I am dedicated to providing authentic, excellent customer service; to me this means getting to know your needs and wants and finding the best solution for your specific situation. I plan to diligently work with you to prepare a competent strategy to effectively sell and/or purchase your home. I’d like to provide you with the information you need to make an informed decision. As we navigate through this process I will walk alongside you as your knowledgeable, trusted real estate resource.

Friday, April 21, 2017

How Owning a Home Pays Off at Tax Time

DAILY REAL ESTATE NEWS | TUESDAY, APRIL 18, 2017

Homeownership-related tax deductions can prove advantageous in lowering your tax bill. HouseLogic lists some of the ways homeownership helps at tax time:

Get Your Taxes in Order

Mortgage interest deduction: Itemizing homeowners can deduct the interest they pay on their mortgage up to $1 million—or $500,000 if married but filing separately. The deductions can be made for loans issued to buy, build, or improve your home, and can apply to a house, trailer, or boat as long as it serves as your residence. A second mortgage, home equity loan, or home equity loan of credit to improve your home or buy a second home can also be included toward that $1 million limit.

Property tax deduction: The real estate property taxes paid can be another chunk of a deduction. For homeowners who purchased a home this year, they’ll want to check their HUD-1 settlement statement to see if they paid any property taxes when they closed on the purchase of the home.

Prepaid interest deduction: The prepaid interest, or points you paid when you took out your mortgage, is also deductible in the year you paid it too. This could apply to homeowners who refinanced their mortgage and used the money for home improvements. You can also deduct the points if you refinanced to get a better mortgage rate or shortened the length of your mortgage, but the deduction of the points must be over the life of your mortgage. See an example at HouseLogic.com.

PMI and FHA mortgage insurance premiums: The costs of private mortgage insurance can be deducted on loans taken out in 2007 or later. There are some stipulations, particularly if your adjusted gross income is more than $100,000, on how much you can deduct. Government insurance from the FHA, VA, and Rural Housing Service can also be deducted, but varies among agencies.

Vacation-home tax deductions: If the vacation home is used only by you, you can deduct the mortgage interest and real estate taxes. That means the home is not rented out for more than 14 days a year. If the home is rented out for more than that and used by yourself for less than 15 days, the home is classified like a rental property. Expenses are then deducted on IRS form Schedule E.

Energy-efficiency upgrades: Some energy-efficient upgrades may be eligible to be deducted via the Nonbusiness Energy Tax Credit. Among the upgrades that may qualify for the credit include: Biomass stoves; heating, ventilation, and air conditioning; insulation; roofs (metal and asphalt); water heaters (non-solar); and windows, doors, and skylights.

Source: “Are You Getting the Home Tax Deductions You’re Entitled To?” HouseLogic (2017)

Monday, April 17, 2017

Housing Recovery Still Incomplete - Josh Lehner | March 28, 2017

Our office has done a lot of housing work in recent years — things like The Housing Trilemma, Peak Renter, Rural Affordability and The Housing Inflection Point

— but haven’t published much of the basic nuts and bolts numbers. What

follows is a handful of updated charts that show the still incomplete

housing recovery.

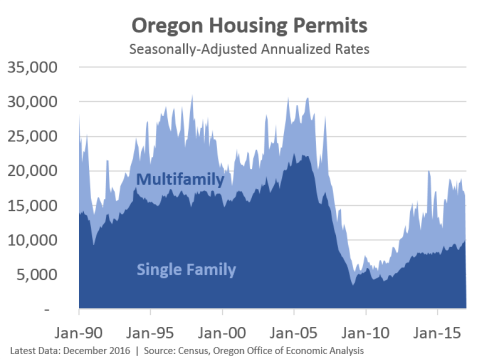

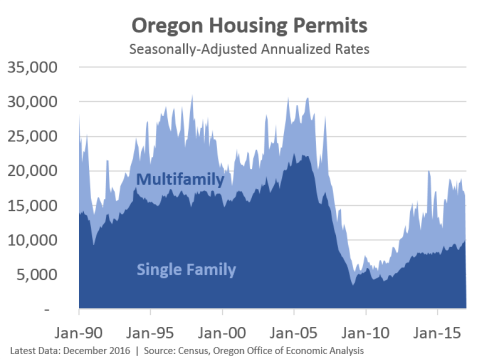

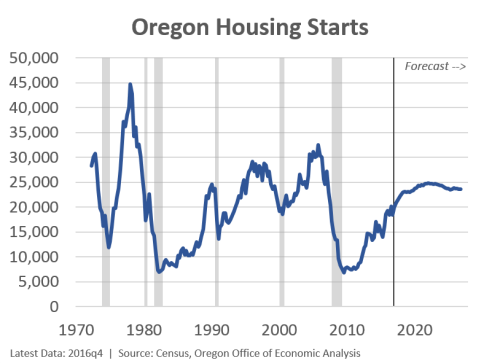

First, permits for new construction continue to increase, albeit slowly. Multifamily permits rebounded first and seem to be holding steady at a relatively high level — somewhat larger than the mid-2000s but not quite as strong as the construction booms in the late 1980s and late 1990s. Single family permits have lagged and are just now about halfway back to 1990s level of construction, let alone peak bubble rates.

Given the nature of the Great Recession — a housing bubble and financial crisis — it wasn’t a huge surprise to see housing lag the recovery, even if it used to be the first thing to bounce back. However in recent years the lack of construction has become a big issue in terms of eroding affordability, which is a national and a statewide problem.

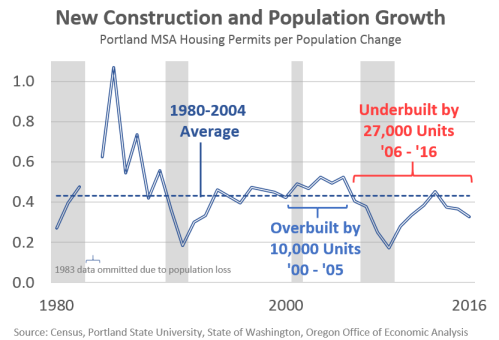

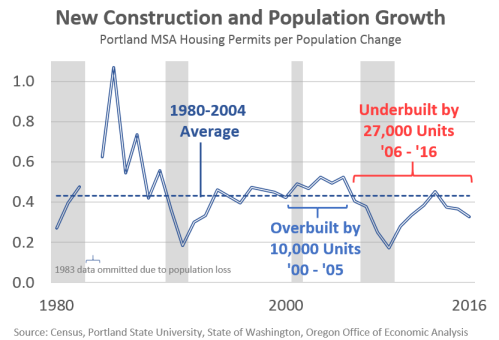

Of course it’s not just that the total number of housing starts is relatively low that’s an issue. The problem is that the level of new construction in the past decade has been considerably less than what is needed to keep pace with a growing population. It’s the lack of supply relative to the growing demand that underlies the affordability challenges. The housing bust has clearly been disproportionate to the boom. The fact we were/are underbuilding was apparent all the way back in 2011. While our office had a more subdued housing outlook than many national forecasters, we still expected starts to increase faster than they have to meet the the actual need and demand in the economy.

Note: While our office’s chart below tracks the Portland region, everywhere else in the state I have looked, the pattern is essentially the same.

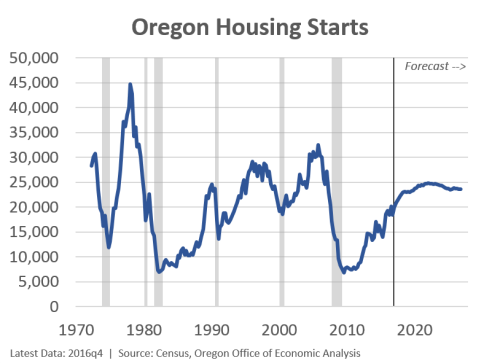

In terms of the outlook, our office still expects housing starts to increase a bit further. As we write in our forecast document:

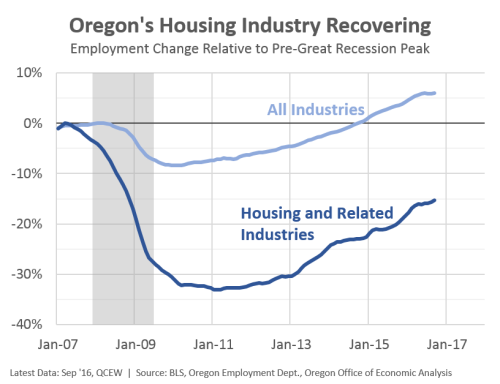

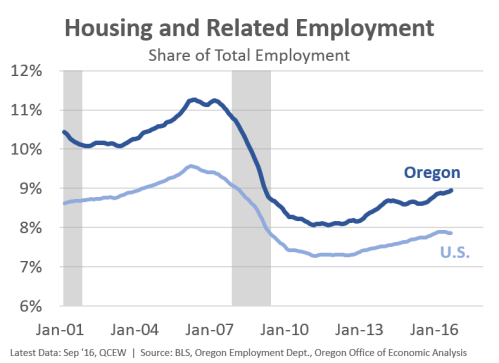

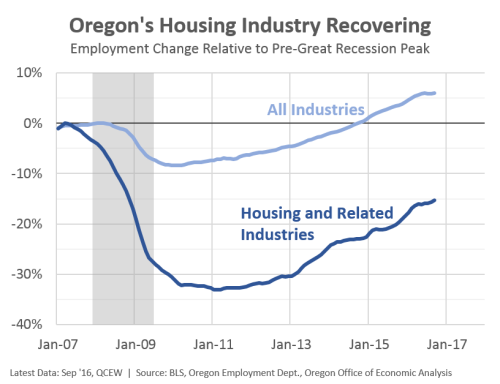

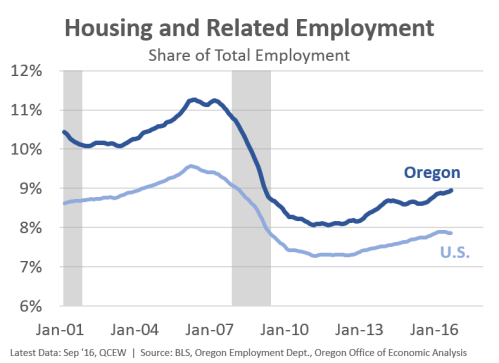

Just as construction activity has yet to recover, construction and related employment remains about 15 percent below pre-Great Recession levels [1].

Such jobs have been growing at an above average pace in recent years, however there remains considerable room left to go in order to return to something approaching historical norms. It should also be noted that housing (and government) jobs represent a larger share of local employment in the state’s secondary metros and rural areas. As the housing market has returned to growth, it has boosted local economies in recent years. This was missing throughout the early stages of recovery in much of the state.

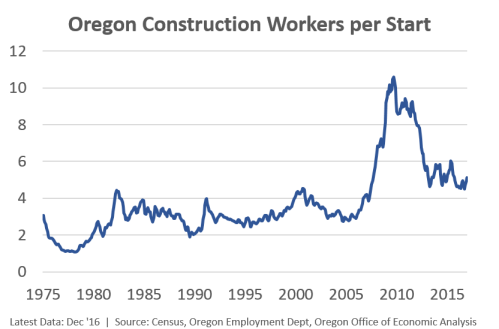

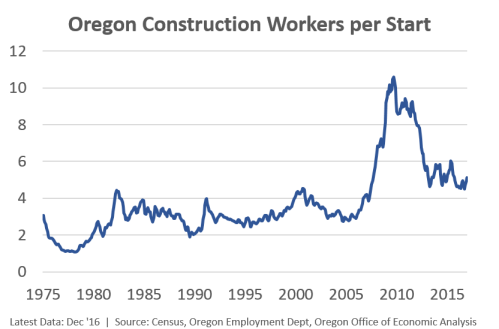

One other interesting trend has been the shift in the number of construction workers per housing start. This ratio remains higher than has historically been the case. Now, I don’t think it means there are literally more individuals working on each home. Rather it is a crude ratio. The shift likely reflects a few different trends, including more multifamily, but also increased remodeling activity which requires workers (and permits) but does not result in a newly build home.

Overall these trends seen in the data are not unique to Oregon. The national data show the same issues. That is both encouraging and discouraging at the same time. On the positive side, it means that local problems are not the main driver behind the housing market issues today. On the bad side, it means there is something impacting the entire national housing market that is driving these results which makes it harder to fix locally. Our office has dug into a number of the supply side constraints in recent months and will summarize that work in the near future. Update: Here is our summary of the main supply constraints.

First, permits for new construction continue to increase, albeit slowly. Multifamily permits rebounded first and seem to be holding steady at a relatively high level — somewhat larger than the mid-2000s but not quite as strong as the construction booms in the late 1980s and late 1990s. Single family permits have lagged and are just now about halfway back to 1990s level of construction, let alone peak bubble rates.

Given the nature of the Great Recession — a housing bubble and financial crisis — it wasn’t a huge surprise to see housing lag the recovery, even if it used to be the first thing to bounce back. However in recent years the lack of construction has become a big issue in terms of eroding affordability, which is a national and a statewide problem.

Of course it’s not just that the total number of housing starts is relatively low that’s an issue. The problem is that the level of new construction in the past decade has been considerably less than what is needed to keep pace with a growing population. It’s the lack of supply relative to the growing demand that underlies the affordability challenges. The housing bust has clearly been disproportionate to the boom. The fact we were/are underbuilding was apparent all the way back in 2011. While our office had a more subdued housing outlook than many national forecasters, we still expected starts to increase faster than they have to meet the the actual need and demand in the economy.

Note: While our office’s chart below tracks the Portland region, everywhere else in the state I have looked, the pattern is essentially the same.

In terms of the outlook, our office still expects housing starts to increase a bit further. As we write in our forecast document:

Over the extended horizon, starts are expected to average a little more than 23,000 per year to meet demand for a larger population and also, partially, to catch-up for the underbuilding that has occurred in recent years. As of today, new home construction in cumulatively about one year behind the stable growth levels of prior decades even after accounting for the overbuilding during the boom.

Just as construction activity has yet to recover, construction and related employment remains about 15 percent below pre-Great Recession levels [1].

Such jobs have been growing at an above average pace in recent years, however there remains considerable room left to go in order to return to something approaching historical norms. It should also be noted that housing (and government) jobs represent a larger share of local employment in the state’s secondary metros and rural areas. As the housing market has returned to growth, it has boosted local economies in recent years. This was missing throughout the early stages of recovery in much of the state.

One other interesting trend has been the shift in the number of construction workers per housing start. This ratio remains higher than has historically been the case. Now, I don’t think it means there are literally more individuals working on each home. Rather it is a crude ratio. The shift likely reflects a few different trends, including more multifamily, but also increased remodeling activity which requires workers (and permits) but does not result in a newly build home.

Overall these trends seen in the data are not unique to Oregon. The national data show the same issues. That is both encouraging and discouraging at the same time. On the positive side, it means that local problems are not the main driver behind the housing market issues today. On the bad side, it means there is something impacting the entire national housing market that is driving these results which makes it harder to fix locally. Our office has dug into a number of the supply side constraints in recent months and will summarize that work in the near future. Update: Here is our summary of the main supply constraints.

Friday, April 7, 2017

New-Home Trend: Bigger Houses, Smaller Lots

DAILY REAL ESTATE NEWS | THURSDAY, APRIL 06, 2017

New homes are getting larger, but their lot sizes are getting smaller. The median size of a new home increased from 1,938 square feet in 1990 to 2,300 square feet in 2016, but lot sizes during this same period decreased from 8,250 square feet to 6,970 square feet. That amounts to about a 16 percent decrease.

Read more: Other Hot New-Home Trends to Watch

However, the trend hasn't been consistent: Between 2006 and 2011, home buyers were showing demand for larger homes andlarger lots. As home prices dropped during the housing crisis, greater affordability gave buyers opportunities to seek larger outdoor spaces. Today's pullback in lot sizes come as builders look to cut costs.

"When home prices appreciate at a fast pace, the land value rises even faster, which, in turn, drives the cost of homes higher," according to CoreLogic's Insights blog. "In order to mitigate the high cost of the land value, home builders reduce the size of the lots to bring the cost of the new home down so they can price these homes at a reasonable level."

Indeed, the data shows that sizable price gains on large homes between 2014 and 2016 put pressure on builders in the cost of acquiring and developing land. More builders responded by building larger homes but on smaller lots.

Source: “The More, the Merrier,” CoreLogic Insights Blog (April 5, 2017)

Thursday, April 6, 2017

Why Sellers Are So Stressed in a Seller’s Market

DAILY REAL ESTATE NEWS | WEDNESDAY, APRIL 05, 2017

Home sellers say the greatest challenge for them this year is the lack of homes to choose from when it’s time for them to move, according to a new survey of more than 800 real estate professionals from Redfin.

“It’s a seller’s market, but the catch is, most sellers need to buy as well,” says Eileen Lorway, a Redfin real estate professional in the Boston area. “This is a conversation I have with many clients at our first meeting. We discuss options like ‘seller to find suitable housing’ contingencies for the sale contract, ‘purchase contingent on sale of current home’ options for the buy offer, rental options, stay-with-family options, and bridge loans. Sellers who are buying need to think outside the box a little bit. It’s not easy, but we often do end up closing on sale and purchase on the same day.”

Lorway also encourages more of her sellers lately to sell first, then buy. They will need to consider temporary housing options, but “then they will be able to take the time they need to find their dream house, know exactly what they’ll have to work with financially, and won’t end up adding unnecessary contingencies to offers, which will give them a better chance to get the home,” Lorway says.

Inventories of homes for sale have hit record lows in many parts of the country. Buyer demand, however, remains high. About fifty-seven percent of real estate professionals surveyed by Redfin say they have been involved in at least one instance of a home receiving 10 or more offers this year.

Source: “Lack of Homes for Sale Is a Problem for Sellers, Too,” Redfin (March 31, 2017)

Subscribe to:

Comments (Atom)

The Real Reason Home Sales Slowed in January. And It’s Not What You Think.

The Real Reason Home Sales Slowed in January. And It’s Not What You Think. If you saw headlines that talked about how “ home sales fell sh...

-

Pending Home Sales Jumped 6.1% in March : The solid rise in pending home sales implies a sizable build-up of potential home buyers, fueled b...

-

Pending Home Sales Waned 4.6% in January : The Midwest, South, and West saw month-over-month losses in transactions, while the Northeast saw...