I am dedicated to providing authentic, excellent customer service; to me this means getting to know your needs and wants and finding the best solution for your specific situation. I plan to diligently work with you to prepare a competent strategy to effectively sell and/or purchase your home. I’d like to provide you with the information you need to make an informed decision. As we navigate through this process I will walk alongside you as your knowledgeable, trusted real estate resource.

Friday, February 28, 2020

Freddie: Mortgage Rates Are ‘Deal of the Century’

Freddie: Mortgage Rates Are ‘Deal of the Century’: “These low rates combined with high consumer confidence continue to drive home sales upward, a trend that is likely to endure as we enter spring,” says Freddie Mac’s chief economist.

Thursday, February 27, 2020

‘Zombie’ Foreclosures Are Rising Again

‘Zombie’ Foreclosures Are Rising Again: Pockets of distressed properties continue to haunt certain areas, but the recent rise in vacant foreclosures is no cause for concern, economists say.

‘Zombie’ Foreclosures Are Rising Again

‘Zombie’ Foreclosures Are Rising Again: Pockets of distressed properties continue to haunt certain areas, but the recent rise in vacant foreclosures is no cause for concern, economists say.

Contract Signings Surge, But They Could Be Even Higher

Contract Signings Surge, But They Could Be Even Higher: Real estate pros are having a busy winter. Pending home sales climbed 5.7% over a year ago. Read more from NAR’s latest housing report.

Wednesday, February 26, 2020

The Share of Single Homeowners Is at Record High

The Share of Single Homeowners Is at Record High: More than 38% of U.S. homeowners are single.

Homeowners Sound Off on Their Biggest Housing Worries

Homeowners Sound Off on Their Biggest Housing Worries: Homeowners are sitting on a record amount of equity, so what has them so worried about housing?

How Buyers Can Instantly Improve Their Credit Scores

How Buyers Can Instantly Improve Their Credit Scores: But be aware: The better your scores are to start with, the more difficult it can be to improve them right away, financial experts say.

Tuesday, February 25, 2020

Mortgage Rates Plunge to 8-Year Low Amid Coronavirus Fears

Mortgage Rates Plunge to 8-Year Low Amid Coronavirus Fears: Borrowing rates for home buyers and refinancers are falling fast, and they could sink even lower, Mortgage News Daily reports.

Racial Disparities Persist on Path to Homeownership

Racial Disparities Persist on Path to Homeownership: Mortgage rejections are among the biggest hurdles for African American and Hispanic home shoppers.

Investors Find Pet-Friendly Properties More Profitable

Investors Find Pet-Friendly Properties More Profitable: American households are more likely to include pets than children, and vacancy rates are lower for rental properties where pets are allowed, a study finds.

Top Repairs to Tackle Before Listing Your Home

When you put your home on the market, you obviously want to get as much as you can for the property. A lot of things can affect your home’s value, including many items that are largely out of your control. That’s not saying that you can’t do anything to bring the value up before listing your home, however. In fact, there are some things that you absolutely need to do before you even think about sticking that “For Sale” sign in the yard.

Depending on what city, county and state your home is in, there may be code requirements you need to address before you’re allowed to list or sell your property. On top of that, however, here are five fixes that you can make to help get the most from your home when you sell.

Water Stains

If you’ve got water stains on the ceiling or walls, they tell potential buyers that there are leaks somewhere. It’s possible that you already took care of the leak, but a buyer isn’t going to know that, and will likely assume that there’s still a nasty surprise waiting for them somewhere. You obviously need to track down the leak and repair it, but after that’s done you should do something about the water stain as well. Don’t just slap a thin coat of paint on them and call it a day, either; take the time to do it right so that the stains don’t reappear.

Slow Drains

If you have slow drains in your home, this can be a big red flag for some home buyers. They might ask about the plumbing, or even want to run more water to see what the water pressure and drains are like everywhere else. To head off potential problems it’s important to do your best to take care of the issue. In many cases it’s a relatively easy fix, though there are some causes of slow drains that will take a plumber to straighten out. Still, the effort you put into it now can result in a higher selling price once someone buys the house.

Switches and Outlets

People don’t want to buy houses that have electrical problems. If your switches or outlets look discolored or beaten up, this can lead people to assume that there are problems even if there aren’t. Take the time to replace any damaged, discolored or malfunctioning switches and outlets, along with any non-working fixtures or “mystery switches” that you might have around the house. Even if it’s not a very big job, it can have a major impact on how potential buyers view your home.

Trip Hazards

Are there any loose bits of carpet or wood on your floor that you’ve learned to just step around? Fix them before you have people in to look at the house. You might have gotten used to them, but a potential buyer won’t be. They’ll see potential tripping hazards as something they’ll need to fix, and they’ll negotiate the price down as a result.

Walls and Ceilings

Are your walls drab, dull and damaged? Take the time to fix any holes or dings before you list the house. A little bit of drywall repair can go a long way, and this can be a perfect time to update the look of your rooms with a fresh coat of paint as well. Don’t neglect the ceiling either, since those little issues that you’ve learned to overlook will stick out like a sore thumb to potential buyers.

Don’t Let Sellers Leave Tax Breaks on the Table

Don’t Let Sellers Leave Tax Breaks on the Table: Remind clients to ask their financial advisers about the deductions they’re eligible for in a home sale. One of the big ones: selling costs.

Monday, February 24, 2020

Study: Lack of Accessible Housing Fosters Unfair Cost Burdens

Study: Lack of Accessible Housing Fosters Unfair Cost Burdens: Homes with features designed to improve quality of life for people with disabilities are 10% more expensive than nonaccessible homes nationwide, data shows.

Friday, February 21, 2020

Home Sales Dip, But First-Timers Return to Market

Home Sales Dip, But First-Timers Return to Market: Low mortgage rates entice rookie buyers, and more robust housing starts should boost sales in the near future, according to NAR.

Thursday, February 20, 2020

Buyers Drawn to ‘Right-Sizing,’ But Also Leery of Losing Space

Buyers Drawn to ‘Right-Sizing,’ But Also Leery of Losing Space: Homes can be small without feeling cramped. Strategic planning and smart design can help maximize the space.

It’s a Better Time to Buy Than 10 Years Ago

It’s a Better Time to Buy Than 10 Years Ago: While low mortgage rates are improving buyers' purchasing power, the cheaper borrowing costs are drawing more house hunting competition.

Housing Permits Surge to 13-Year High

Housing Permits Surge to 13-Year High: The housing industry is upbeat about the spring market now that more construction is on the way.

The Burning Question: Can This Home Fit Multiple Generations?

The Burning Question: Can This Home Fit Multiple Generations?: More than 40% of Americans are looking for a home where they and their relatives can live together comfortably, research shows.

Tuesday, February 18, 2020

Top 20 Toughest, Easiest Markets to Find a Home

Top 20 Toughest, Easiest Markets to Find a Home: Inventory shortages are making places like Rochester, N.Y., and Columbus, Ohio, feel more like Silicon Valley and other competitive tech hubs.

Monday, February 17, 2020

Metro Home Prices Rise in 94% of Metro Areas in Fourth Quarter of 2019

Metro Home Prices Rise in 94% of Metro Areas in Fourth Quarter of 2019: The vast majority of metro areas saw price gains and very small increases in inventory in the final quarter of 2019

Automatic Attic Vents: Healthy Venting?

Keeping your home cool in the summer and warm in the winter is one of the big goals of most homeowners. There are a number of ways to do this, including upgrading the windows to more energy-efficient models and performing seasonal maintenance on heating and cooling systems to keep them operating at peak condition. One thing that’s often overlooked however is the influence that attic temperatures can have on the temperature of your whole house.

You may have seen suggestions about installing automatic attic vents to help regulate the temperature in your attic. Is there something behind this, or is it just another upgrade to your home that provides very little benefit? You might be surprised at how effective automatic attic vents can be.

Hot Attic, Cold Attic

It’s pretty common knowledge that hot air rises. The question is, where does all that hot air go? If your attic isn’t well vented, it can build up within the attic itself and increase the temperature of your attic space significantly. The problem with this is that future hot air won’t really have anywhere to go, causing it to linger in the house itself for longer. This is great if it’s the middle of winter and you’re trying to keep your house warm, but you can see how it might be a problem during the heat of summer.

You can run into the opposite situation as well if you have open vents in the attic. Heat can escape more easily, but if it’s cold outside you’ll find all that heat escaping much faster than you would like. This in turn causes heat within your house to escape faster, making it harder to stay warm in the depth of winter’s chill.

Regardless of the situation you find yourself in, the end result will be the same: higher energy costs to keep your house cool in the summer or warm in the winter.

Proper Attic Venting

Attic ventilation is part of the key to solving this issue, but there isn’t a one-size-fits-all solution. During the summer, you want open attic vents to expel heat and keep your attic as cool as possible. In winter, you want attic vents to be closed to hold heat in for as long as possible. You can open and close these vents manually as part of your seasonal preparations, of course, though this won’t be a perfect solution. The truth is, unless you open or close the vents to account for all the temperature fluctuations during the year, you’ll still be losing money to unnecessary heating and cooling.

Automatic Attic Vents

This is where automatic attic vents come into play. These vents are connected to thermostats (and sometimes even humidistats) to monitor the condition of your attic and open or close the vents as needed based on what things are actually like in the attic. If the temperature goes too high during the summer or if it becomes too humid, the vent opens and lets that unwanted heat and humidity escape. If temperatures drop, the vents close to prevent outside heat from coming in. The opposite happens during the winter, keeping the vents shut to keep warm air in your attic.

Some automatic vents function as simple ventilation units, possessing little function beyond opening and closing. Others include connected fans to force air in or out of the attic to even greater effect. Regardless of the vent type you choose, however, adding one to your attic can make a notable difference in how warm or cool the attic air gets during the year.

Installing New Vents

If you want automatic attic vents but aren’t sure where to start, HomeKeepr has your back. Sign up for a free account today to connect to pros who can install the automatic vent unit that will be the best fit for your current attic setup. All you have to lose is all of that unwanted energy waste.

Friday, February 14, 2020

Reasons to Fall in Love with Homeownership [INFOGRAPHIC] - KCM BLOG

Some Highlights:

- There are many benefits to love about homeownership, and they’re not all financial.

- Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these advantages.

- Reach out to a local real estate professional today to determine if you’re ready to embrace the rewards of owning your own home.

Home Price Gains by Years of Tenure

Home Price Gains by Years of Tenure: This study analyzes whether homeowners are more likely to experience a home price gain or loss during the period when they hold a home.

See How Hackers Gain Access to Transactions

See How Hackers Gain Access to Transactions: These screenshots show ways hackers are using emails and document attachments to infiltrate your deals.

Housing Likely to Withstand Future Recessions

Housing Likely to Withstand Future Recessions: Home buyers who think a new recession would bring lower home prices may be wrong, a new report shows.

Thursday, February 13, 2020

Are You Saving Enough for Retirement?

Are You Saving Enough for Retirement?: If you carry the burden of saving for your own retirement, here are ideas to help you reach your goal.

Wednesday, February 12, 2020

Home Price Hikes Widen Sellers’ Advantage

Home Price Hikes Widen Sellers’ Advantage: The 2019 housing market saw prices increase faster than wage growth, showing double-digit hikes in some areas.

The #1 Reason to List Your House Right Now - KCM Content

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that are available to buy. With early 2020 housing data now rolling in, it’s quite evident there are two big stories impacting this year’s residential real estate market:

1. Buyer demand is already extremely strong

2. Housing supply is at a historically low level

2. Housing supply is at a historically low level

Demand

ShowingTime is a firm that compiles data from property showings scheduled across the country. The latest ShowingTime Showing Index reveals how showings have increased in each of the country’s four regions for five months in a row.

Supply

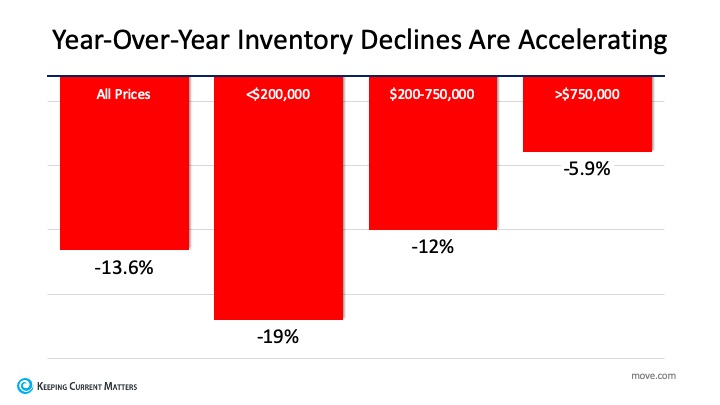

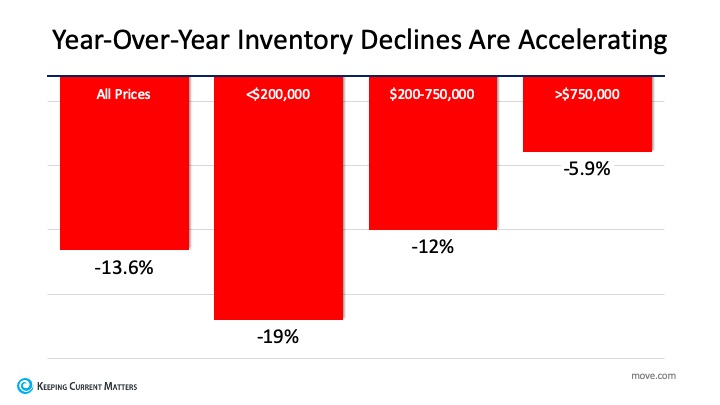

Move.com also just released information indicating that the number of homes currently for sale has declined rapidly and now sits at the lowest level in almost a decade. They explained,

“National housing inventory declined 13.6 percent in January, the steepest year-over-year decrease in more than 4 years, pushing the supply of for sale homes in the U.S. to its lowest level since realtor.com began tracking the data in 2012.”

In response to these numbers, Danielle Hale, Chief Economist at realtor.com, said,

“Homebuyers took advantage of low mortgage rates and stable listing prices to drive sales higher at the end of 2019, further depleting the already limited inventory of homes for sale. With fewer homes coming up for sale, we’ve hit another new low of for sale-listings in January.”

The decrease in inventory impacted every price range, too. Here’s a graph showing the data released by move.com:

Bottom Line

Since there’s a historic shortage of homes for sale, putting your home on the market today could drive an excellent price and give you additional negotiating leverage when selling your house. Reach out to a local real estate professional to determine if listing your house now is your best move.

Yun: We Can’t Rely on Low Mortgage Rates Forever

Yun: We Can’t Rely on Low Mortgage Rates Forever: Sub-4% rates are improving buyers’ purchasing power now, but higher borrowing costs will come at some point, says NAR’s chief economist. What will happen to sales then?

Monday, February 10, 2020

Top Reasons for a Mortgage Denial

Top Reasons for a Mortgage Denial: What can borrowers do to improve their odds of getting approved?

NAR’s Second Annual Policy Forum Explores Barriers to Affordable Housing in U.S.

NAR’s Second Annual Policy Forum Explores Barriers to Affordable Housing in U.S.: As home prices continue rising faster than wages in a majority of U.S. cities, NAR has made housing affordability a top advocacy priority in 2020.

Housing Inventory Falls to Record Low

Housing Inventory Falls to Record Low: The shortage affects all price points, but it is most acute for entry-level homes, according to realtor.com®.

What You Need to Know About Debt Consolidation

If you’re carrying around a lot of debt, the number of payments and the various interest rates you have can make managing it quite difficult. Some people choose to get this under control through debt consolidation. By consolidating your debts, you can reduce multiple items to a single payment with a single interest rate, making your finances easier to manage. Before rushing into debt consolidation, though, it’s important that you take the time to understand exactly how it works and what its benefits are.

Consolidating Your Debt

As its name implies, debt consolidation is the process of combining multiple debts into one that is (theoretically) easier to make payments on. Debt consolidation can even combine different types of debt such as loans and credit cards into a single debt. At its most basic, debt consolidation establishes a new loan or line of credit and then uses that to make payments against the other debts to pay them off. This leaves you with a single remaining debt. Depending on how you manage your consolidation, though, there may be a few differences in your experience.

Consolidation Loans

Taking out a loan to consolidate debt is one of the most common forms of debt consolidation. These loans are typically pretty straightforward, since the borrowed money is used to pay off existing debts and you simply need to pay off the loan after that point. In some cases, you may even be able to piggyback debt consolidation on top of a loan taken out for a purchase, borrowing extra to pay off existing debt. Just be sure to check with your lender to make sure this sort of use is okay before borrowing the money for it.

Credit Card Consolidation

Credit card consolidations typically occur when taking out a new card, using balance transfers to consolidate your existing balances to a single card. This is especially useful if the card has an introductory interest rate such as a 0 percent APR for six months or some other promotion. The theory remains the same, however; instead of having balances across multiple cards, you have only one balance to focus on and pay down.

Debt Management Programs

Though not necessarily a true “consolidation”, debt management programs are another way to get debt under control. These programs can negotiate with debtors, allowing you to make payments on a negotiated schedule without worrying about late fees and other costs piling up. You may have restrictions placed on you such as not being able to take out additional loans, but you will have the advantage of not having to work through getting your debt under control by yourself.

The Effects of Consolidation

Debt consolidation can have a major impact on your financial health, both improving your credit score and helping you to pay down your existing debts faster. It can also save you time and money, since you’ll only have one set of interest charges instead of multiple to keep track of. Best of all, most forms of debt consolidation won’t have a negative impact on things like buying a house since there isn’t a special classification to the loans or transfers in most cases. Even debt management won’t necessarily interfere, since its restrictions are usually focused on unsecured loans instead of secured ones like a mortgage.

What to Watch Out For

There are a few things that you should be careful of when looking into debt consolidation. Perhaps the most important is to avoid getting yourself even deeper in debt once you pay off the balance of your credit cards or other lines of credit. The goal is to pay off what you owe, so hold off on using your cards again until you’re more financially stable. You should also watch out for predatory lenders and fraudulent debt consolidation companies that will charge you a significant amount for things that you could manage on your own for free.

Is Consolidation Right for You?

If you aren’t sure whether debt consolidation is right for you, HomeKeepr may be able to help. Sign up today for free and get in touch with loan experts who can advise you on getting your finances in order without having to sacrifice your big dreams like owning your own home.

Metro Areas Where Owners Are Most Likely to Be Equity-Rich

Metro Areas Where Owners Are Most Likely to Be Equity-Rich: One in four homes with a mortgage in the U.S. were considered equity-rich in the fourth quarter of 2019.

NAR’s Second Annual Policy Forum Explores Barriers to Affordable Housing in U.S.

NAR’s Second Annual Policy Forum Explores Barriers to Affordable Housing in U.S.: As home prices continue rising faster than wages in a majority of U.S. cities, NAR has made housing affordability a top advocacy priority in 2020.

Tuesday, February 4, 2020

Existing-Home Sales

Existing-Home Sales: Total December existing-home sales rose 3.6% from November to a seasonally adjusted rate of 5.54M.

Monday, February 3, 2020

Standing Under an Umbrella Policy

Insurance is important, especially for homeowners. There are a lot of things that can go wrong around the house, and having a good insurance policy helps to guard against unexpected problems or accidents that can occur. What happens when your homeowner’s policy isn’t enough, though? There are some instances where you may find yourself in need of a bit more coverage than your current policies offer. This is where an umbrella policy comes in.

Umbrella insurance policies provide you with additional liability protection on top of your existing insurance coverage. If you’re like a lot of homeowners, though, you might not be sure whether you need an umbrella policy and may not even know exactly what coverage it provides. If that’s the case, here is some information to help you decide whether you need an umbrella over your head.

What Is an Umbrella Policy?

Umbrella coverage is known by a few different names: personal umbrella policies, umbrella insurance and even umbrella liability insurance. Regardless of what it’s called, though, the coverage is designed to protect individuals from large liability claims and judgments. These policies cover some of the biggest causes of liability claims including bodily injury, property damage, landlord liability and similar situations. As the name implies, they are intended for personal claims and won’t cover liability due to contracts (beyond property rental agreements in the case of landlords) or business losses.

How Umbrella Policies Work

An umbrella policy acts as additional insurance coverage once the primary insurance liability limit is reached. For homeowners, this means that if someone is injured on your property or you face some other significant liability, the liability coverage in your homeowner’s insurance or other policy will be used to cover the cost first. If the liability is substantial and requires a larger payout than what your policy limit covers, the umbrella policy will take over to cover the additional amount.

It’s worth noting that umbrella policies aren’t just for homeowners. They can provide coverage over other types of insurance as well. Many homeowners also use umbrella coverage to protect against automobile accident liability as well, since a car accident could easily cause property damage or injury that exceeds the liability coverage offered by a lot of car insurance policies.

Why Get an Umbrella Policy?

Having the extra liability coverage provided by an umbrella policy is a good way to put your mind at ease. Not only does it ensure that medical and other costs that can result from accidents will be taken care of, but it also provides additional protection against lawsuits that might arise from those same accidents. This becomes particularly important if you own a fixer-upper or are in the process of slowly remodeling your home, since the little imperfections and other problems that you hope to eventually fix can increase the likelihood of accidents or other damage. While it’s possible that your existing insurance will cover your liabilities, the umbrella coverage gives you an extra layer of protection.

Is an Umbrella Policy Right for You?

Whether you need an umbrella policy depends on your current lifestyle, the home you live in, its state of repair and even the coverage limits of your existing insurance. In most cases you won’t be required to have umbrella coverage, unlike a homeowner’s policy or mortgage insurance often required by lenders. You should take the time to consider your situation, shop around for umbrella policy quotes and think about whether an umbrella policy will give you a little more security.

Finding Your Perfect Policy

If you decide that you need umbrella coverage, the next thing you need to do is make sure that you aren’t paying too much for the coverage that you get. HomeKeepr can help. Sign up for a free account today so you can find an insurance agent who has the perfect umbrella policy for your needs without you getting left out in the rain

10 Upgrades Owners Think Are Necessary Before Selling

10 Upgrades Owners Think Are Necessary Before Selling: Because many buyers seek move-in-ready properties, sellers are tackling remodeling projects they believe will speed a sale.

Subscribe to:

Comments (Atom)

-

Pending Home Sales Jumped 6.1% in March : The solid rise in pending home sales implies a sizable build-up of potential home buyers, fueled b...

-

Pending Home Sales Waned 4.6% in January : The Midwest, South, and West saw month-over-month losses in transactions, while the Northeast saw...

![Top Reasons to Love Homeownership [INFOGRAPHIC] | Keeping Current Matters](https://files.keepingcurrentmatters.com/wp-content/uploads/2020/02/13171723/Feb-Infographic-01-ENG.jpg)