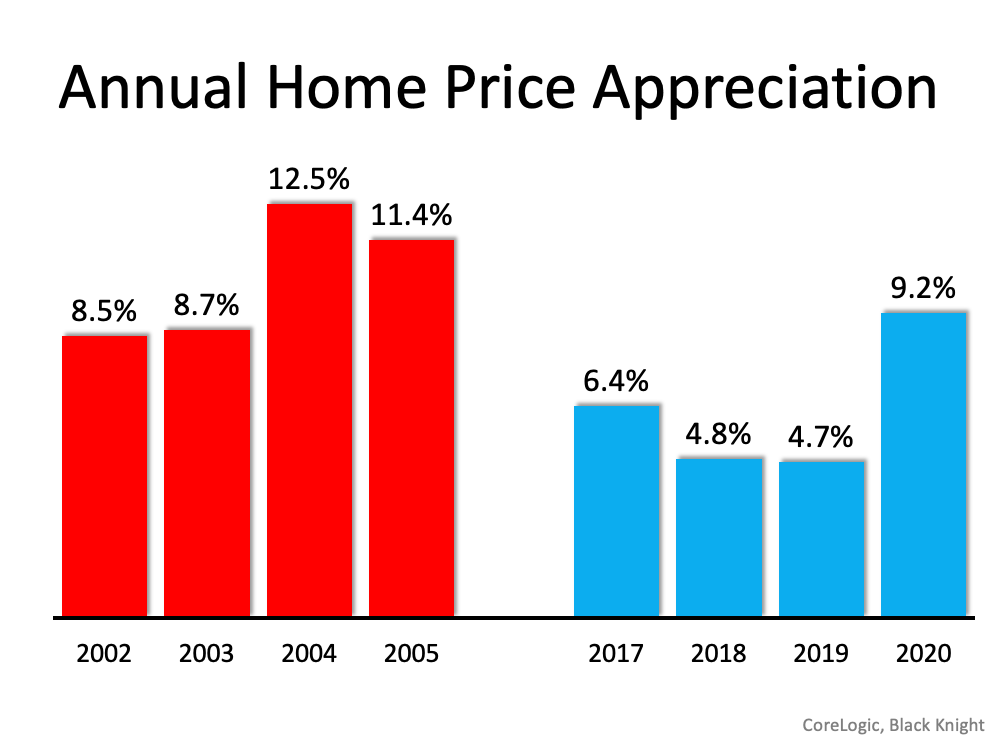

Below is a graph showing annual home price appreciation over the past four years compared to the four years leading up to the height of the housing bubble. Though price appreciation was quite strong last year, it’s nowhere near the rise in prices that preceded the crash. There’s a stark difference between these two periods of time. Normal appreciation is 3.8%. So, while current appreciation is higher than the historic norm, it’s certainly not accelerating out of control as it did in the early 2000s.

There’s a stark difference between these two periods of time. Normal appreciation is 3.8%. So, while current appreciation is higher than the historic norm, it’s certainly not accelerating out of control as it did in the early 2000s.

This is nothing like the last time.

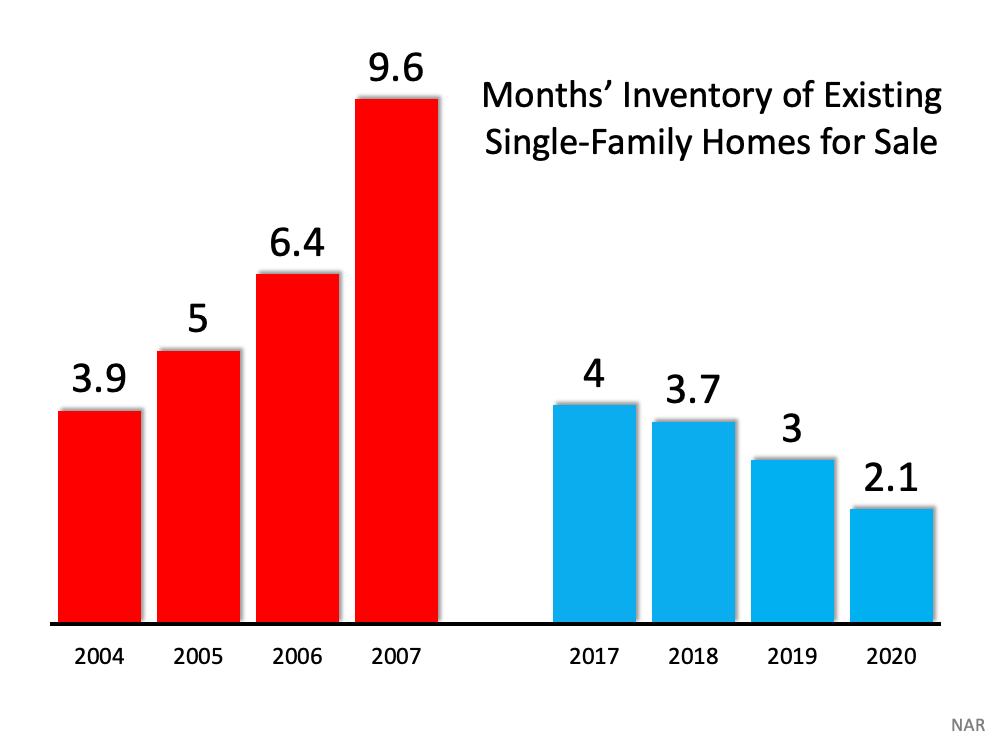

3. We don’t have a surplus of homes on the market. We have a shortage.

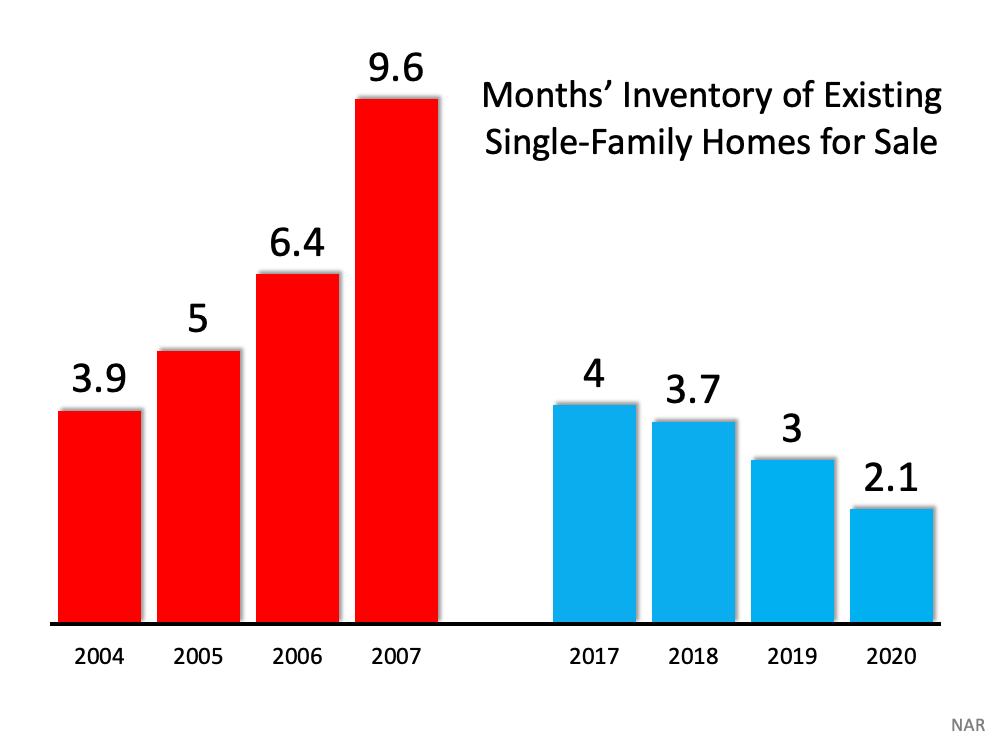

The months’ supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued appreciation. As the next graph shows, there were too many homes for sale in 2007, and that caused prices to tumble. Today, there’s a shortage of inventory, which is causing an acceleration in home values. This is nothing like the last time.

This is nothing like the last time.

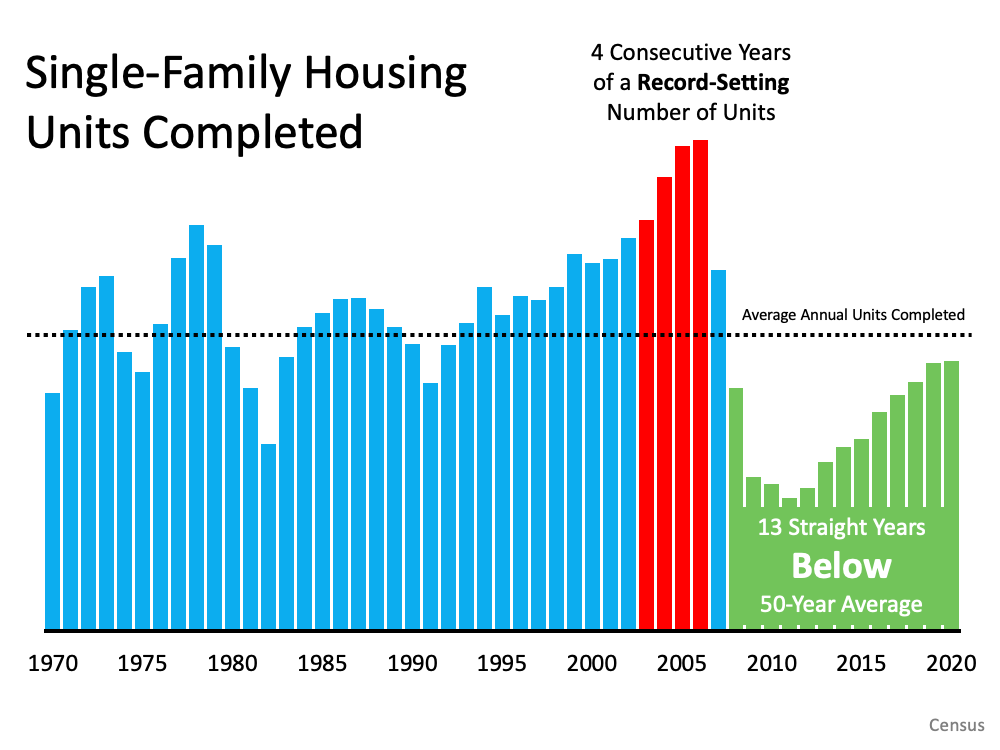

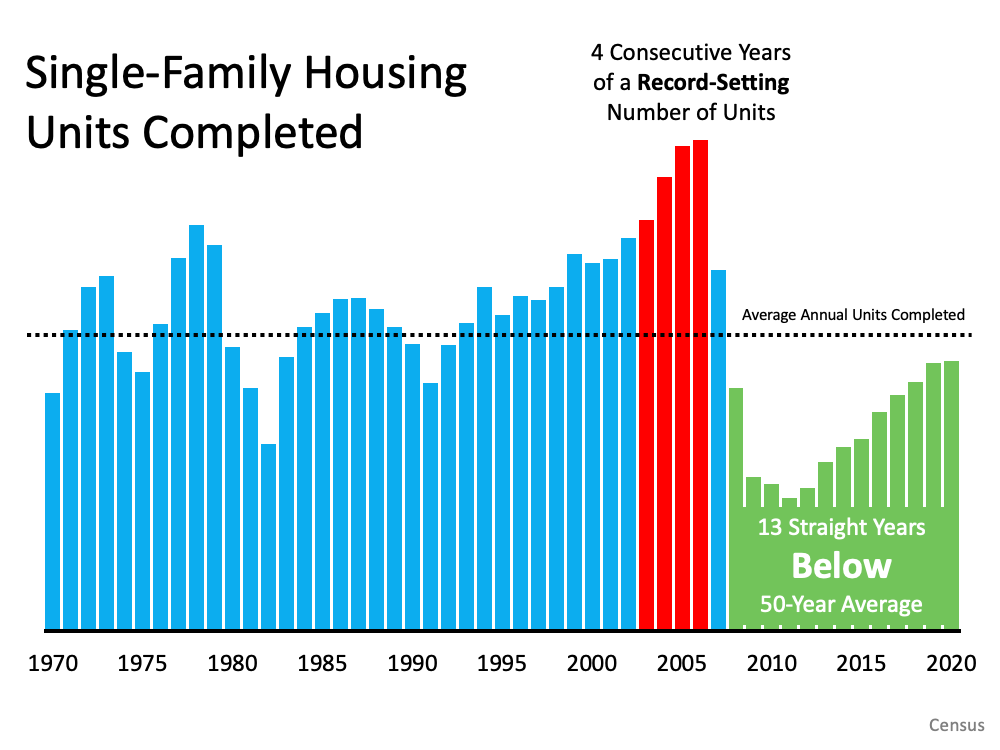

4. New construction isn't making up the difference in inventory needed.

Some may think new construction is filling the void. However, if we compare today to right before the housing crash, we can see that an overabundance of newly built homes was a major challenge then, but isn’t now. This is nothing like the last time.

This is nothing like the last time.

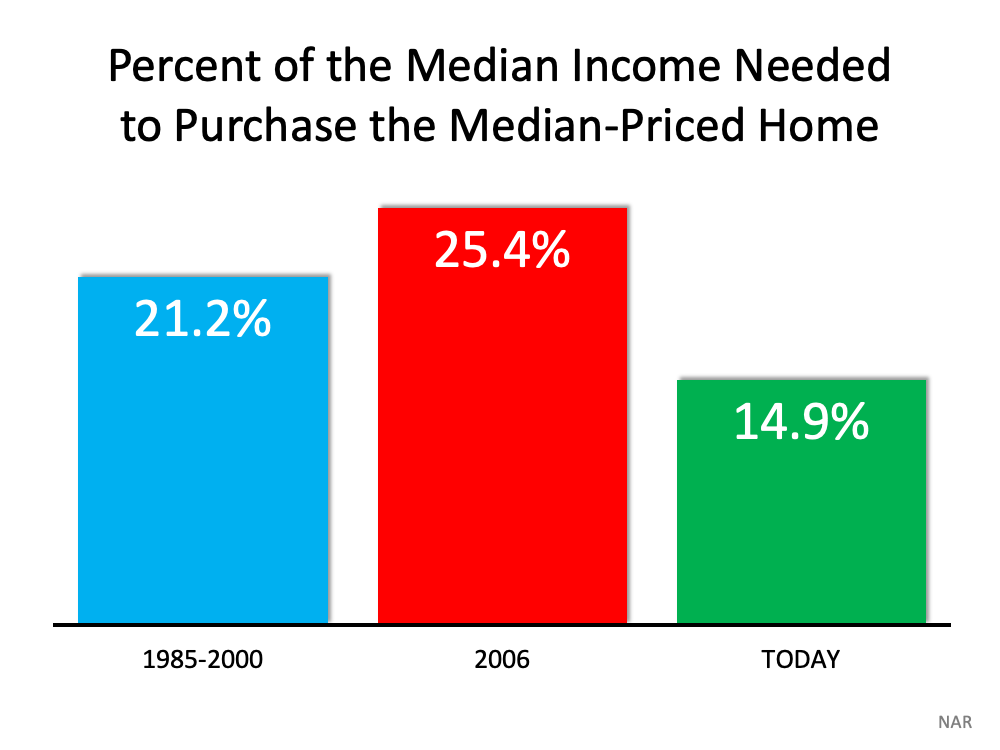

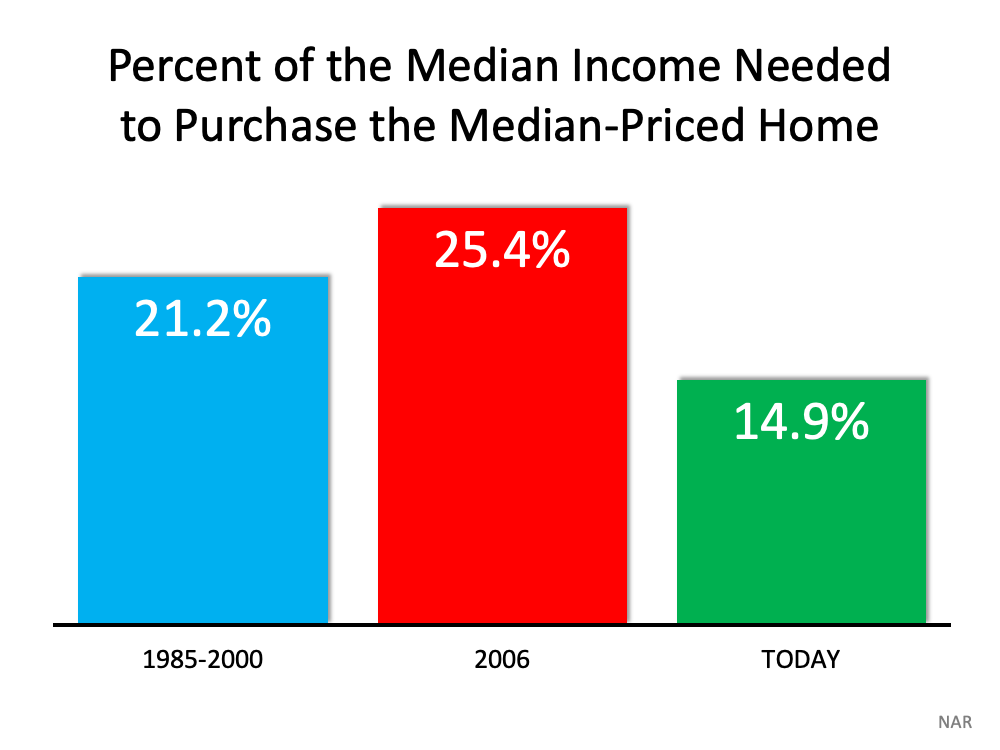

5. Houses aren’t becoming too expensive to buy.

The affordability formula has three components: the price of the home, the wages earned by the purchaser, and the mortgage rate available at the time. Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. Today, prices are still high. Wages, however, have increased, and the mortgage rate is about 3%. That means the average homeowner pays less of their monthly income toward their mortgage payment than they did back then. Here’s a chart showing that difference: As Mark Fleming, Chief Economist for First American, explains:

As Mark Fleming, Chief Economist for First American, explains:

“Lower mortgage interest rates and rising incomes correspond with higher house prices as home buyers can afford to borrow and buy more. If housing is appropriately valued, house-buying power should equal or outpace the median sale price of a home. Looking back at the bubble years, house prices exceeded house-buying power in 2006, but today house-buying power is nearly twice as high as the median sale price nationally.”

This is nothing like the last time.

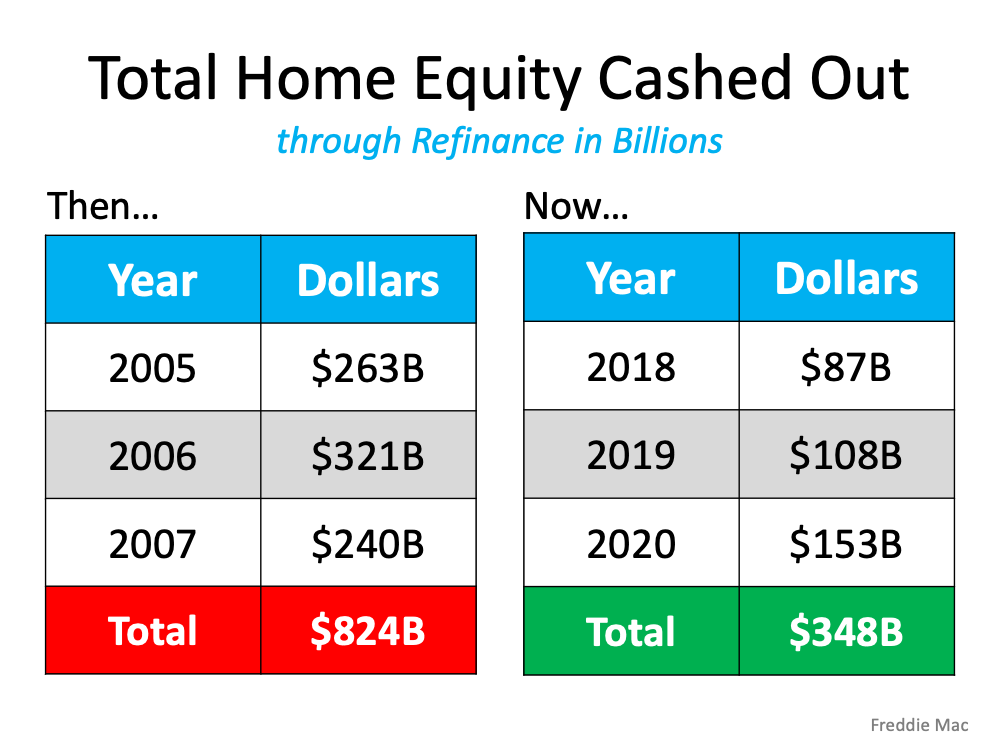

6. People are equity rich, not tapped out.

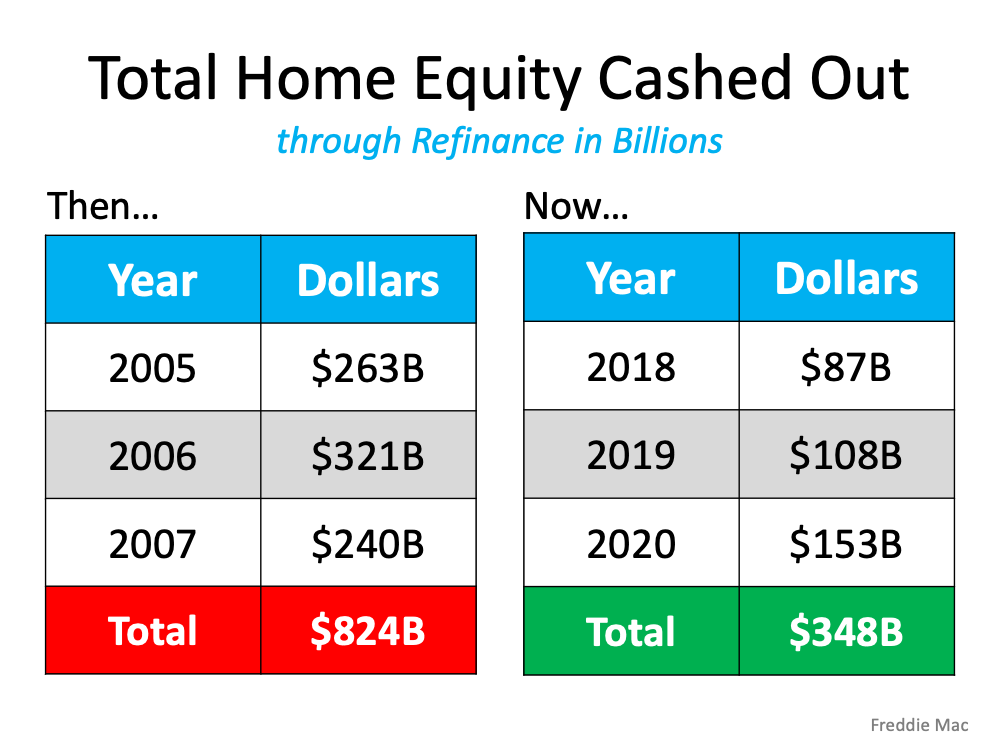

In the run-up to the housing bubble, homeowners were using their homes as personal ATM machines. Many immediately withdrew their equity once it built up, and they learned their lesson in the process. Prices have risen nicely over the last few years, leading to over 50% of homes in the country having greater than 50% equity – and owners have not been tapping into it like the last time. Here’s a table comparing the equity withdrawal over the last three years compared to 2005, 2006, and 2007. Homeowners have cashed out almost $500 billion dollars less than before: During the crash, home values began to fall, and sellers found themselves in a negative equity situation (where the amount of the mortgage they owed was greater than the value of their home). Some decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area. With the average home equity now standing at over $190,000, this won’t happen today.

During the crash, home values began to fall, and sellers found themselves in a negative equity situation (where the amount of the mortgage they owed was greater than the value of their home). Some decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area. With the average home equity now standing at over $190,000, this won’t happen today.

This is nothing like the last time.

Bottom Line

If you’re concerned that we’re making the same mistakes that led to the housing crash, take a look at the charts and graphs above to help alleviate your fears.

Monday, March 15, 2021

How to Make a Winning Offer on a Home

How to Make a Winning Offer on a Home

Today’s homebuyers are faced with a strong sellers’ market, which means there are a lot of active buyers competing for a relatively low number of available homes. As a result, it’s essential to understand how to make a confident and competitive offer on your dream home. Here are five tips for success in this critical stage of the homebuying process.

1. Listen to Your Real Estate Advisor

An article from Freddie Mac gives direction on making an offer on a home. From the start, it emphasizes how trusted professionals can help you stay focused on the most important things, especially at times when this process can get emotional for buyers:

“Remember to let your homebuying team guide you on your journey, not your emotions. Their support and expertise will keep you from compromising on your must-haves and future financial stability.”

A real estate professional should be the expert guide you lean on for advice when you’re ready to make an offer.

2. Understand Your Finances

Having a complete understanding of your budget and how much house you can afford is essential. The best way to know this is to get pre-approved for a loan early in the homebuying process. Only 44% of today’s prospective homebuyers are planning to apply for pre-approval, so be sure to take this step so you stand out from the crowd. Doing so make it clear to sellers you’re a serious and qualified buyer, and it can give you a competitive edge in a bidding war.

3. Be Prepared to Move Quickly

According to the latest Realtors Confidence Index from the National Association of Realtors (NAR), the average property sold today receives 3.7 offers and is on the market for just 21 days. These are both results of today’s competitive market, showing how important it is to stay agile and alert in your search. As soon as you find the right home for your needs, be prepared to submit an offer as quickly as possible.

4. Make a Fair Offer

It’s only natural to want the best deal you can get on a home. However, Freddie Mac also warns that submitting an offer that’s too low can lead sellers to doubt how serious you are as a buyer. Don’t make an offer that will be tossed out as soon as it’s received. The expertise your agent brings to this part of the process will help you stay competitive:

“Your agent will work with you to make an informed offer based on the market value of the home, the condition of the home and recent home sale prices in the area.”

5. Stay Flexible in Negotiations

After submitting an offer, the seller may accept it, reject it, or counter it with their own changes. In a competitive market, it’s important to stay nimble throughout the negotiation process. You can strengthen your position with an offer that includes flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). Freddie Mac explains that there are, however, certain contingencies you don’t want to forego:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

Bottom Line

Today’s competitive market makes it more important than ever to make a strong offer on a home. Let’s connect to make sure you rise to the top along the way.

Friday, March 12, 2021

How to Be a Competitive Buyer in Today’s Housing Market

How to Be a Competitive Buyer in Today’s Housing Market [INFOGRAPHIC]

![How to Be a Competitive Buyer in Today’s Housing Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/03/10135710/20210312-MEM-1046x2024.png)

Some Highlights

- With so few houses for sale today, it’s important to be prepared when you’re ready to buy a home.

- Meeting with your lender early, knowing your must-haves and nice-to-haves, preparing for a bidding war, and keeping your emotions in check are all ways to gain confidence in the homebuying process.

- If you’re looking for an expert guide to help you navigate today’s lightning-fast housing market, let’s connect today.

Wednesday, March 10, 2021

Study: Homeowners in Black Neighborhoods See Massive Equity Spike

6 Simple Graphs Proving This Is Nothing Like Last Time

6 Simple Graphs Proving This Is Nothing Like Last Time

Last March, many involved in the residential housing industry feared the market would be crushed under the pressure of a once-in-a-lifetime pandemic. Instead, real estate had one of its best years ever. Home sales and prices were both up substantially over the year before. 2020 was so strong that many now fear the market’s exuberance mirrors that of the last housing boom and, as a result, we’re now headed for another crash.

However, there are many reasons this real estate market is nothing like 2008. Here are six visuals to show the dramatic differences.

1. Mortgage standards are nothing like they were back then.

During the housing bubble, it was difficult not to get a mortgage. Today, it’s tough to qualify. Recently, the Urban Institute released their latest Housing Credit Availability Index (HCAI) which “measures the percentage of owner-occupied home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.”

The index shows that lenders were comfortable taking on high levels of risk during the housing boom of 2004-2006. It also reveals that today, the HCAI is under 5 percent, which is the lowest it’s been since the introduction of the index. The report explains:

“Significant space remains to safely expand the credit box. If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.”

This is nothing like the last time.

This is nothing like the last time.

2. Prices aren’t soaring out of control.

Below is a graph showing annual home price appreciation over the past four years compared to the four years leading up to the height of the housing bubble. Though price appreciation was quite strong last year, it’s nowhere near the rise in prices that preceded the crash. There’s a stark difference between these two periods of time. Normal appreciation is 3.8%. So, while current appreciation is higher than the historic norm, it’s certainly not accelerating out of control as it did in the early 2000s.

There’s a stark difference between these two periods of time. Normal appreciation is 3.8%. So, while current appreciation is higher than the historic norm, it’s certainly not accelerating out of control as it did in the early 2000s.

This is nothing like the last time.

3. We don’t have a surplus of homes on the market. We have a shortage.

The months’ supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued appreciation. As the next graph shows, there were too many homes for sale in 2007, and that caused prices to tumble. Today, there’s a shortage of inventory, which is causing an acceleration in home values. This is nothing like the last time.

This is nothing like the last time.

4. New construction isn't making up the difference in inventory needed.

Some may think new construction is filling the void. However, if we compare today to right before the housing crash, we can see that an overabundance of newly built homes was a major challenge then, but isn’t now. This is nothing like the last time.

This is nothing like the last time.

5. Houses aren’t becoming too expensive to buy.

The affordability formula has three components: the price of the home, the wages earned by the purchaser, and the mortgage rate available at the time. Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. Today, prices are still high. Wages, however, have increased, and the mortgage rate is about 3%. That means the average homeowner pays less of their monthly income toward their mortgage payment than they did back then. Here’s a chart showing that difference: As Mark Fleming, Chief Economist for First American, explains:

As Mark Fleming, Chief Economist for First American, explains:

“Lower mortgage interest rates and rising incomes correspond with higher house prices as home buyers can afford to borrow and buy more. If housing is appropriately valued, house-buying power should equal or outpace the median sale price of a home. Looking back at the bubble years, house prices exceeded house-buying power in 2006, but today house-buying power is nearly twice as high as the median sale price nationally.”

This is nothing like the last time.

6. People are equity rich, not tapped out.

In the run-up to the housing bubble, homeowners were using their homes as personal ATM machines. Many immediately withdrew their equity once it built up, and they learned their lesson in the process. Prices have risen nicely over the last few years, leading to over 50% of homes in the country having greater than 50% equity – and owners have not been tapping into it like the last time. Here’s a table comparing the equity withdrawal over the last three years compared to 2005, 2006, and 2007. Homeowners have cashed out almost $500 billion dollars less than before: During the crash, home values began to fall, and sellers found themselves in a negative equity situation (where the amount of the mortgage they owed was greater than the value of their home). Some decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area. With the average home equity now standing at over $190,000, this won’t happen today.

During the crash, home values began to fall, and sellers found themselves in a negative equity situation (where the amount of the mortgage they owed was greater than the value of their home). Some decided to walk away from their homes, and that led to a wave of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area. With the average home equity now standing at over $190,000, this won’t happen today.

This is nothing like the last time.

Bottom Line

If you’re concerned that we’re making the same mistakes that led to the housing crash, take a look at the charts and graphs above to help alleviate your fears.

Friday, March 5, 2021

How to Prepare Your House for a Winning Sale This Spring

How to Prepare Your House for a Winning Sale This Spring [INFOGRAPHIC]

![How to Prepare Your House for a Winning Sale This Spring [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/03/04132426/20210305-MEM-1046x2324.png)

Thursday, March 4, 2021

Buyers May Want to Ask Lenders: How Long to Close?

Wednesday, March 3, 2021

It’s a Sellers’ Market [INFOGRAPHIC]

It’s a Sellers’ Market [INFOGRAPHIC]

![It’s a Sellers’ Market [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/02/25131035/20210226-MEM-1046x1503.png)

Some Highlights

- Over the past year, homeowners have gained an unprecedented opportunity to sell with great success while buyer demand is soaring.

- With homes selling twice as fast as they did last year at this time, getting multiple offers, and rising in price, homeowners are in the driver’s seat.

- Let’s connect today if you’re ready to learn about the leverage you have as a seller in today’s housing market.

Tuesday, March 2, 2021

New-Home Sales Jump 19% Annually

Monday, March 1, 2021

Existing-Home Sales Tick Up 0.6% in January

The Real Reason Home Sales Slowed in January. And It’s Not What You Think.

The Real Reason Home Sales Slowed in January. And It’s Not What You Think. If you saw headlines that talked about how “ home sales fell sh...

-

Pending Home Sales Jumped 6.1% in March : The solid rise in pending home sales implies a sizable build-up of potential home buyers, fueled b...

-

Pending Home Sales Waned 4.6% in January : The Midwest, South, and West saw month-over-month losses in transactions, while the Northeast saw...