Turning a House Into a Home: The Benefits You Can Actually Feel

There’s a lot of conversation about home prices, mortgage rates, and affordability right now – and those things are important. But if you’re thinking about buying a home, it’s worth remembering something the headlines rarely talk about: people don’t buy homes just for financial reasons. They buy them for their lives.

Because while homeownership can absolutely be a smart long-term financial move, it also comes with some emotional benefits spreadsheets just can’t capture. Maybe that’s why a 2025 survey from Fannie Mae notes:

“Consumers were twice as likely to mention lifestyle benefits (67%)—like security, customization, and outdoor space—than financial benefits (34%) when explaining why their homes have become more important in recent years.”

Here are a few reminders of what owning a home gives you that renting never will.

1. A Milestone You Get To Be Proud Of

Buying a home is a big deal. First home, fifth home – it doesn’t matter. It’s a moment you’ll remember. And when you finally get those keys and walk through the door, that feeling of “I did this” hits different. It’s not just a purchase. It’s an accomplishment.

2. A Place That Feels Like Your Reset Button

Life is busy. Having a place that’s truly yours where you can shut the door, take a breath, and settle into your own routine is something renters rarely talk about until they finally experience it. Home becomes the place you go to recharge, not just the place your mail is delivered.

3. Space That Fits the Way You Actually Live

Need a quiet corner for work calls? A backyard big enough for the dog that thinks it’s a person? A shorter drive to see the people who are most important to you? When you own, you get to choose a space that fits your life now and where it’s heading – and it just feels right.

4. Freedom To Make It 100% Yours

Want to paint the kitchen navy? Go for it. Thinking about a wall of floating shelves or a bold wallpaper moment? Do it. Need space for a home gym or a reading nook? Make it happen. Homeownership gives you the freedom to shape your space instead of asking for permission to change it.

Bottom Line

Buying a home isn’t only about dollars and data points – it’s about building a life you love.

So, if you’re thinking about a move in 2026, keep the emotional side in the conversation too. And when you’re ready to explore your options, let's connect so you have a pro on your side to guide you through the process with clarity and confidence.

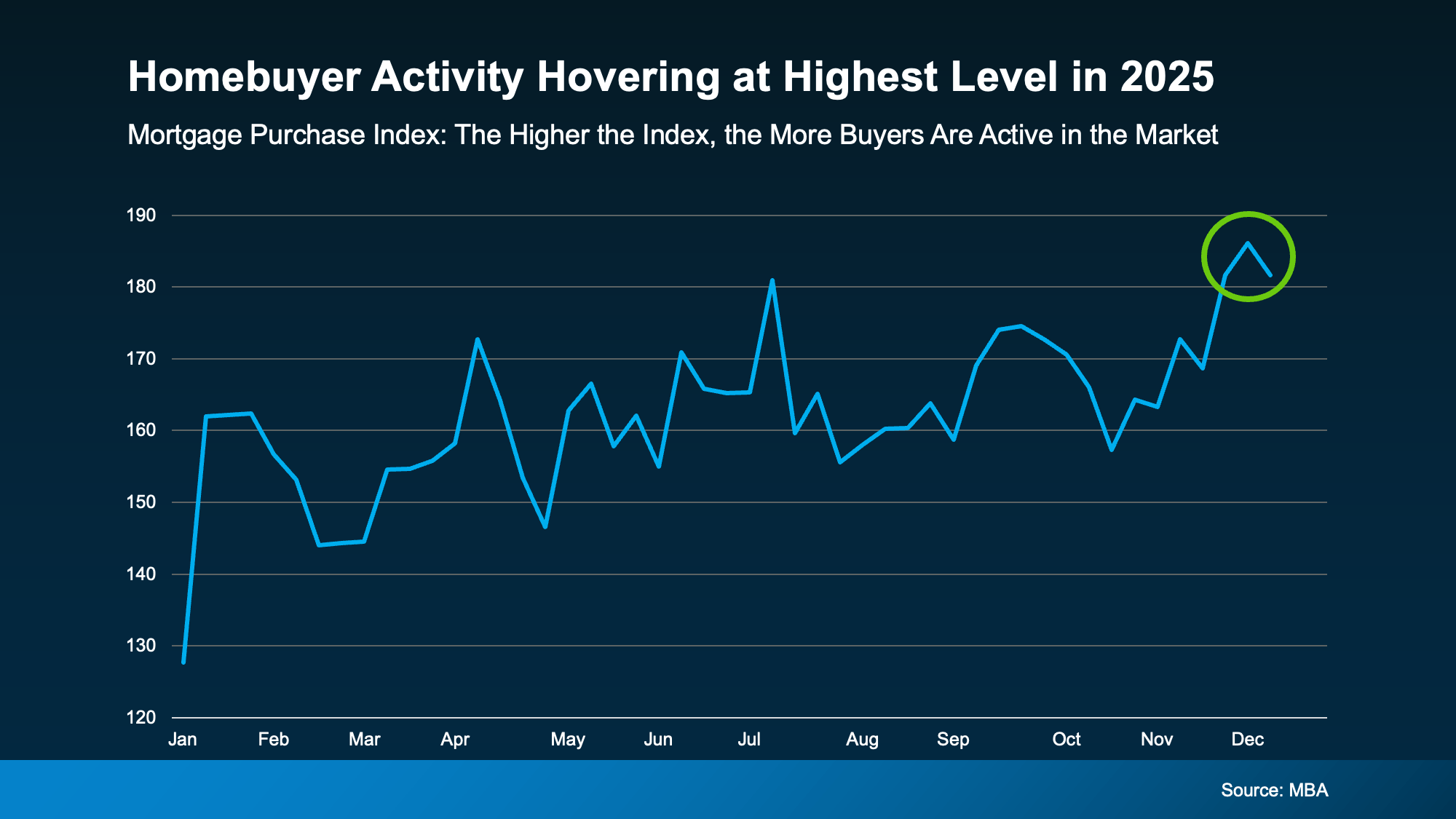

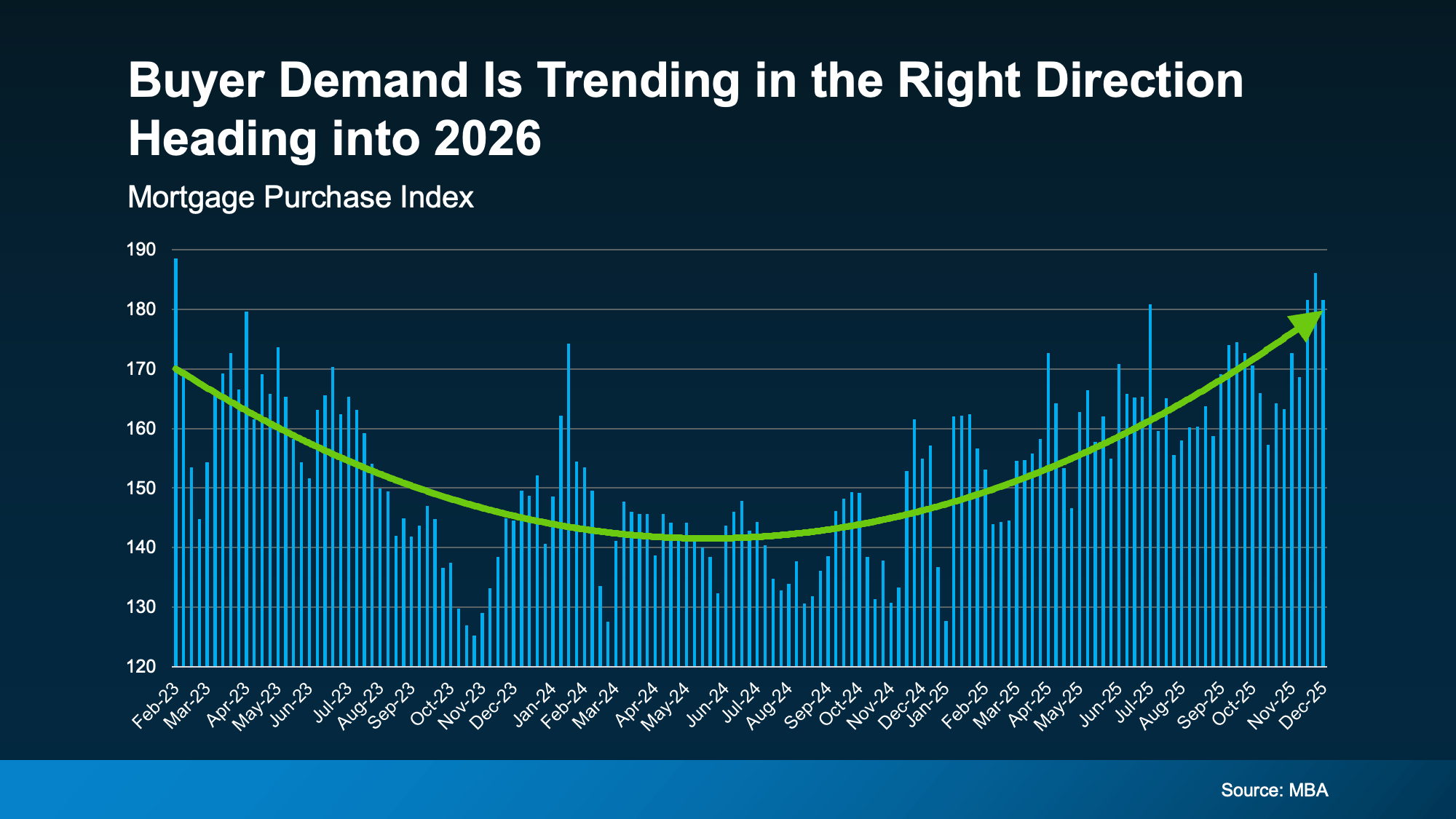

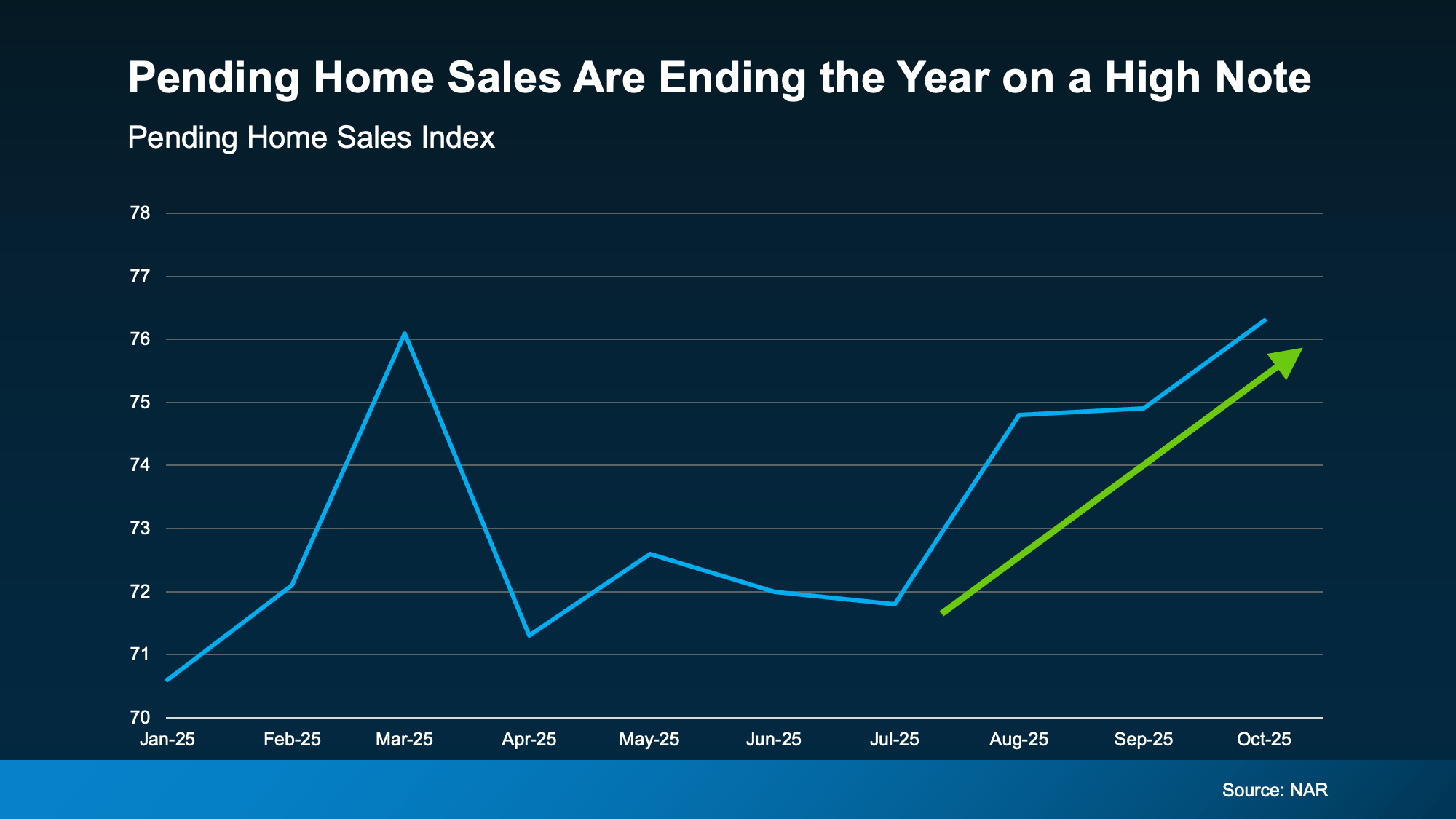

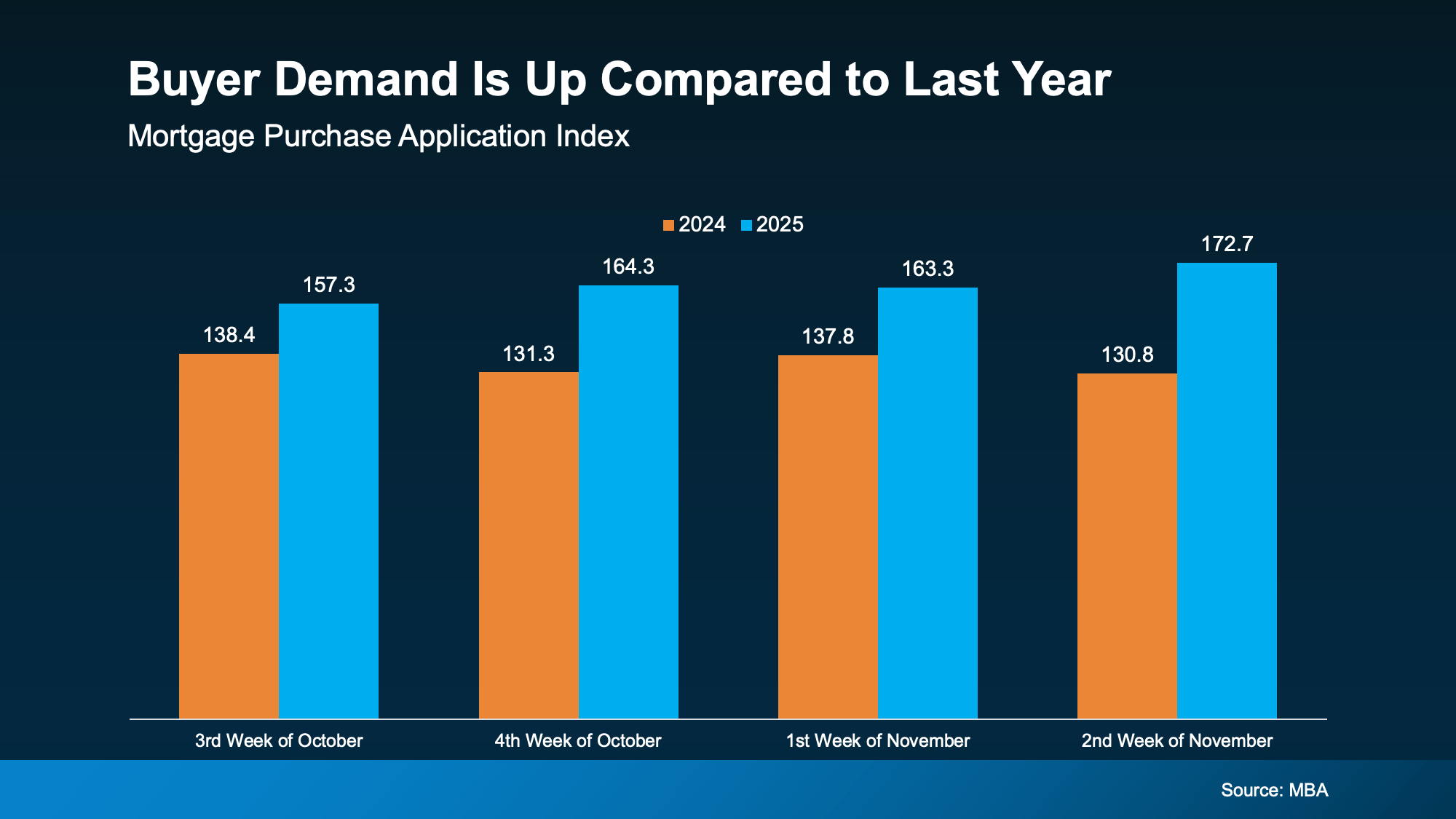

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

And that means the market is ending the year on a high note and headed into 2026 with renewed energy. While that may not seem like a big shift, it’s a rebound worth talking about.

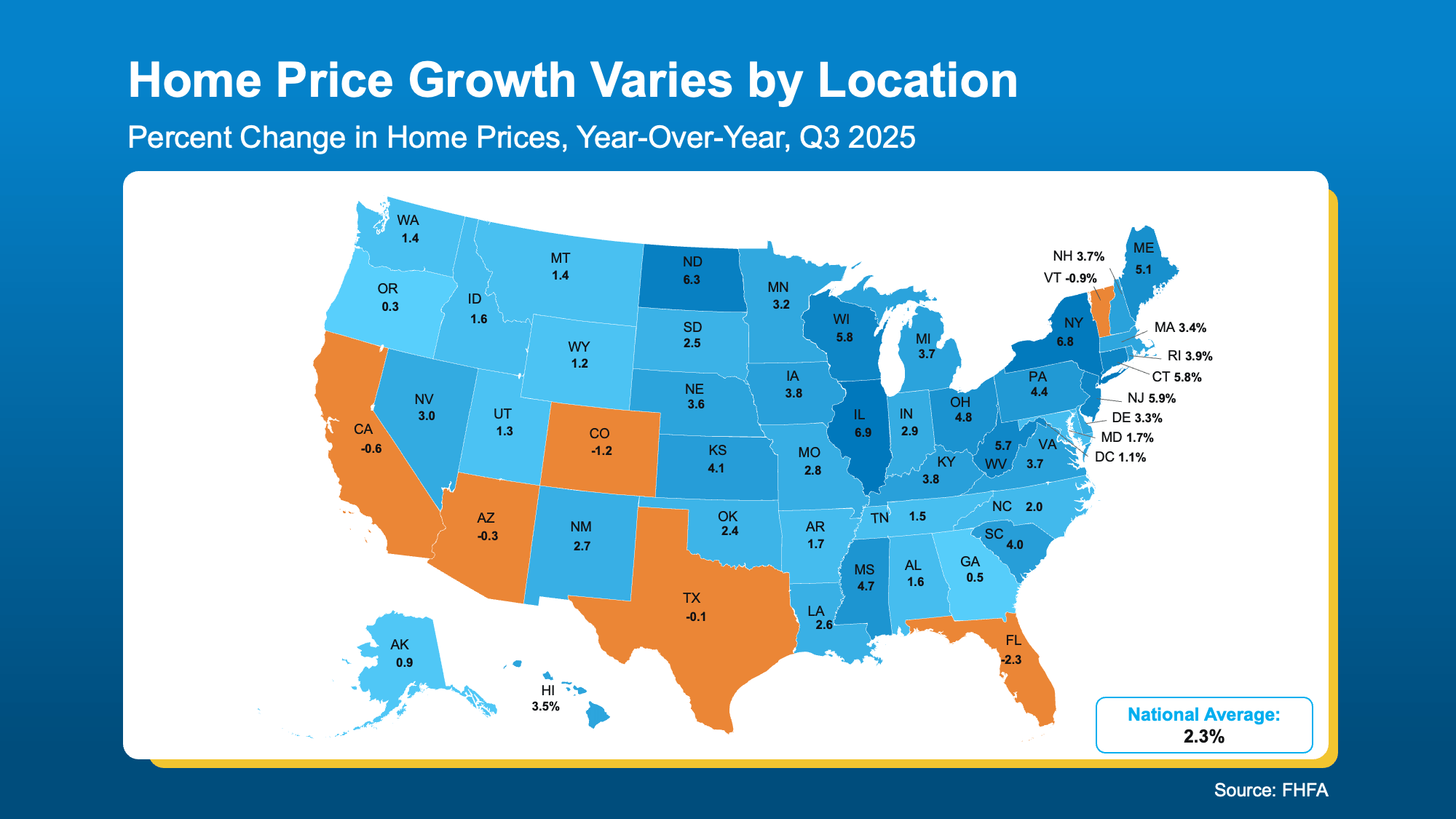

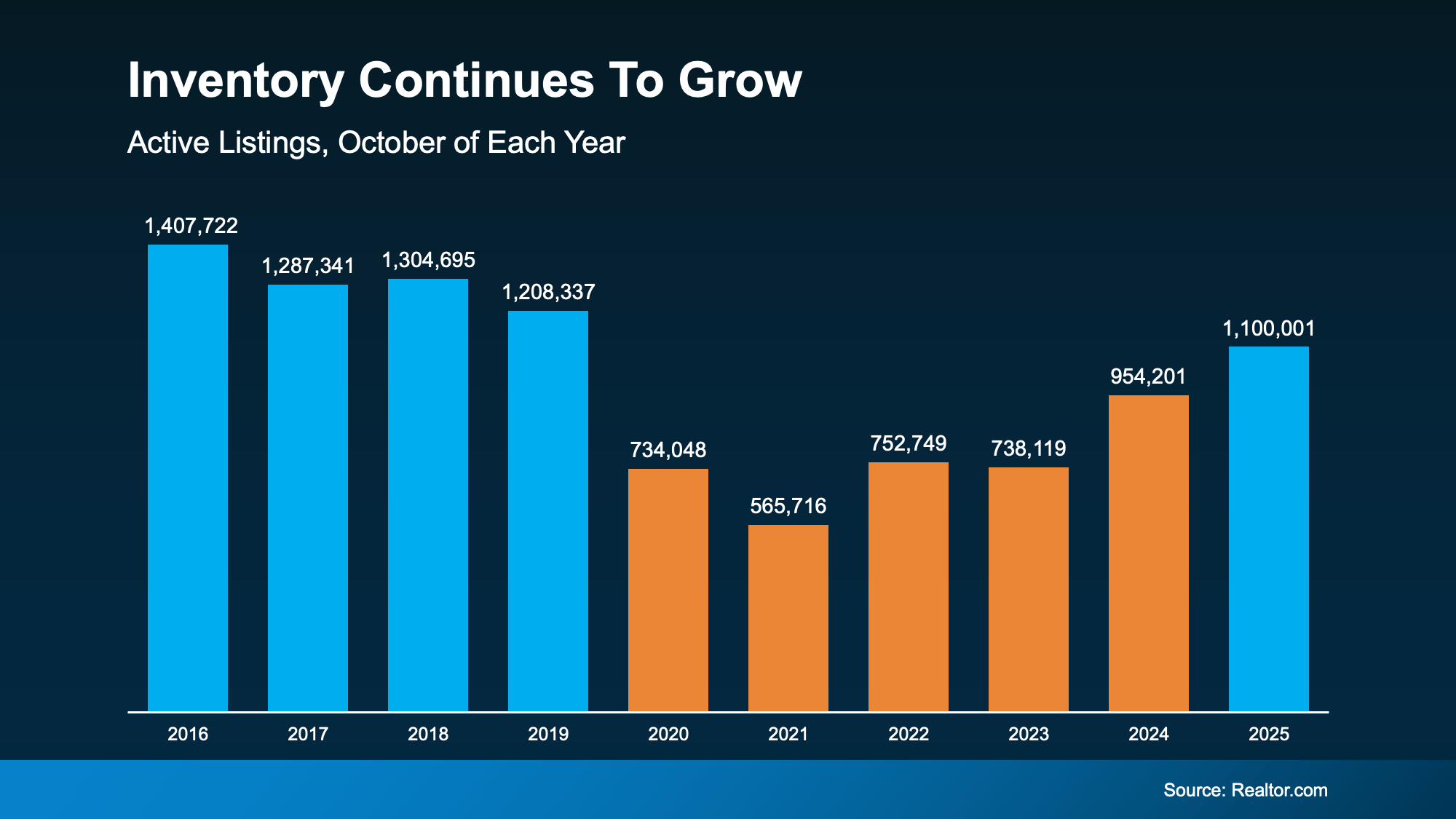

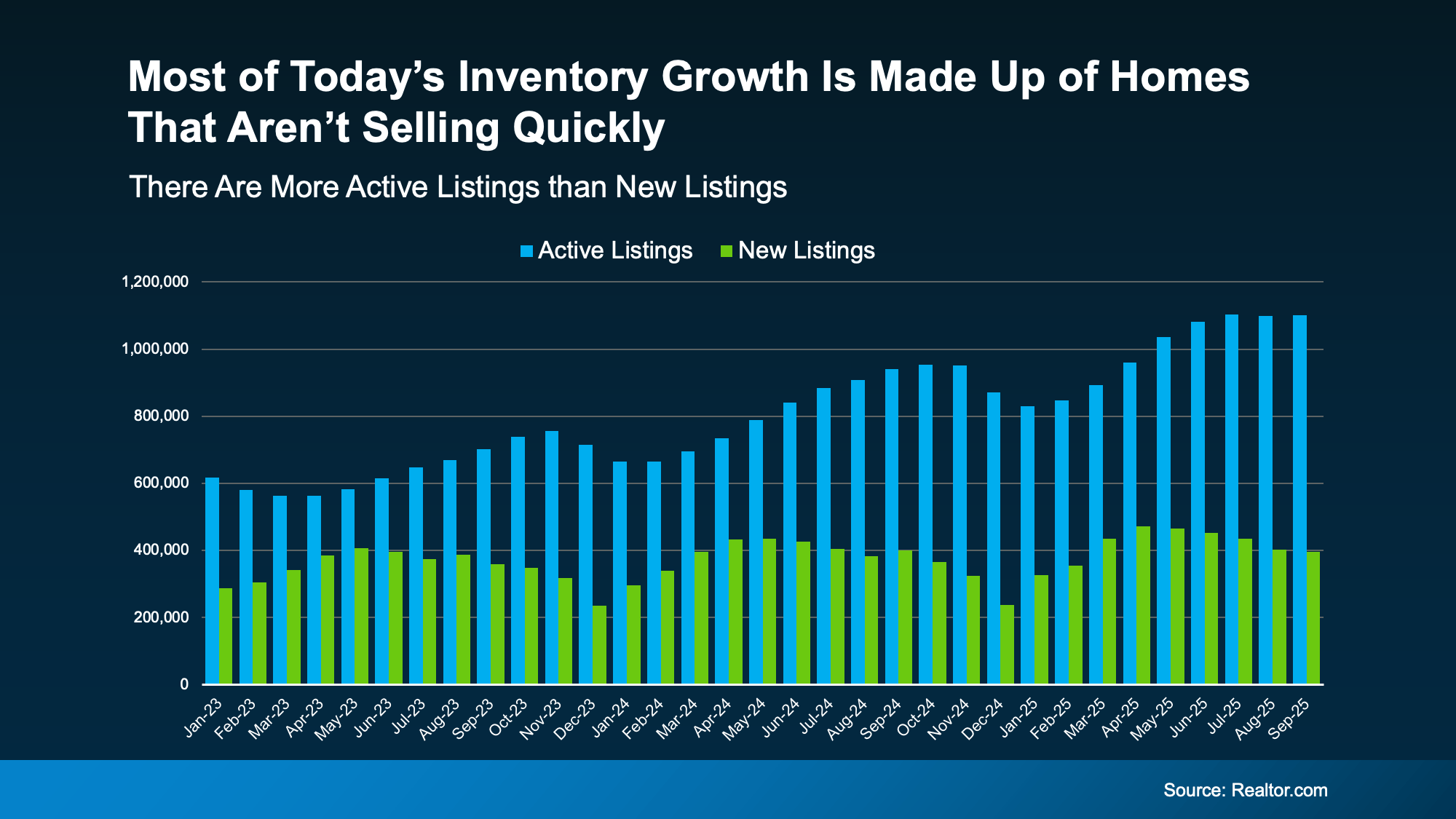

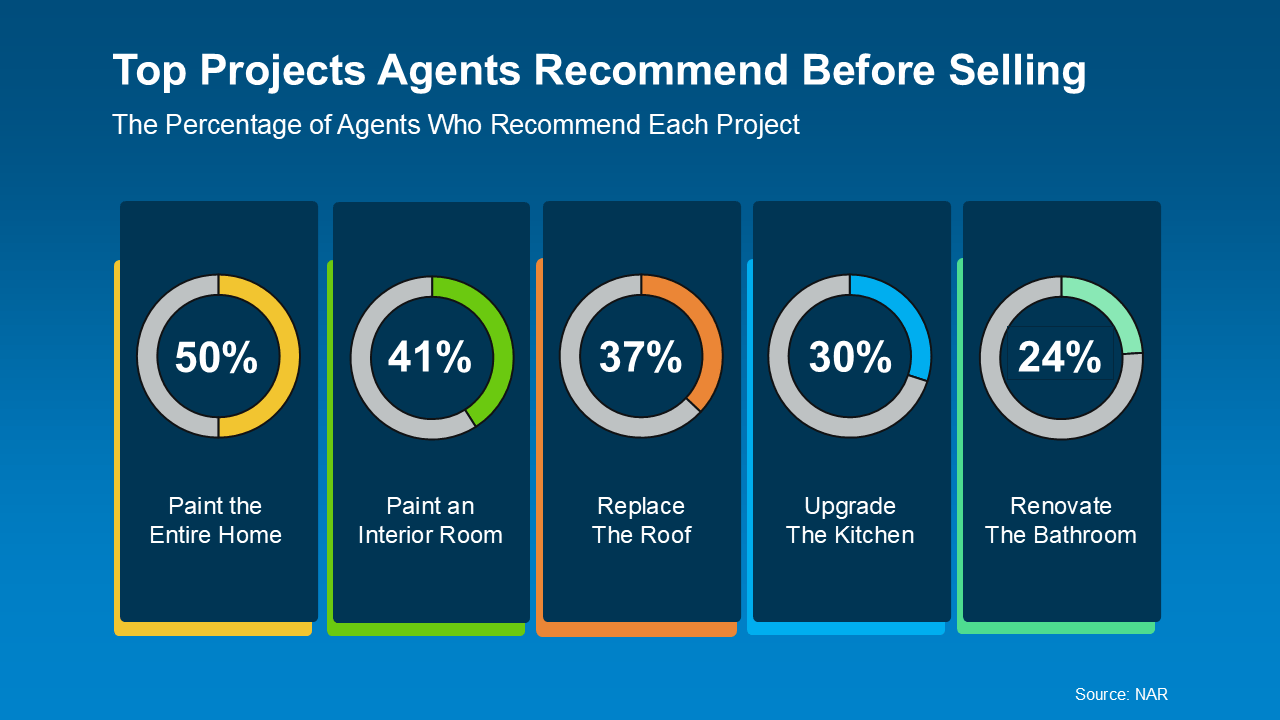

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

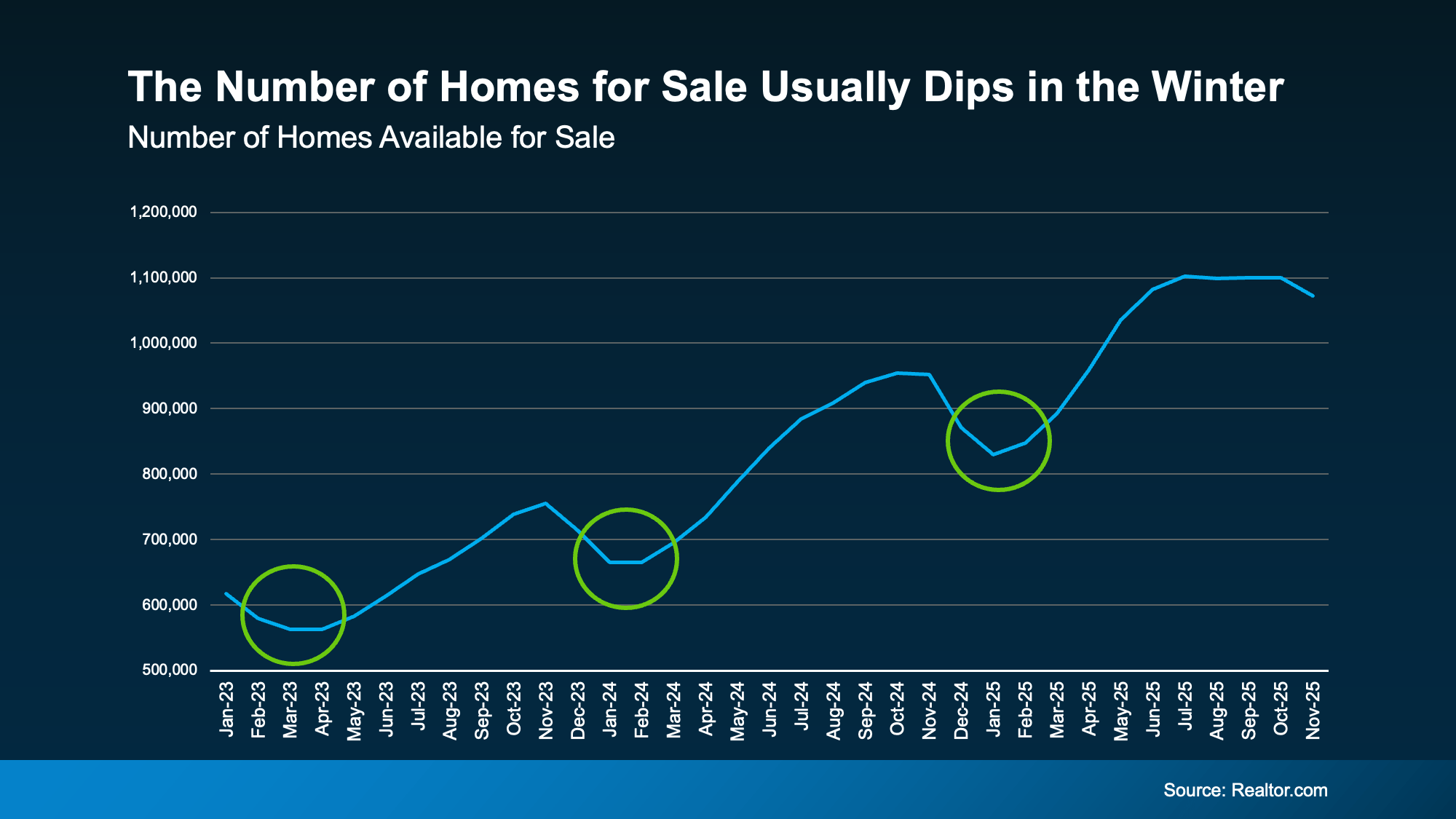

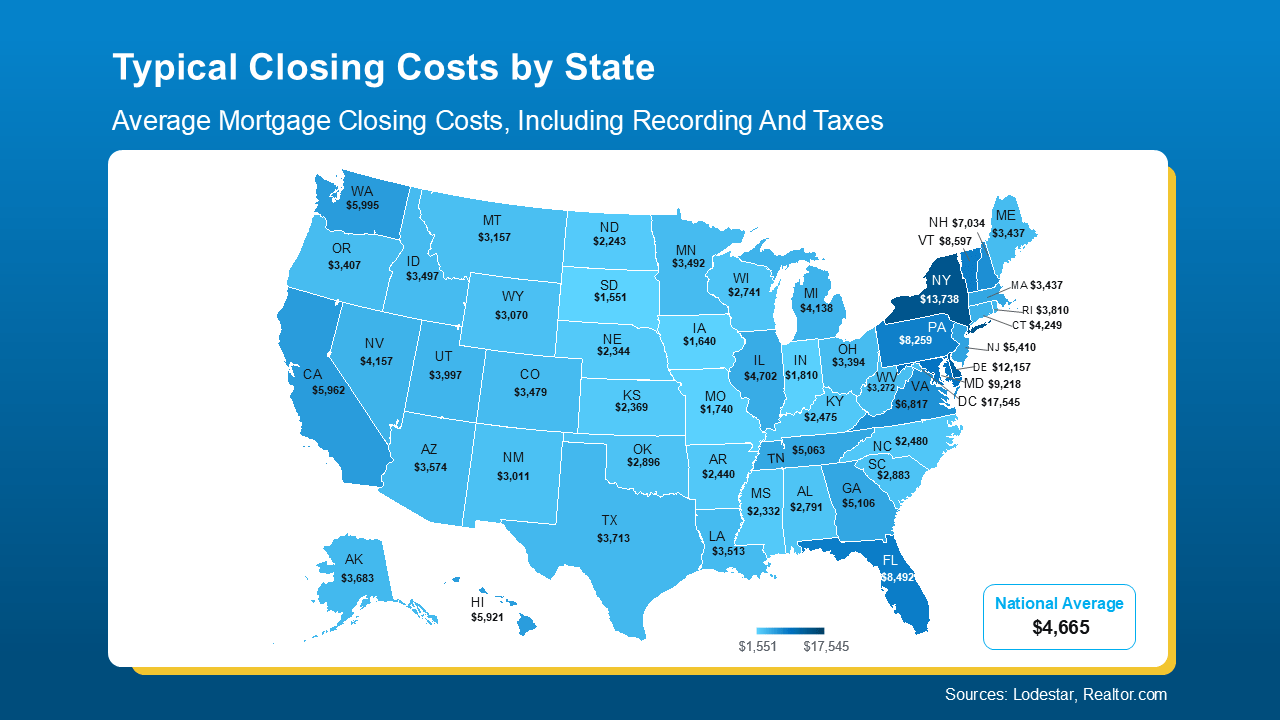

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.