I am dedicated to providing authentic, excellent customer service; to me this means getting to know your needs and wants and finding the best solution for your specific situation. I plan to diligently work with you to prepare a competent strategy to effectively sell and/or purchase your home. I’d like to provide you with the information you need to make an informed decision. As we navigate through this process I will walk alongside you as your knowledgeable, trusted real estate resource.

Tuesday, May 28, 2024

Existing-Home Sales Retreated 1.9% in April

Thursday, May 23, 2024

Questions You May Have About Selling Your House

Questions You May Have About Selling Your House

There’s no denying mortgage rates are having a big impact on today’s housing market. And that may leave you with some questions about whether it still makes sense to sell your house and make a move.

Here are three of the top questions you may be asking – and the data that helps answer them.

1. Should I Wait To Sell?

If you’re thinking about waiting to sell until after mortgage rates come down, here’s what you need to know. So are a ton of other people.

And while mortgage rates are still forecasted to come down later this year, if you wait for that to happen, you may be dealing with a lot more competition as other buyers and sellers jump back in too. As Bright MLS says:

“Even a modest drop in rates will bring both more buyers and more sellers into the market.”

That means if you wait it out, you’ll have to deal with things like prices rising faster and more multiple-offer scenarios when you buy your next home.

2. Are Buyers Still Out There?

But that doesn’t mean no one is moving right now. While some people are holding off, there are still plenty of buyers active today. And here’s the data to prove it.

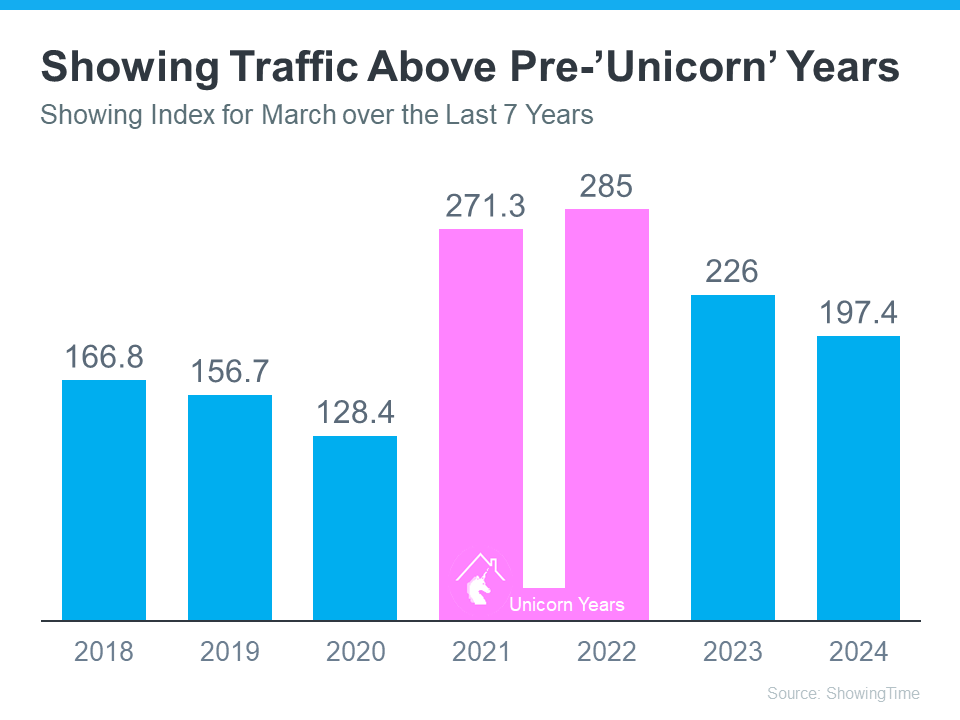

The ShowingTime Showing Index is a measure of how frequently buyers are touring homes. The graph below uses that index to show buyer activity for March (the latest data available) over the past seven years:

You can see demand has dipped some since the ‘unicorn’ years (shown in pink). That’s in response to a lot of market factors, like higher mortgage rates, rising prices, and limited inventory. But, to really understand today’s demand, you have to compare where we are now with the last normal years in the market (2018-2019) – not the abnormal ‘unicorn’ years.

When you focus on just the blue bars, you can get an idea of how 2024 stacks up. And that gives you a whole new perspective.

Nationally, demand is still high compared to the last normal years in the housing market (2018-2019). And that means there’s still a market for your house to sell.

3. Can I Afford To Buy My Next Home?

And if you’re worried about how you’ll afford your next move with today’s rates and prices, consider this: you probably have more equity in your current home than you realize.

Homeowners have gained record amounts of equity over the past few years. And that equity can make a big difference when you buy your next home. You may even have enough to be an all-cash buyer and avoid taking out a mortgage altogether. As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“ . . . those who have earned housing equity through home price appreciation are the current winners in today's housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.”

Bottom Line

If you’ve had these three questions on your mind and they’ve been holding you back from selling, hopefully, it helps to have this information now. A recent survey from Realtor.com shows more than 85% of potential sellers have been considering selling for over a year. That means there are a number of sellers like you who are on the fence.

But that same survey also talked to sellers who recently decided to take the plunge and list. And 79% of those recent sellers wish they’d sold sooner.

If you want to talk more about any of these questions or need more information, let’s connect.

Monday, May 20, 2024

Why a Condo May Be a Great Option for Your First Home

Why a Condo May Be a Great Option for Your First Home

Having a hard time finding a first home that's right for you and your wallet? Well, here's a tip – think about condominiums, or condos for short.

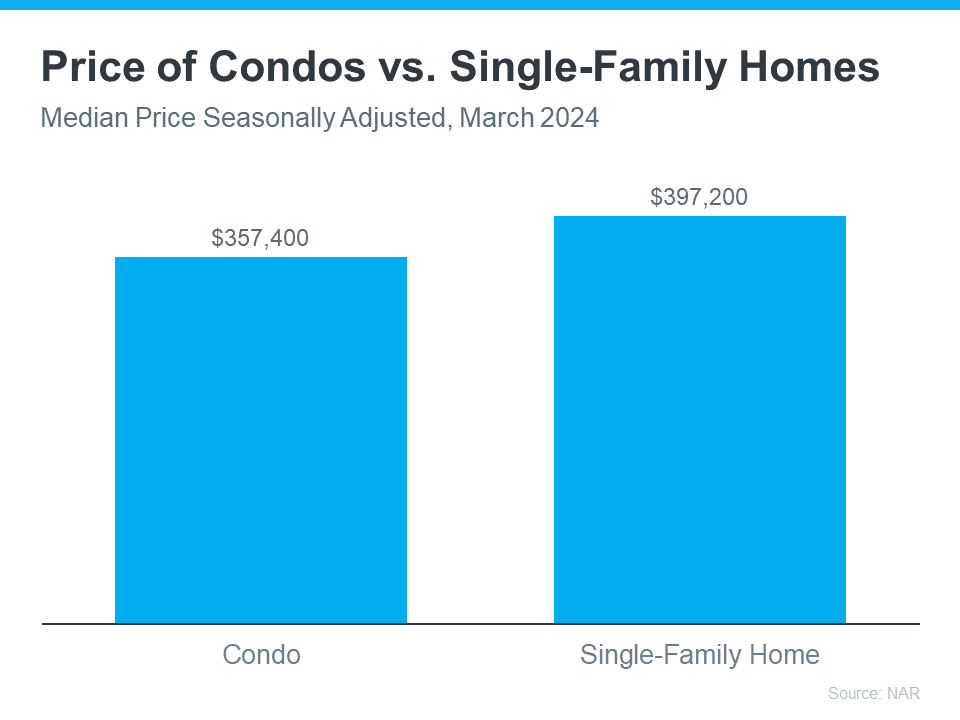

They're usually smaller than single-family homes, but that's exactly why they can be easier on your budget. According to the latest data from the National Association of Realtors (NAR), condos are typically less expensive than single-family homes (see graph below):

So, if you're comfortable with a smaller space and want to buy your first home this year, adding condos to your search might be easier on your wallet.

Besides giving you more options for your home search and maybe fitting your budget better, living in a condo has a bunch of other perks, too. According to Rocket Mortgage:

“From community living to walkable urban areas, condos are great options for first-time home buyers and people looking to enjoy homeownership without extensive upkeep.”

Let’s dive into a few of the draws of condos for first-time buyers from Bankrate:

- They require less maintenance. Condos are great if you want to own your place but don't want to mow the lawn, shovel snow, or fix the roof. Your real estate agent can help explain any associated fees and details for the condos you’re interested in.

- They allow you to start building equity. When you buy a condo, you build equity and your net worth as you make your mortgage payments and as your condo’s value goes up over time.

- They often come with added amenities. Your condo might come with access to amenities like a pool, dog park, or parking. And the best part? You don’t have to take care of any of them.

- They provide you with a sense of community. Buying a condo means you'll be living close to other people, which is nice if you enjoy having neighbors around and making friends. Many condo communities hold fun events like barbecues and parties during holidays for everyone to enjoy.

Remember, your first home doesn't have to be the one you stay in forever. The important thing is to get your foot in the door as a homeowner so you can start to gain home equity. Later on, that equity can help you buy another place if you need something different.

Ultimately, owning and living in a condo is a lifestyle choice. And if it’s one that appeals to you, they could provide the added options you need in today’s market.

Bottom Line

It might be a good idea to think about condos in your home search. If you're ready to see what's out there, let's get in touch today.

-

Pending Home Sales Jumped 6.1% in March : The solid rise in pending home sales implies a sizable build-up of potential home buyers, fueled b...

-

Pending Home Sales Waned 4.6% in January : The Midwest, South, and West saw month-over-month losses in transactions, while the Northeast saw...